[ad_1]

© Reuters.

2023 closed as a stable 12 months for inventory markets worldwide as bets that the Fed will as quickly as early 2024 prompted buyers again to threat belongings after a greater than forgettable 2022.

However regardless of the seemingly stable bull run, analysts rightly argue that 2023 was a 12 months for inventory pickers, with a handful of corporations beating the market by a hefty margin and carrying a great chunk of the benchmark features as many others underperformed.

The truth is, a whopping 72% of the ’s parts didn’t beat their benchmark index in the course of the 12 months, whereas the remaining 28% completely crushed the market with once-in-a-lifetime features.

Towards this backdrop, buyers confronted related luck with their portfolios: they both crushed the market or – almost certainly – underperformed the benchmark indexes just by holding on to the mistaken shares.

That’s the place our flagship AI-powered stock-picking device, ProPicks, can show a game-changer for 2024.

Utilizing state-of-the-art AI sources, ProPicks picks one of the best shares accessible available in the market, granting top-tier efficiency for InvestingPro customers with full entry to the device.

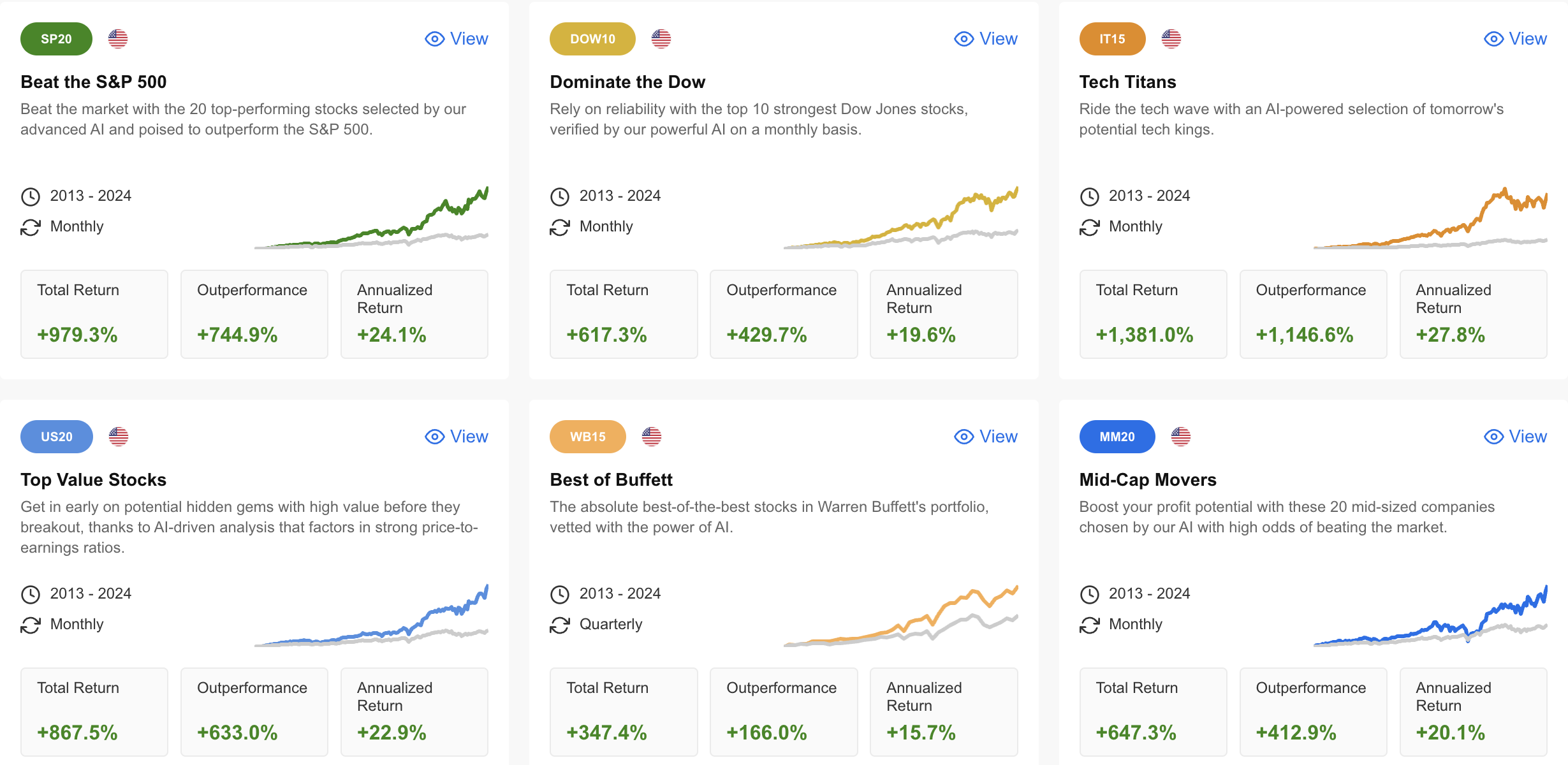

Methods are then rebalanced in the beginning of every month, including new shares which can be prone to outperform going ahead and eradicating those which have already handed their prime.  Supply: ProPicks

Supply: ProPicks

For the second month since its debut, all of our 5 methods which can be rebalanced month-to-month beat their benchmark indexes by a stable margin, making the yearly and compounded 10-year efficiency of the methods a good larger landslide in favor of ProPicks.

