[ad_1]

RichVintage/E+ through Getty Pictures

It lastly seems just like the AI increase in investor shopping for of semiconductor equities is able to roll over right into a stretch of promoting. Why? Certain, valuations and pricing have been reaching for ever greater extremes since final summer time. My bearish view is an sudden rise in inflation and rates of interest into the summer time will blow a gap into the falling-rate rationale supporting the large upmove in Huge Tech and semiconductor share costs since October.

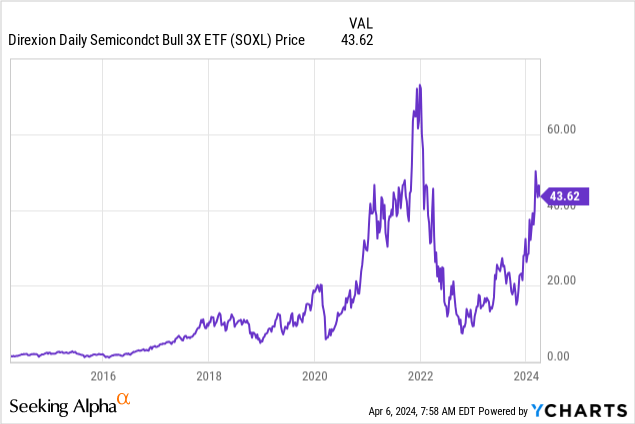

So, if a painful correction of -20% to a crash of -50% is subsequent for the main semiconductor names the remainder of 2024, I’d completely keep away from the Direxion Every day Semiconductor 3x Bull ETF (NYSEARCA:SOXL). We may very well be getting into a protracted interval like 2022, the place the every day rebalance and compounding options work in opposition to holders, as fund bills and swap contract prices pile up. A deep selloff within the Huge Tech sector, particularly the highest AI-frenzy semi names, might initially give buyers large losses in SOXL’s 300% lengthy design, whereas making the mathematics for a rebound again to unchanged pricing ranges very tough years into the longer term.

YCharts – SOXL, Weekly Value Modifications, 10 Years

Rotten Valuation Backdrop

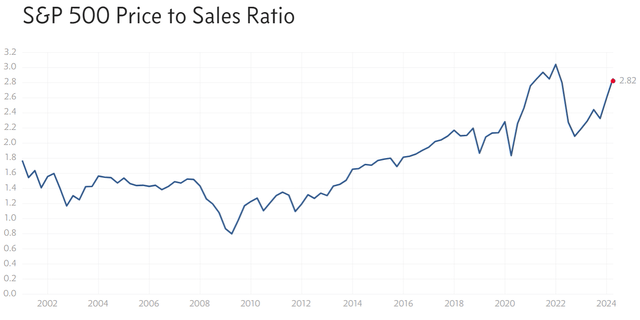

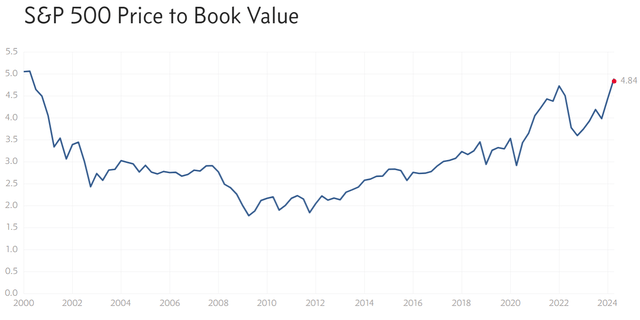

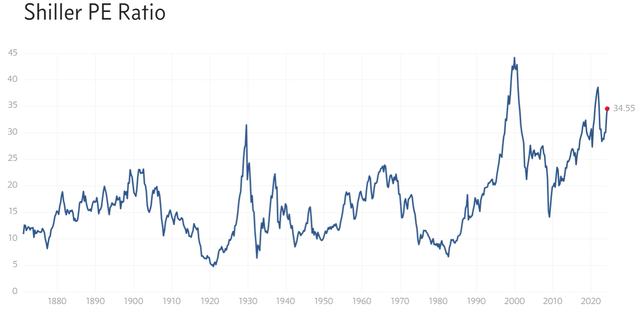

Your complete U.S. inventory market (as measured by the S&P 500 index) is now priced close to document value to gross sales and guide worth multiples, on high of one of many worst setups within the well-known long-term Shiller CAPE ratio (reviewing 10-year tendencies).

