[ad_1]

Residence Depot and Walmart unveiled their This fall 2023 outcomes, with the previous reporting gross sales barely exceeding expectations and the latter surpassing income projections.

Residence Depot’s This fall earnings report confirmed resilience within the face of challenges, and a constructive outlook for 2024.

Nonetheless, warning is suggested as each corporations face potential corrections, in response to InvestingPro’s honest worth evaluation.

In 2024, make investments like the large funds from the consolation of your own home with our AI-powered ProPicks inventory choice software. Be taught extra right here>>

Retailers (NYSE:) and (NYSE:) unveiled their This fall 2023 outcomes immediately forward of the opening bell.

Residence Depot reported This fall gross sales of $34.8 billion, reflecting a 2.9% year-on-year lower. InvestingPro had anticipated This fall gross sales of $34.67 billion, and the precise gross sales barely exceeded expectations.

The report highlighted a 3.5% decline in comparable gross sales, barely higher than the 4% lower in comparable gross sales within the US.

Analyzing earnings experiences from these retail giants offers essential insights for assessing client demand developments.

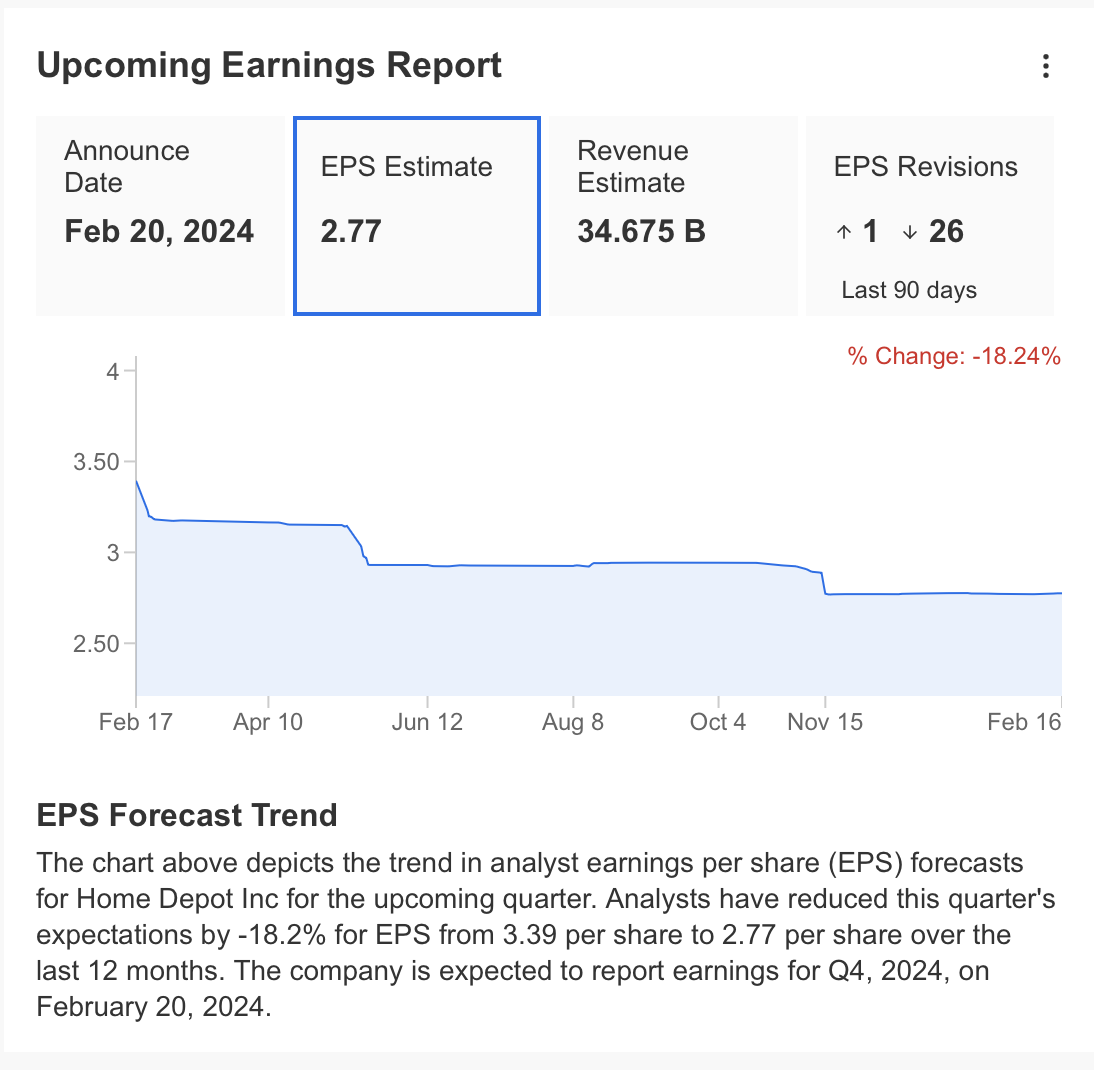

Supply: InvestingPro