Right here’s the December efficiency of all of the methods, adopted by their full-year returns and their compounded 10-year efficiency:

Beat the S&P 500: December – 7.3%; FY23 – 47.8%; 10Y – 979.3%

Dominate the Dow: December – 5.2%; FY23 – 28.1%; 10Y – 617.3%

Tech Titans: December – 13.3%; FY23 – 28.9%; 10Y – 1,381%

High Worth Shares: December – 5.9%; FY23 – 54.7%; 10Y – 867.5%

Mid-Cap Movers: December – 8.6%; FY23 – 40.3%; 10Y – 647.3%

(*Better of Buffett technique is rebalanced quarterly and, thus, solely in comparison with the benchmark in that very same interval).

As a way to sustain the superb efficiency, the methods have been rebalanced once more in the beginning of January. Let’s check out two shares that had been added by the technique and one which was dropped.

InvestingPro customers can see all of the January updates right here.

Not but a Professional person? Subscribe right here and begin outperforming the market instantly.

Be a part of now for as much as 50% off for a restricted time solely as a part of our New 12 months promo!

* Readers of this text can get pleasure from an unique 10% low cost on our yearly plan with the code JANREB1 and an analogous 10% low cost on the by-yearly Professional+ plan through the use of the coupon code JANREB2 at checkout.

2 ProPicks Buys for January

Inventory 1: Lennar Corp

Technique: High Worth Shares

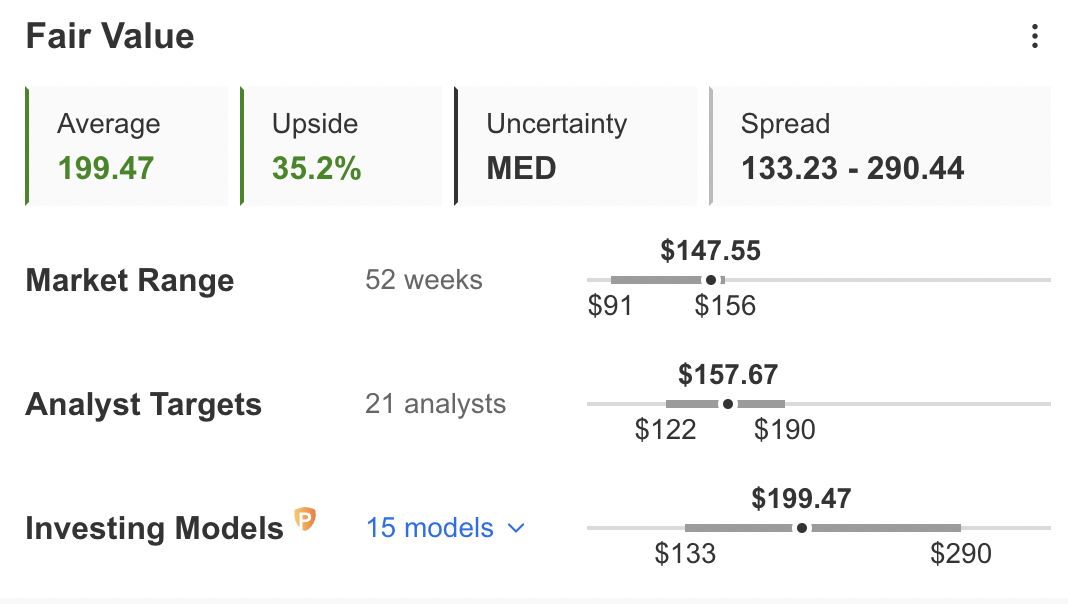

InvestingPro Upside Potential: 35.2%

As actual state shares steal the present on the again of the attitude of decreasing rates of interest, Lennar Company (NYSE:) has been added by our High Worth Shares technique as one of many high picks to trip the pattern.