Multipl.com – S&P 500 Value to Gross sales, Since 2001 Multipl.com – S&P 500 Value to Gross sales, Since 2000 Multipl.com – S&P 500 Value to Gross sales, Since 1872

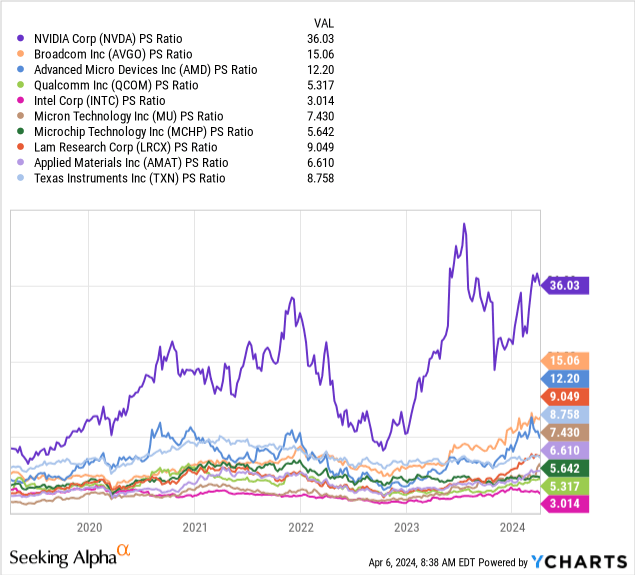

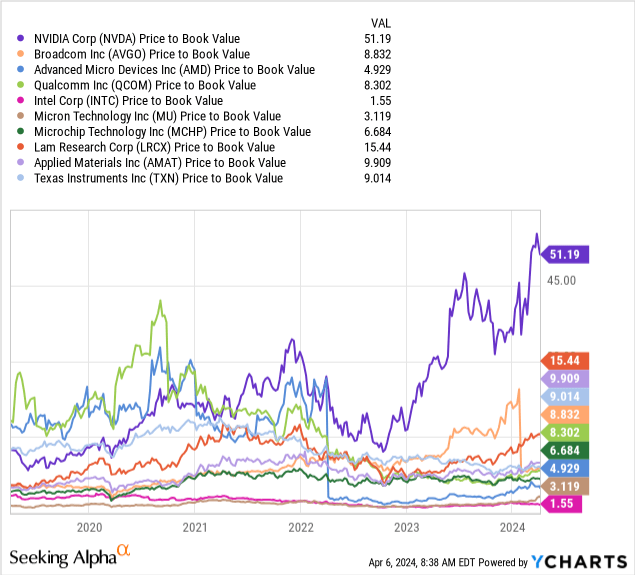

Extra dangerous information, the primary semiconductor-company holdings of SOXL are sitting at even greater valuations. Reviewing a number of the highest-weighted positions in SOXL, it is simple to grasp the underlying valuation image is kind of stretched for brand spanking new consumers at this time. I’m together with NVIDIA (NVDA), Broadcom (AVGO), Superior Micro Units (AMD), Qualcomm (QCOM), Intel (INTC), Micron (MU), Microchip Know-how (MCHP), Lam Analysis (LAM), Utilized Supplies (AMAT), and Texas Devices (TXN) in my charts. This group represents round 50% of the underlying index weighting utilized by SOXL.

On the 5-year charts under, you may assessment the median averages for each value to gross sales and guide worth at the moment are within the 8x a number of vary, far above S&P 500 readings.

YCharts – Main Semiconductor Shares, Value to Gross sales, 5 Years YCharts – Main Semiconductor Shares, Value to Ebook Worth, 5 Years

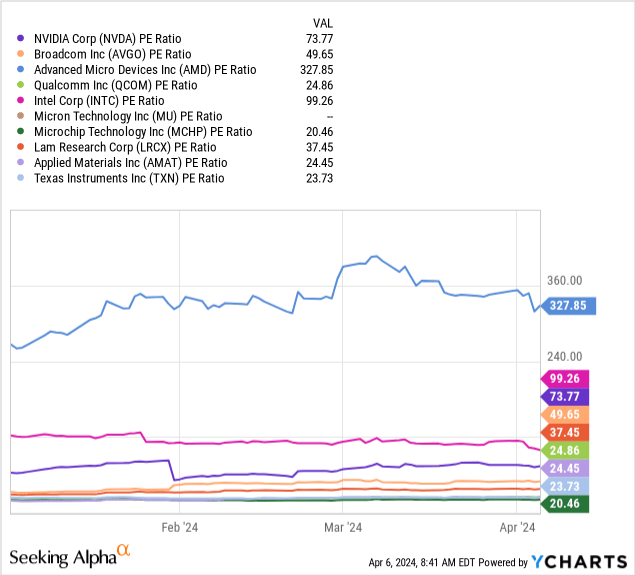

As well as, the median common of 37x for trailing value to earnings is kind of a distance above the prevailing S&P 500 P/E of 27x at this time.