For the 4th quarter of 2023, internet revenue was introduced as $2.8 billion, whereas earnings per share got here in at $2.82.

This was above the InvestingPro EPS estimate of $2.77. In the identical interval final 12 months, EPS was $3.3 in comparison with a revenue of $3.4 billion, a 14.5% lower.

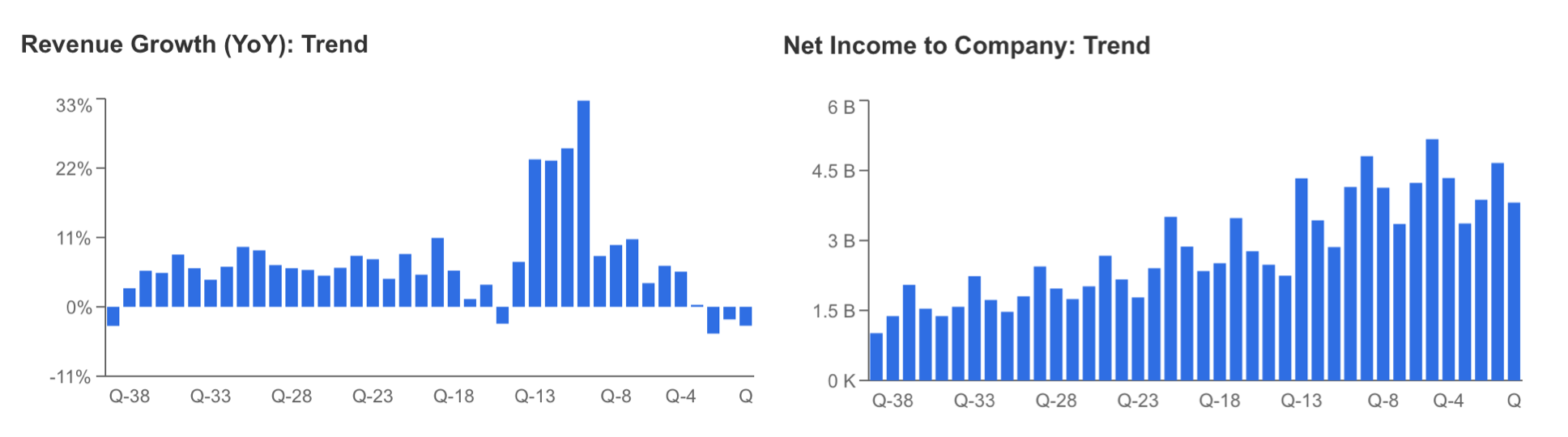

Because the This fall earnings report reveals, the unfavourable pattern within the firm’s income development continues. The decline in internet earnings was unfavourable within the final quarter, falling under $3 billion for the primary time after the primary quarter of 2021.

Supply: InvestingPro

Following This fall outcomes, gross sales for fiscal 2023 have been down 3% y-o-y to $152.7 billion. Annual internet revenue was recorded as $15.1 billion and $15.11 EPS, down 9.5% in comparison with final 12 months.

Though the corporate noticed declines in its This fall outcomes, it confirmed vital resilience in a difficult 12 months for retail with figures above expectations.

Residence Depot Seems to Achieve Market Share

Residence Depot CEO Ted Decker stated that the corporate spent 2023 reasonably after a 3-year development interval.

Decker continued his assertion by saying that they remained loyal to their strategic investments in 2023 and expressed optimism about rising their market share within the sector.

