[ad_1]

Mega-cap shares have been a favourite for long-term buyers, offering stability, international attain, and constant dividends.

Utilizing InvestingPro, now we have curated a listing of the highest 36 mega-cap shares.

Our evaluation has in the end led us to 2 mega-cap shares with vital development potential that would beat the index in 2024.

Missed out on Black Friday? Safe your as much as 60% low cost on InvestingPro subscriptions with our prolonged Cyber Monday sale.

Mega-cap shares characterize shares of firms listed on the US inventory market with a market capitalization exceeding $200 billion, making them the biggest publicly traded firms globally.

With the help of InvestingPro, let’s prepare the mega-cap shares in descending order. Right here is the present listing of the highest 36 shares ranked based mostly on market cap:

These are well-established firms within the international monetary markets with annual revenues within the billions of {dollars}, they usually function globally, not simply within the US.

These shares additionally represent the biggest share within the index. Mega-cap shares with a secure monetary construction are particularly favored by long-term buyers, as they have a tendency to supply extra strong returns at low volatility. As well as, most of those shares pay common dividends and supply buyers with a big mounted revenue.

The shares with the best market capitalization, that are secure and comparatively proof against market fluctuations, are principally firms working within the expertise sector.

Right this moment, in our InvestingPro evaluation, we evaluated the very best mega-cap shares to purchase for 2024.

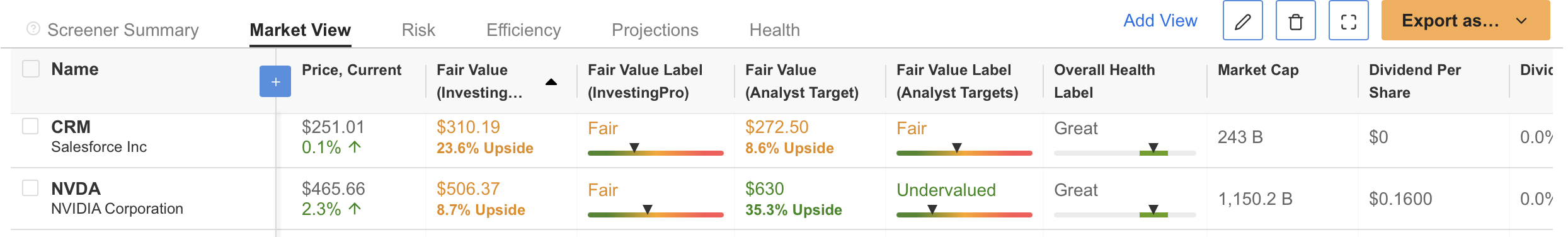

Among the many shares with a market capitalization of over $200 billion, we will see that two expertise shares stand out after we rank the shares of firms working within the expertise sector in accordance with honest worth and analyst targets.

Supply: InvestingPro

The primary of those shares, Salesforce (NYSE:), has the potential to rise near 24% in a yr in accordance with InvestingPro.

The opposite inventory, Nvidia (NASDAQ:), has an upside forecast of lower than 10% within the InvestingPro honest worth evaluation.

Nonetheless, whereas the consensus forecast of analysts is a rise within the 35% band, it’s thought that the inventory is at the moment shifting beneath its worth.

