[ad_1]

fhm/Second by way of Getty Photos

Pricey readers,

Vonovia (OTCPK:VONOY) is a German actual property holding firm, which operates very equally to a REIT, and owns 550,000 flats situated primarily in Germany, Sweden, and Austria.

It is an organization I’ve written about extensively on Searching for Alpha, publishing six articles final 12 months. That is no coincidence, as Vonovia was one in all my highest conviction concepts final 12 months and accounted for as a lot as 7.5% of my portfolio at one time.

Do not get me improper, issues had been fairly scary on the backside. The corporate was brief on money, debt maturities had been approaching and it wasn’t clear whether or not Vonovia would have the ability to promote some belongings in time to repay their maturing bonds or need to threat refinancing. That might show disastrous given the extraordinarily tight lending market on the time.

However my actual property background and native information of the market gave me the boldness to know that the inventory was buying and selling deeply under the honest worth of their properties in a market which may be very prone to expertise undersupply of housing over the remainder of the last decade.

That is what gave me the boldness to speculate closely.

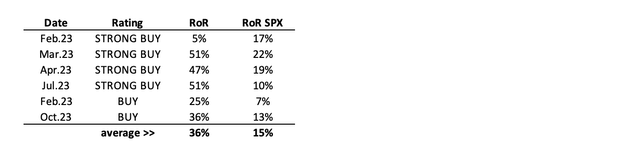

And the decision has paid off, with 5 out of six rankings beating the S&P 500 (SPX) and a median RoR of 36% vs 15% of the S&P 500. I am not saying this to pad myself on the again, however to indicate that if there’s one firm I actually perceive, it is Vonovia, and I am keen to place my cash the place my mouth is.

Searching for Alpha Creator’s calculations

It has been some time since my final replace, which targeted on demand and provide dynamics in Germany, and the worth has moved materially increased to EUR 27 per share for the native shares (ticker VNA). I stay bullish on the inventory, and proceed to carry a sizeable place round 4.5% of my portfolio, however I acknowledge that a big a part of the potential upside has been realized.

At the moment’s replace is supposed to indicate that Vonovia immediately is kind of out of the woods and far safer than a 12 months in the past, and to offer you an inexpensive estimate of their honest worth and a worth goal to shoot for.

Debt compensation issues are gone (for now)

For those who return to a few of my earlier articles, you may discover two issues:

On an operational stage, Vonovia was doing extraordinarily effectively all alongside, averaging 98% occupancy, rising their rents by 3.5-4% per 12 months, amassing 99.9% of income and rising their margin by 2% to 80.8% final 12 months. The explanation for the unload had the whole lot to do with excessive near-term debt maturities which led to fears of enormous curiosity expense will increase and potential chapter.

Vonovia had a comparatively clear plan to cope with this drawback – promote EUR 2 Billion of belongings to repay maturing bonds and refinance maturing financial institution loans.

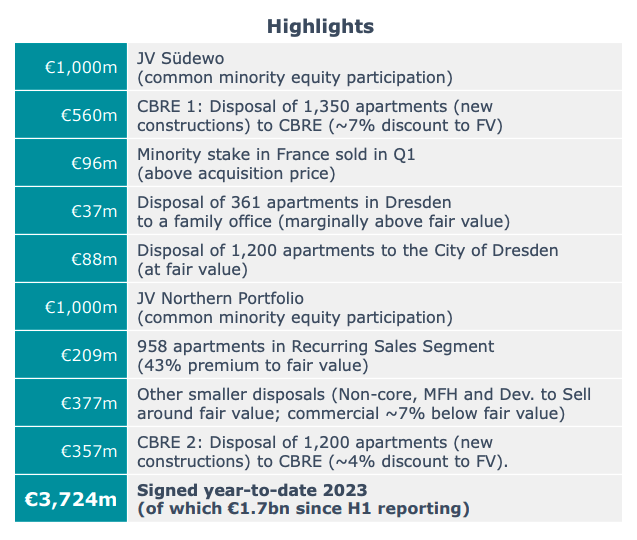

However the preliminary progress with disposals was very gradual. Ultimately, nevertheless, the corporate over-delivered on their goal in 2023 and generated EUR 3.7 Billion in disposal proceeds, consisting of:

Vonovia Presentation

Importantly, a big portion of those transactions was closed close to reported guide worth with a median price ticket solely 5% under guide worth, or at EUR 2,250/sqm. This issues, as a result of the market (in contrast to me) has been fairly sceptical of Vonovia’s guide worth and there is no higher proof than precise market transactions.