The corporate additionally introduced in its earnings report that the quarterly dividend of $2.25 per share was elevated by 7.7% and the annual dividend will probably be 9 {dollars}.

Within the steerage for 2024, Residence Depot reported that it goals to extend its complete gross sales by about $2.3 billion.

This confirmed that the corporate expects a average development of about 1%. The corporate expects comparable gross sales to say no by 1% in 2024.

The corporate’s forecast for 2024 was under the forecast of analysts, who’re presently forecasting sub-1.6% annual development in gross sales.

Supply: InvestingPro

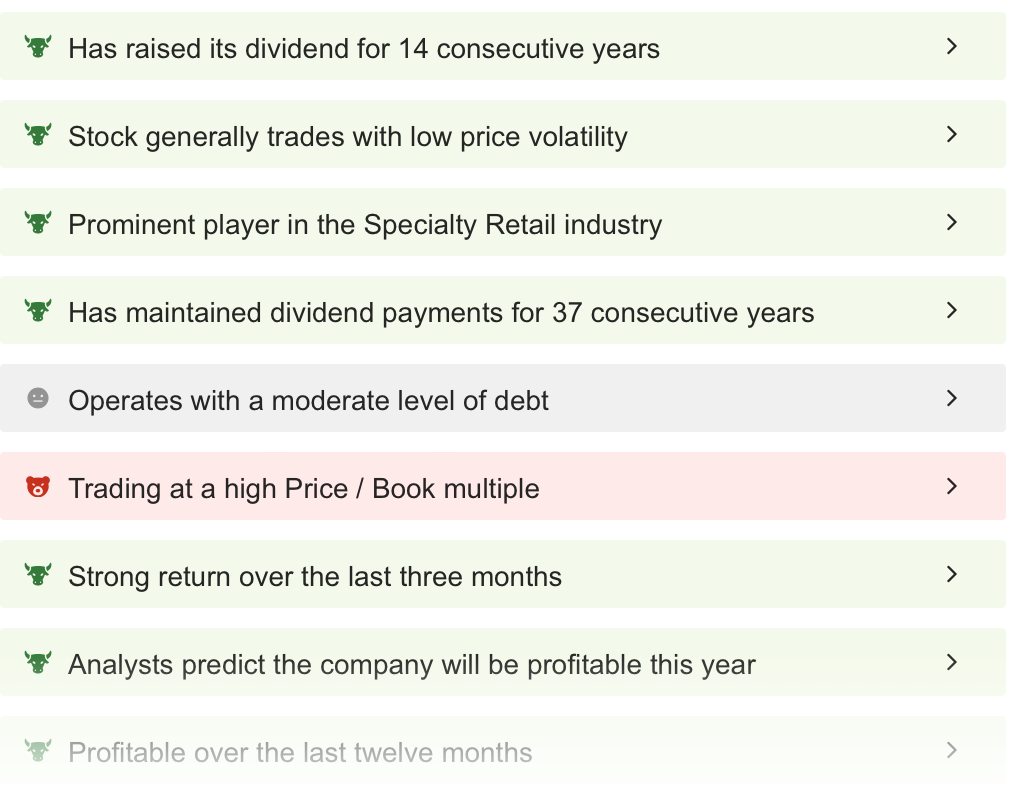

Residence Depot: ProTips Abstract

With the ProTpis abstract on the InvestingPro platform, we will shortly get an summary of the corporate.

The retailer, which has been paying dividends for 37 years, has elevated its dividend funds for 14 consecutive years, which the corporate determined to extend this 12 months.

The corporate’s continued profitability, albeit in a downward pattern, and the sturdy efficiency and low volatility of the HD share regardless of the difficult situations are listed as strengths.