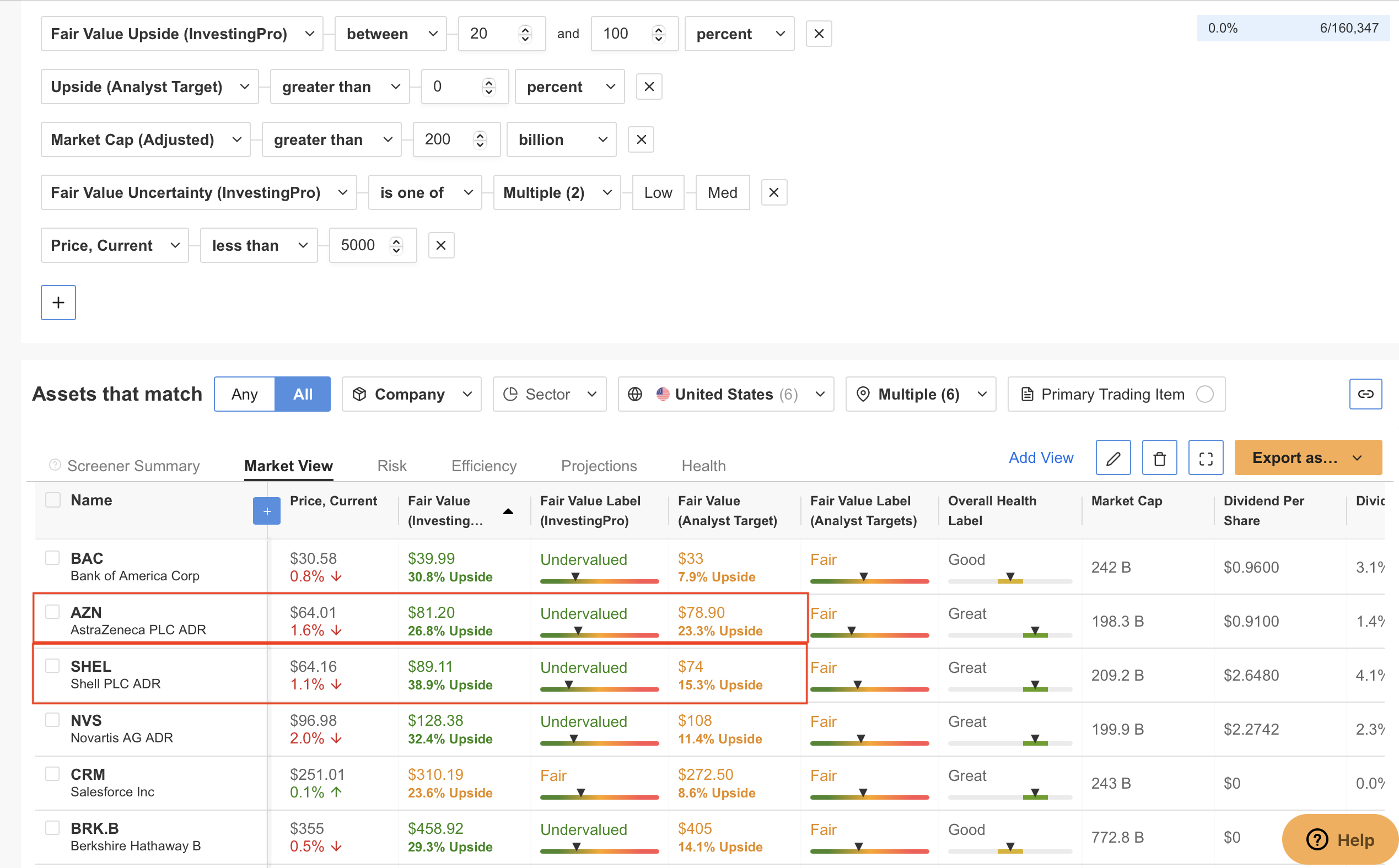

Supply: InvestingPro

In 2024, after we develop the screening of mega-cap shares with upside potential to cowl all sectors, we come throughout 6 shares in accordance with the honest worth evaluation.

Amongst these shares, Shell (NYSE:) has the best potential to extend in worth inside a yr, with a rise of almost 40%.

AstraZeneca (NASDAQ:) is the one inventory with an upside potential of greater than 20% in accordance with each InvestingPro’s honest worth evaluation and analysts’ consensus estimate.