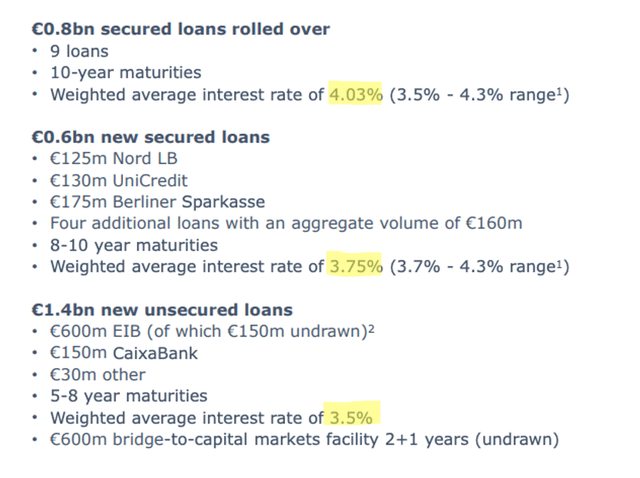

Having raised sufficient liquidity to cowl all bond maturities till Q1 2025 (inclusive) and having refinanced EUR 2.8 Billion value of financial institution loans at cheap rates of interest of beneath 4%, the corporate is now a lot safer than final 12 months.

Vonovia Presentation

If rates of interest stay elevated for years to return, the corporate must promote extra belongings to scale back their massive debt place additional, but when we have learnt something over the previous 12 months, it is that we are able to rely on administration to ship.

Furthermore, evidently charge cuts are prone to come sooner and be bigger in Europe than within the U.S. Eurozone inflation is at 2.9% and the market is pricing in 150 bps of charge cuts this 12 months, staring in Q2 2024.

Vonovia’s honest worth

With the most important threat now out of the best way, we are able to deal with valuation.

My favourite manner is to calculate the implied valuation per sqm of house after which examine it to substitute prices and precise values available on the market.

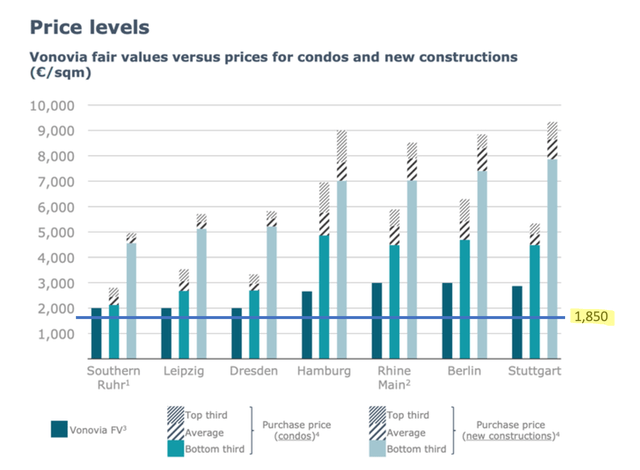

Vonovia has a market cap of EUR 22 Billion and about EUR 42 Billion in internet debt for a complete enterprise worth of EUR 64 Billion. That is the worth we pay for his or her 548 ths. models. With a median unit dimension of 63 sqm, we are able to estimate that the market at present values Vonovia’s residential house at 1,850 EUR/sqm.

And that is the place the chance lies, for my part, because the implied valuation stays deeply under:

reported guide worth of two,350 EUR/sqm common realized costs on disposal of two,250 EUR/sqm (although bought properties had been arguably increased than common high quality) substitute prices of not less than 2,500 EUR/sqm (excl. land value and developer’s revenue) precise costs of comparable flats in Germany of three,000 EUR/sqm

Vonovia Presentation

I personally do not assume that the market will ever worth Vonovia’s portfolio one-to-one with costs of particular person flats available on the market. On the identical time, realizing what these properties appear to be and having seen a lot of them with my very own eyes, the bottom I am keen to worth them is at 2,150 EUR/sqm which corresponds to a worth goal of EUR 40 per share.

My thesis is bolstered by the truth that Germany is prone to see demand for housing surge on account of internet immigration inflows, whereas provide stays largely constraint on account of stringent regulation and excessive vitality, financing and building prices. The ensuing beneath provide is prone to profit landlords by preserving rents, occupancy and property costs excessive. I encourage you to learn up on this in my final article as it’s a key a part of the thesis.

Backside Line

Anybody that invested in Vonovia final 12 months has made cash and the inventory is clearly not as enticing now at EUR 27 per share because it as soon as was.

With that mentioned, I see the implied valuation of 1,850 EUR/sqm as very low and deeply under my lowest cheap estimate of honest worth of two,150 EUR/sqm. With Vonovia’s vital leverage, this re-valuation would end in a virtually 50% upside to my worth goal of EUR 40 per share.

Furthermore, the danger of an lack of ability to refinance near-term debt maturities has been alleviated for now and with the ECB prone to lower charges this 12 months, I see the likelihood of Vonovia returning to the low as extraordinarily low.

Due to this fact I reiterate my BUY ranking right here at EUR 27 per share for the native.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.

[ad_2]

Source link