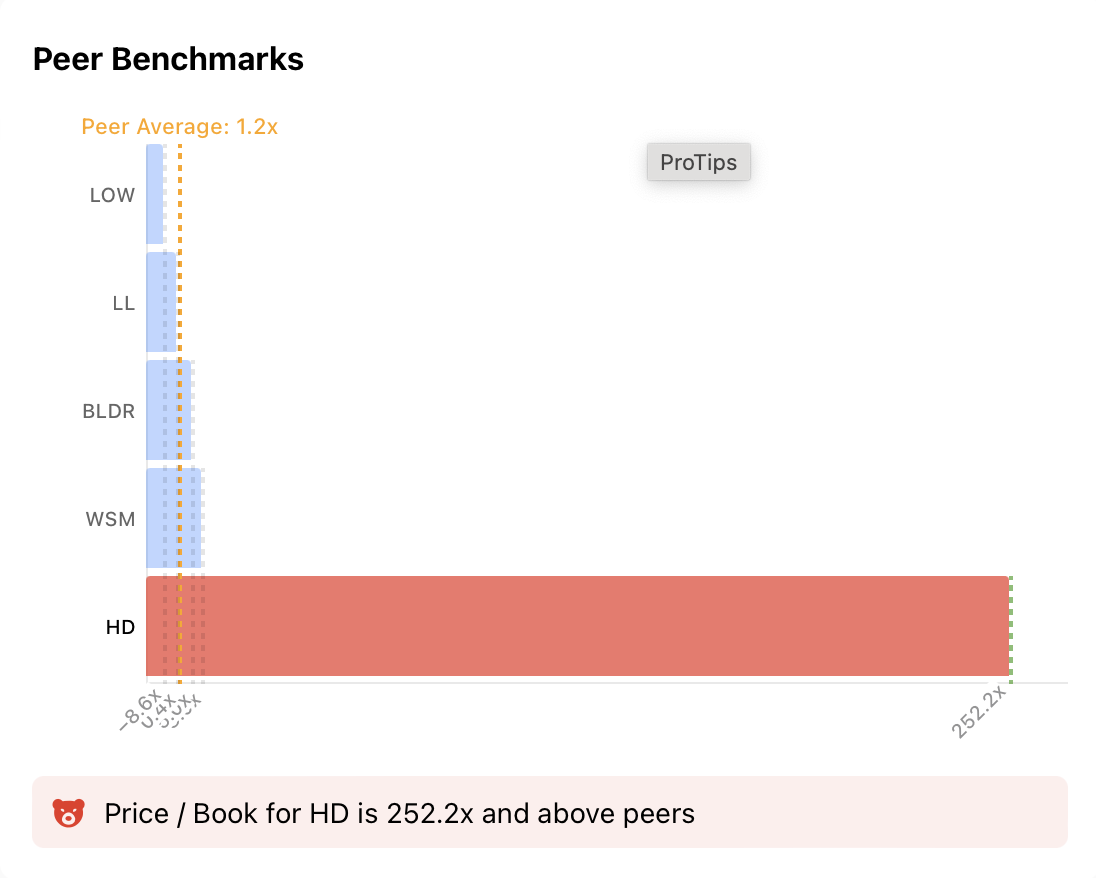

The corporate’s excessive P/E ratio of 252x is nicely above the peer common, signaling a doable correction.

Supply: InvestingPro

Alternatively, the corporate’s common debt stage could be interpreted as a warning signal for the corporate in a interval of excessive rates of interest.

Nonetheless, Residence Depot’s internet debt to capitalization ratio stays at 11.5%, which is low in comparison with the common internet debt to capitalization ratio of 28.9% for peer corporations.