YCharts – Main Semiconductor Shares, Value to Trailing Earnings, 3 Months

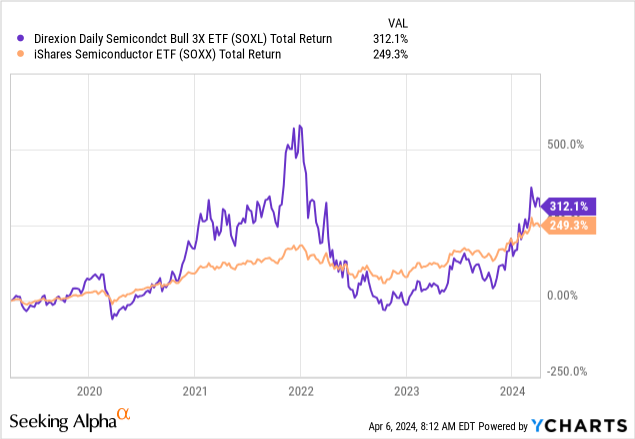

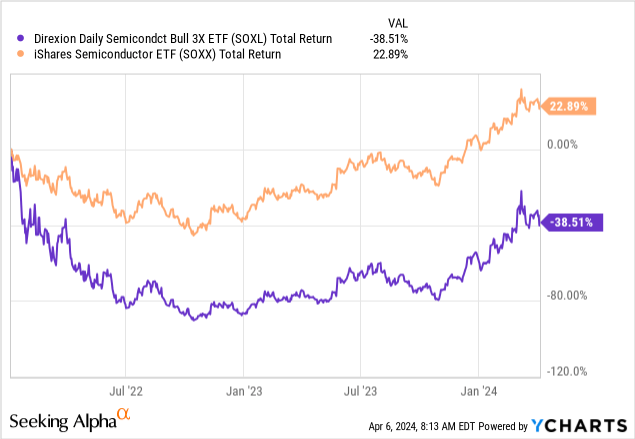

SOXL is priced utilizing the NYSE Semiconductor Index (ICESEMIT), a rules-based, modified float-adjusted market capitalization-weighted index that tracks the efficiency of the 30 largest U.S. listed semiconductor corporations. It’s barely completely different than the Philadelphia Semiconductor Index, however returns in SOXL are likely to carefully mimic value modifications on this extra generally traded and referenced index. The iShares Semiconductor ETF (SOXX) acts as the closest SOXL cousin for a 100% lengthy product.

Over time, additional prices to create its 3x leverage by means of swaps with main banks/brokers, wild value swings within the sector hurting rebalance outcomes, a comparatively excessive 0.76% in administration expense per yr, and little to no money dividend payouts (the present yield is 0.39% yearly), have made it tough for SOXL to maintain up with SOXX. In fact, outsized positive factors within the sector over the past 5 years have helped SOXL to outperform to a minor diploma.

YCharts – 3x SOXL vs. 1x SOXX, Complete Returns, 5 Years

The worst information for brand spanking new consumers in April 2024 is getting in AFTER a spike in value over the previous yr or two “does” scale back the percentages of future funding success dramatically. These shopping for on the late 2021 peak in semiconductors are nonetheless ready to get again to interrupt even! If in case you have the abdomen to lose -90% of your funding like January to October 2022, be my visitor. One thing comparable may very well be approaching for SOXL house owners the remainder of 2024, as giant losses multiplied by an element of 3x may show catastrophic for bulls.

YCharts – 3x SOXL vs. 1x SOXX, Complete Returns, Since January 2022

Why Am I Bearish?

The logic for promoting or avoiding SOXL is the Federal Reserve seems to be caught into tighter credit score/banking coverage than the markets or economic system would like the rest of the yr. And, with investor enthusiasm sky-high once more, and valuations simply as excessive once more as late 2021, I really feel this ETF is overflowing with draw back “threat.”

