[ad_1]

Scott Olson

Only a few have observed that Walmart (WMT) has traded to an all-time-high earlier than the e-commerce juggernaut Amazon (AMZN) has finished so. The three-for-1 inventory break up lately probably helped Walmart push above its earlier all-time-high of $56 and alter final November ’23, because it trades tonight round $59.

Amazon hit an virtually excellent “double-top” at $188 in July and November ’21, and has but to get well that stage within the 27 months. It’s getting shut, but it surely’s not there but.

Only a few observed too that Jeff Bezos’ CEO resignation occurred proper across the July ’21 earnings report, so Jeff “top-ticked” his personal inventory together with his resignation.

Fast recap of Walmart and Amazon earnings experiences

In Walmart’s earnings preview, this weblog talked about WMT being a margin story, however fiscal This autumn ’24 was a gross margin story, with GM growing 122 bps YoY to 23.97% from This autumn ’23 22.75%, fairly than an working margin story, which is what AI and supply-chain enhancements will ship.

To be frank, I used to be proper for the mistaken causes, however the margin story is simply getting began.

Gross margin was helped by promoting which within the convention name notes it was famous that promoting grew 28% YoY to $3.8 billion, nonetheless a small a part of general income, but it surely does fatten Walmart’s margins.

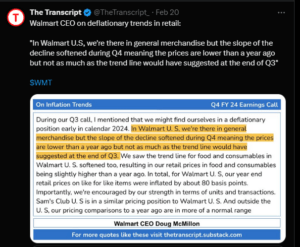

Right here’s an necessary touch upon the convention name on grocery inflation (sourced from The Transcript):

Right here’s what jumped out about Walmart’s metrics:

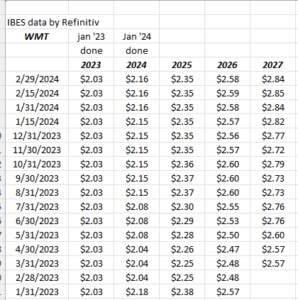

Walmart administration provided very tepid earnings steerage for his or her fiscal ’25 (ends Jan ’25), and it’s proven up the final two weeks in little or no curiosity in elevating ’25, ’26 or ’27 EPS estimates.

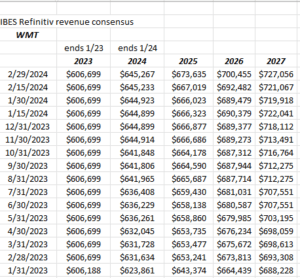

Nevertheless, notice the regular development upward in Walmart income estimates, even after the “deflationary place” referenced above in The Transcript notice.

Analysts will not be shy about elevating Walmart’s income estimates for the following few years.

Abstract/conclusion: Walmart is simply popping out of the 2021 and 2022 extra stock situation, which means it’s simply the previous couple of quarters that there was a return to regular stability sheet and money stream metrics.

For a secular “mid-single-digit” income grower and “excessive single-digit” working revenue and EPS grower, Walmart can proceed to take share in grocery – grocery grew mid-single-digits YoY within the Jan ’24 quarter – Walmart will want the margins to drive further progress.

Amazon: Nice quarter, inventory nonetheless buying and selling beneath all-time-highs

Amazon put up good progress in This autumn ’23 towards a harder quarter in This autumn ’22, however right here’s the larger, longer-term change in Amazon for readers:

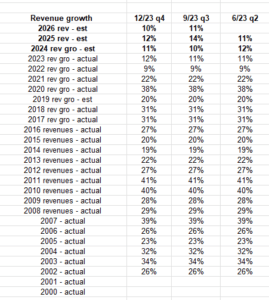

Amazon grew income progress YoY at a higher than 20% price from 2000 to 2021 (one exception), however that income progress appears to be like to have completely slowed to half the earlier 20 years’ tempo.

It’s manageable, as Amazon too (like Walmart) is specializing in margin.

Promoting and AWS drove This autumn ’23 for Amazon, with a giant upside beat in working revenue for the e-commerce big. Working revenue of $13.2 billion beat the consensus of $10.4 billion (LSEG) producing a 26% upside shock.

Morningstar famous that Amazon’s 7.7% working margin was the most effective for the 4th quarter in a decade.

Abstract: No valuation discuss on this submit, fairly it was only a notice to focus on Walmart’s management relative to the S&P 500 and the way Amazon lags.

Are we coming into a interval, the place – regardless of the Magazine 7 standing – Amazon, Alphabet (GOOG) (GOOGL) and Apple (AAPL), have gotten mature companies and the “progress” mantle is being handed to different sectors just like the AI shares?

One other metric I believed was fascinating: Amazon generated $575 billion in income in calendar ’23, and with it, money stream from operations for a similar interval was $85 billion.

Walmart generated $648 billion in fiscal ’24, and with it, money stream from operations for a similar 12 months was $36 billion.

Amazon nonetheless has the extra environment friendly asset base, however Walmart is closing the e-commerce hole.

None of that is recommendation or a suggestion. Previous efficiency isn’t any assure or suggestion of future outcomes. Investing can contain the lack of principal, even for brief time durations. Readers ought to gauge their very own consolation with portfolio and particular person inventory volatility, and modify accordingly.

Thanks for studying.

Unique Submit

Editor’s Observe: The abstract bullets for this text have been chosen by Searching for Alpha editors.

[ad_2]

Source link