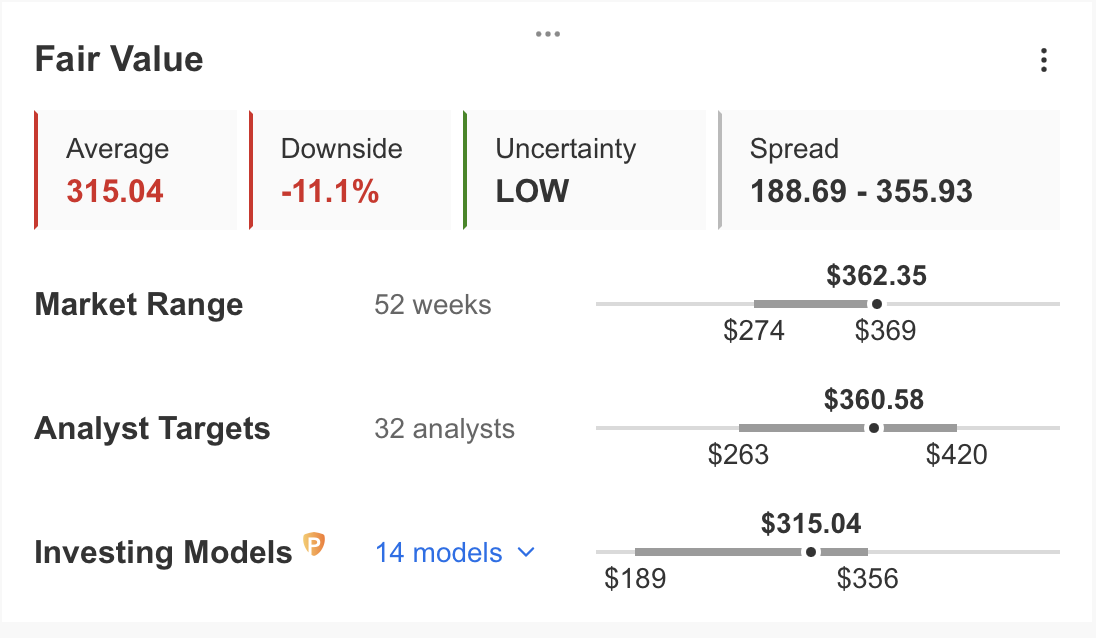

In mild of this info, InvestingPro’s honest worth evaluation based mostly on 14 monetary fashions means that HD may see a correction as much as $315.

Accordingly, the share worth may document a correction exceeding 10% through the 12 months.

Supply: InvestingPro

Walmart Beats Expectations

Walmart elevated its income by 5.7% to $173.4 billion in This fall 2023. The earnings report was led by working revenue, which jumped 30.4% to $1.7 billion, whereas adjusted working revenue rose 13.4%.