Friday’s (April fifth) sturdy U.S. employment numbers, the sudden uptick in inflation studies for 2 months operating in America, spiking crude oil throughout 2024 (+20% from January 1st), a misunderstood and ignored upturn in lots of meals commodities because the center of 2023, and now a leap in gold/silver as a warning shot since early March (gold at all-time highs, silver at multi-year highs), are all screaming a flip for the more severe within the inflation outlook is at hand.

The bond market is beginning to take discover (with regular value losses for weeks operating), whereas the Federal Reserve appears to be simply as misplaced on what’s going on as early 2022. The “hope” that inflation is coming again all the way down to the Fed’s 2% annual goal may quickly be squelched, forcing inventory market buyers to reevaluate how they value the high-growth expertise house. My fear is 4% or 5% CPI modifications by late summer time, with rising odds of extra Fed charge INCREASES, may trigger a monster rerating of semiconductor shares decrease for an appropriate valuation. Plus, this situation means we’ve got to deliver the recession dialogue again for later within the yr, on high of injecting a brand new degree of angst/uncertainty concerning the upcoming and demanding November election cycle.

What I’m saying is a trainwreck for SOXL may very well be approaching, with a decimation of value within the -80% or larger vary an actual risk, on its 3x design.

Last Ideas

Pulling all of the concepts collectively, the Direxion Every day Semiconductor 3x Bull ETF is a safety stuffed with threat in April (bursting on the seams truly). I do know it is tempting to imagine on the spot AI riches are a part of the funding story for SOXL, after an astounding +307% value acquire between the October low and March peak. However, all good issues should come to an finish.

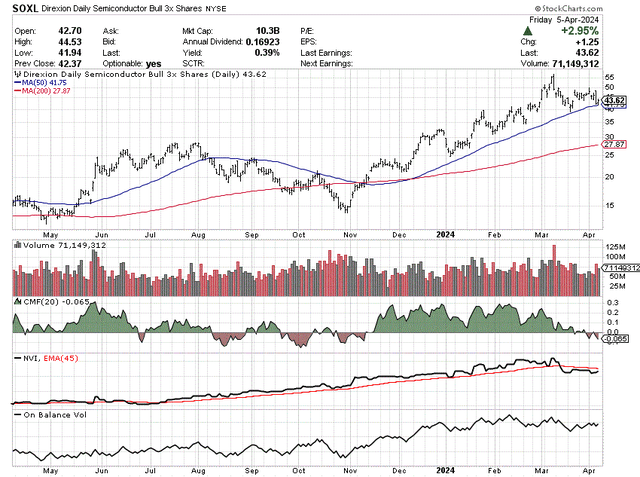

The technical chart energy of late 2023 has light quick since March. Momentum indicators peaked months in the past for this ETF, and value is getting near breaking under its 50-day shifting common for the primary time since early November.

On a 1-year chart of every day buying and selling, you may assessment the 20-day Chaikin Cash Move indicator has flipped into promote territory. The Detrimental Quantity Index energy of 2023 has reversed right into a bearish pattern throughout March-April. And, On Steadiness Quantity stats topped out in February.

StockCharts.com – SOXL, 12 Months of Every day Value & Quantity Modifications

My overriding concern is the U.S. semiconductor shares are outlining a serious high in early 2024. An sudden bounce in inflation and rates of interest means Huge Tech names aren’t solely overvalued, however deserve a drop in valuations again towards long-term norms. If that is true, a depraved selloff in SOXL may very well be at hand. Then, if we do discover ourselves in recession, with sliding demand for semiconductors and chips the fact of late 2024 and early 2025, SOXL may flip from top-of-the-line investments to personal final yr to one of many worst performers of calendar 2024.

I charge SOXL a Promote and Keep away from. For this safety to rise a lot in value into December, we’ve got to expertise an extra drop-off in inflation and rates of interest with out a recession showing. At this stage, I place the percentages of a goldilocks situation at lower than 25%. A recession later within the yr may very well be as excessive as 75%, primarily based on additional credit score crunching through greater rates of interest. For the U.S. inventory market, it might be a “be careful under” second to contemplate.

Thanks for studying. Please think about this text a primary step in your due diligence course of. Consulting with a registered and skilled funding advisor is really helpful earlier than making any commerce.

[ad_2]

Source link

Add comment