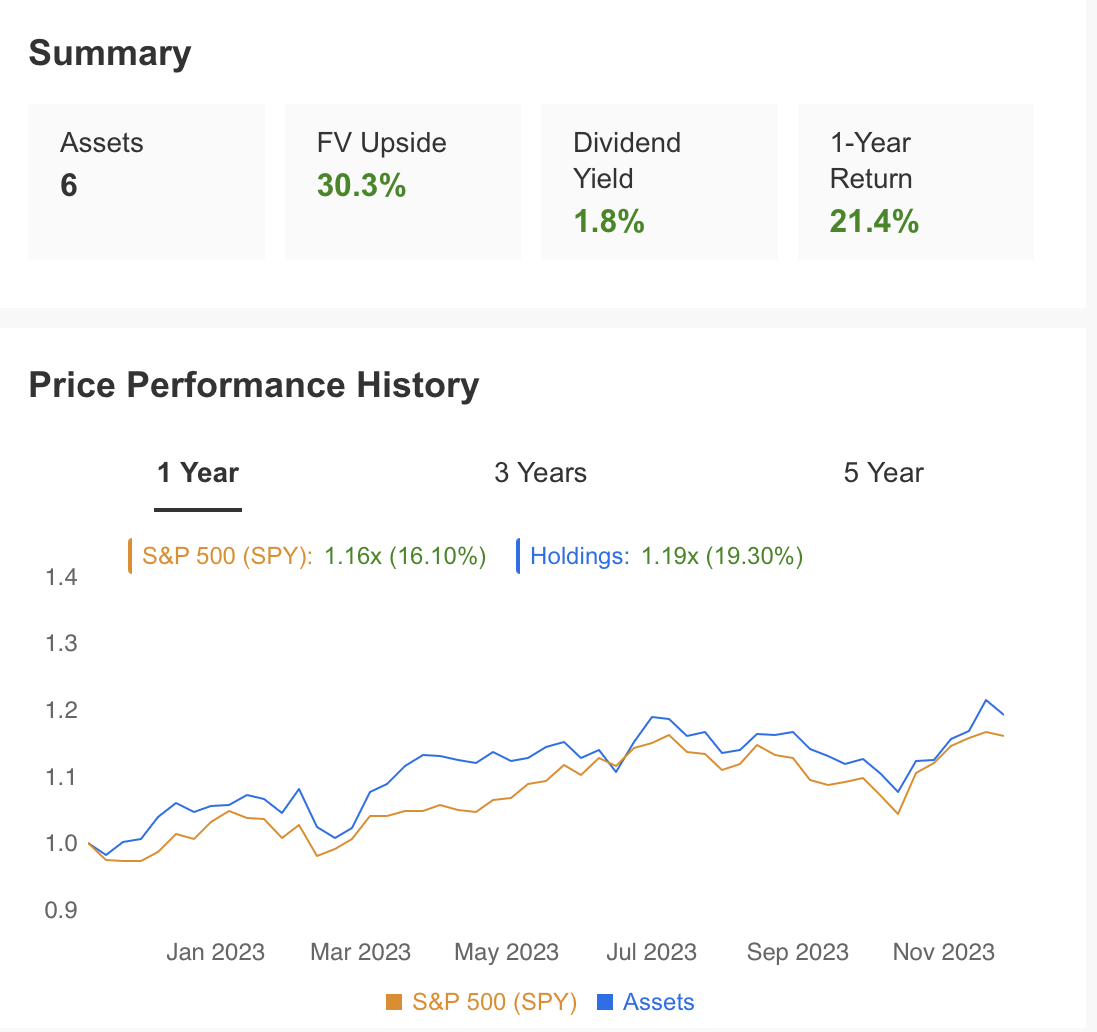

Supply: InvestingPro

Then again, when the portfolio of those shares is in comparison with the one-year efficiency of the S&P 500, it may be seen that it supplies an above-index return with a price improve of almost 20%.

The typical dividend yield of the shares was calculated as 1.8%.

***

You may simply decide whether or not an organization is appropriate in your threat profile by conducting an in depth elementary evaluation on InvestingPro in accordance with your standards. This manner, you’ll get extremely skilled assist in shaping your portfolio.

As well as, you possibly can join InvestingPro, probably the most complete platforms out there for portfolio administration and elementary evaluation, less expensive with the largest low cost of the yr (as much as 60%), by making the most of our prolonged Cyber Monday deal.

Declare Your Low cost Right this moment!

Disclaimer: The writer doesn’t personal any of those shares. This content material, which is ready for purely academic functions, can’t be thought-about as funding recommendation.

[ad_2]

Source link