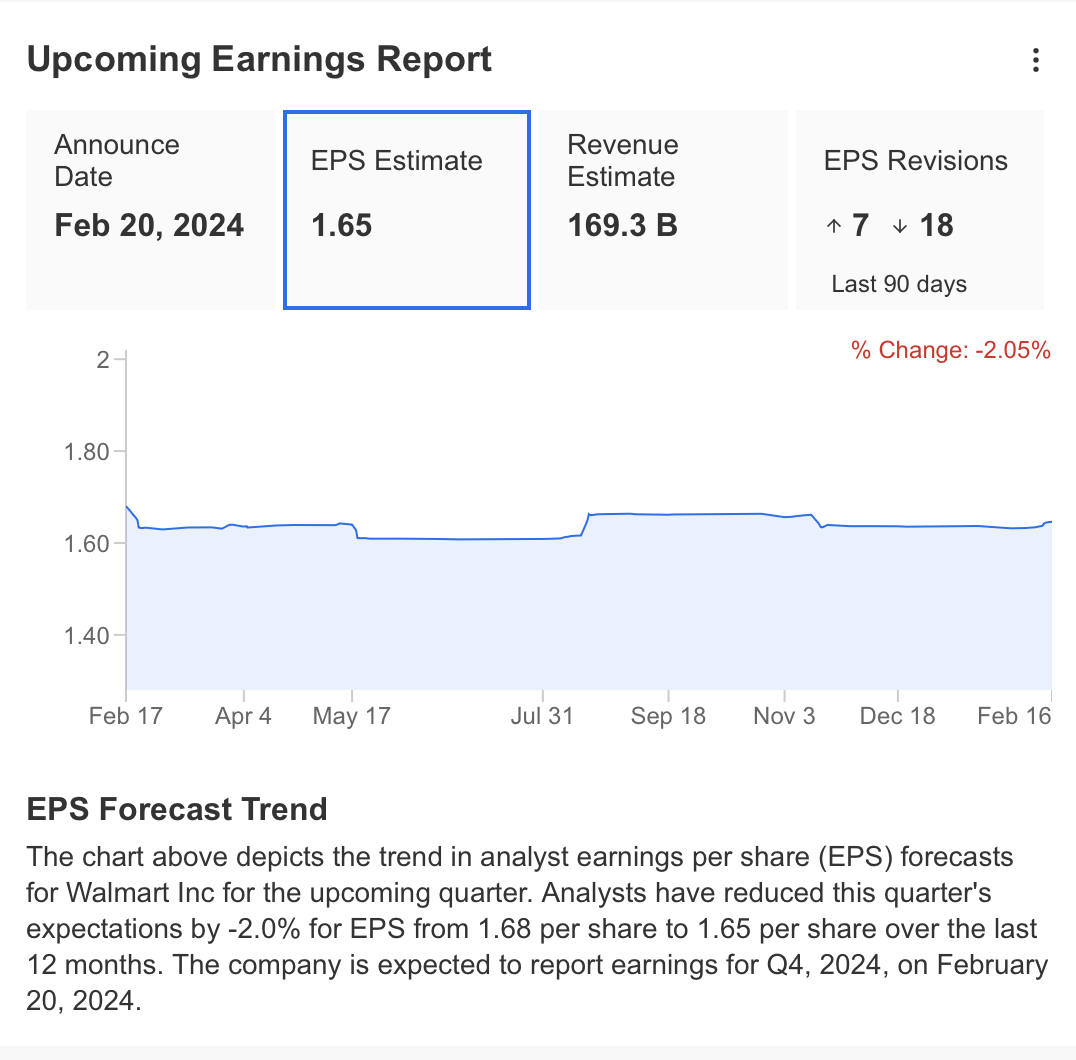

The corporate’s earnings per share additionally got here in above expectations at $1.8. InvestingPro’s expectations have been for Walmart to announce $169.3 billion in income and $1.65 EBIT within the final quarter.

Supply: InvestingPro

Walmart additionally confirmed that it has efficiently managed its digital retailing actions, with e-commerce gross sales growing by 23% within the final quarter, exceeding $100 billion.

Supply: InvestingPro

Walmart’s steerage for the approaching quarters was one of many extremely anticipated sections amongst market contributors.

Whereas the corporate adopted an optimistic method for the approaching intervals, it was additionally cautious to behave cautiously.

Asserting that it elevated its annual dividend by 9%, Walmart elevated its dividend fee per share to $0.83.

This may be thought-about an indication that the corporate’s monetary well being stays stable.

Supply: InvestingPro

Walmart: ProTips Abstract

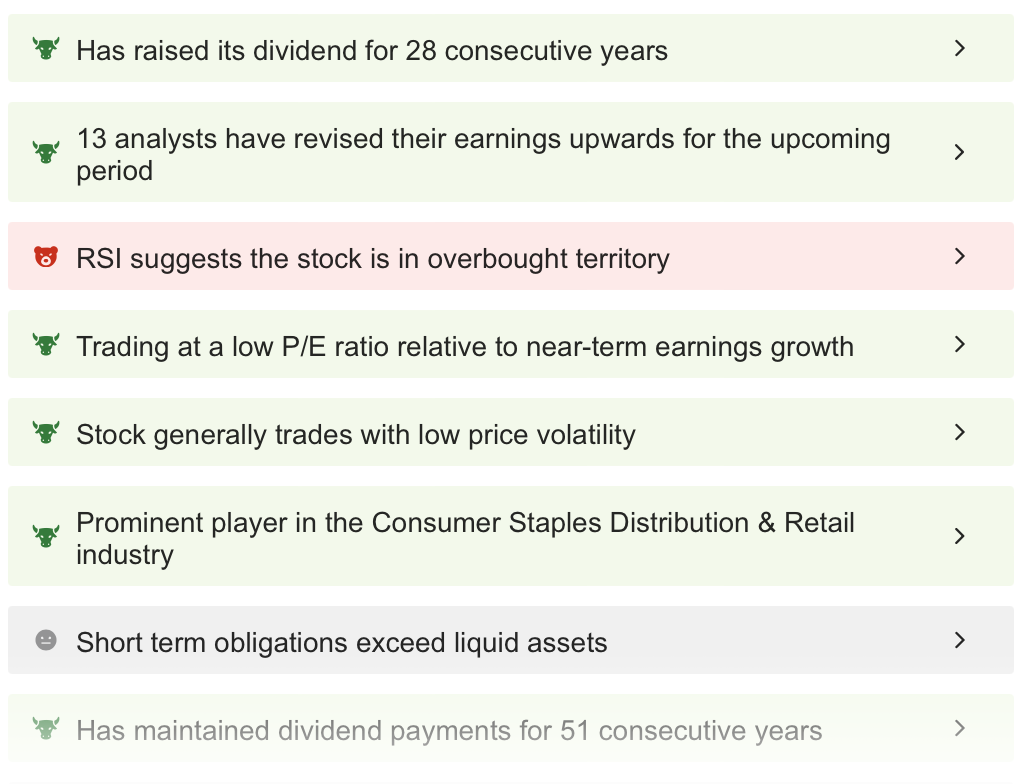

Whereas the corporate continues to reassure traders with its common dividend fee, the truth that it continues with an advantageous P/E ratio in comparison with short-term revenue development is a constructive issue.

With profitability remaining sturdy, the inventory’s low volatility is one other issue that reassures traders.

Supply: InvestingPro

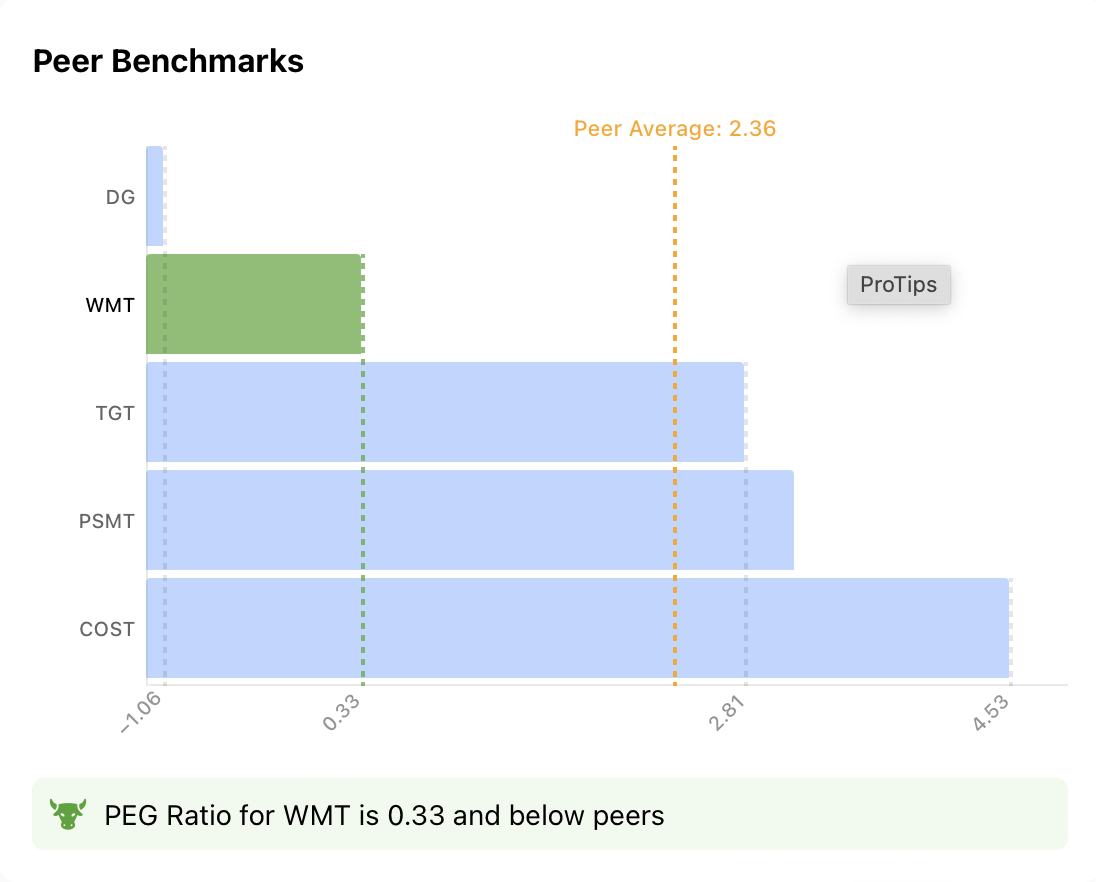

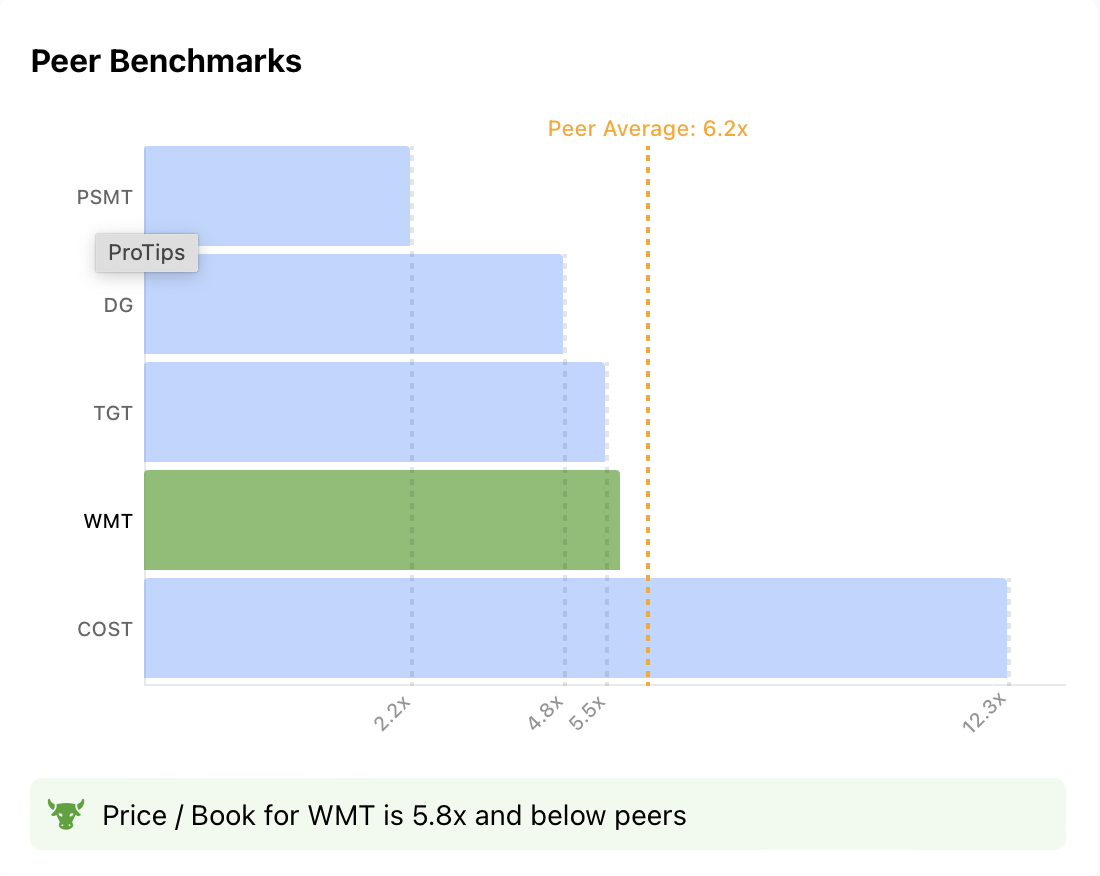

Two cautionary options for the corporate are that it strikes at a median debt stage and short-term liabilities stay above liquid property. As well as, Walmart strikes under the peer common with a P/E ratio of 5.5X.

Alternatively, WMT is technically shifting within the overbought zone with a excessive RSI stage.

As well as, InvestingPro’s honest worth evaluation predicts that WMT is shifting at a 13% premium to its present worth of $170 in response to 15 monetary fashions and estimates that the share worth may see a correction to $152 throughout the 12 months.

***

Take your investing sport to the subsequent stage in 2024 with ProPicks

Establishments and billionaire traders worldwide are already nicely forward of the sport on the subject of AI-powered investing, extensively utilizing, customizing, and growing it to bulk up their returns and reduce losses.

Now, InvestingPro customers can do exactly the identical from the consolation of their very own houses with our new flagship AI-powered stock-picking software: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 1,427.8% during the last decade, traders have the perfect choice of shares available in the market on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Subscribe In the present day!

Remember your free present! Use coupon code INVPROGA24 at checkout for a ten% low cost on all InvestingPro plans.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or advice to take a position as such it’s not supposed to incentivize the acquisition of property in any method. I wish to remind you that any sort of asset, is evaluated from a number of factors of view and is very dangerous and due to this fact, any funding resolution and the related threat stays with the investor.

[ad_2]

Source link