On high of the optimistic macro perspective after two tough years, the Miami, Florida-based homebuilder has all the elemental strengths to maintain on outperforming.

The corporate demonstrates a excessive return on invested capital, maintains a positive cash-to-debt ratio on its stability sheet, and anticipates sustained dividend funds as a consequence of strong earnings.

It additionally holds a ‘nice’ monetary efficiency, in line with InvestingPro, and a sturdy upside potential of 35.2% over the following 12 months.  Supply: InvestingPro

Supply: InvestingPro

Like this choose? InvestingPro customers can see the 30+ new picks for this month together with all the complete methods simply by subscribing right here.

Inventory 2: DocuSign

Technique: Tech Titans

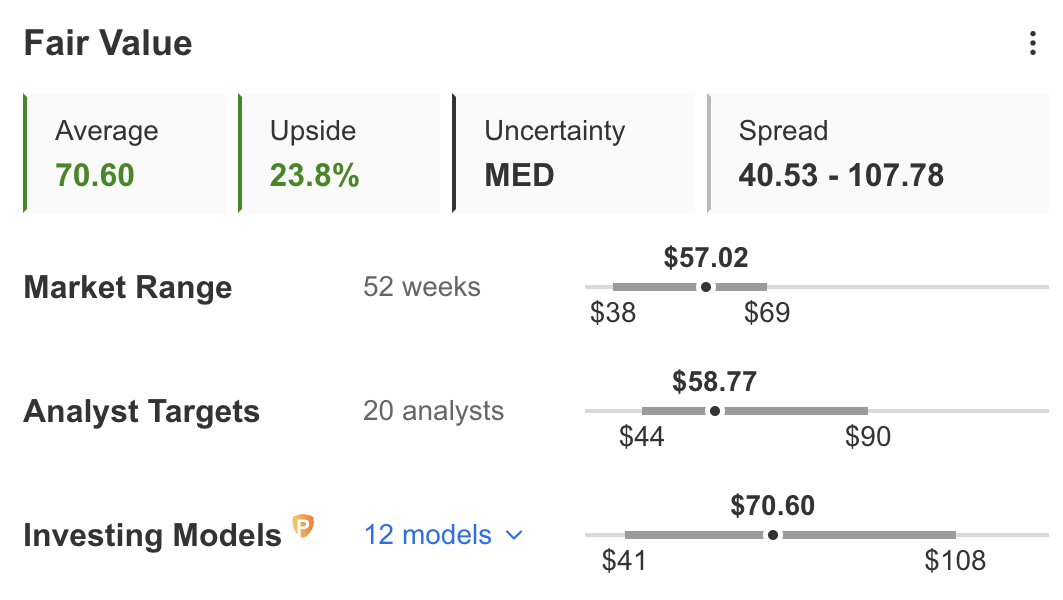

InvestingPro Upside Potential: 23.8%

As tech shares preserve main the pack within the face of a extra dovish macro atmosphere, savvy buyers start to seek for shares which have sturdy stability sheets however haven’t but absolutely ridden the risk-on practice to overbought ranges.

That’s exactly the case with DocuSign (NASDAQ:). One of many pandemic winners, the inventory stays but to reclaim buyers’ full consideration and, thus, presents extra enticing ranges than the competitors.

With a positive cash-to-debt ratio on its stability sheet, the corporate anticipates web earnings progress this 12 months, boasts spectacular gross revenue margins and has proven a sturdy return over the past month.

That’s why InvestingPro offers it a stable 23.8% progress potential beneath a great monetary well being rating.  Supply: InvestingPro

Supply: InvestingPro

Like this choose? InvestingPro customers can see the 30+ new picks for this month together with all the complete methods simply by subscribing right here.

1 ProPicks Promote

Inventory: Palo Alto Networks

Technique: Dominate the Dow

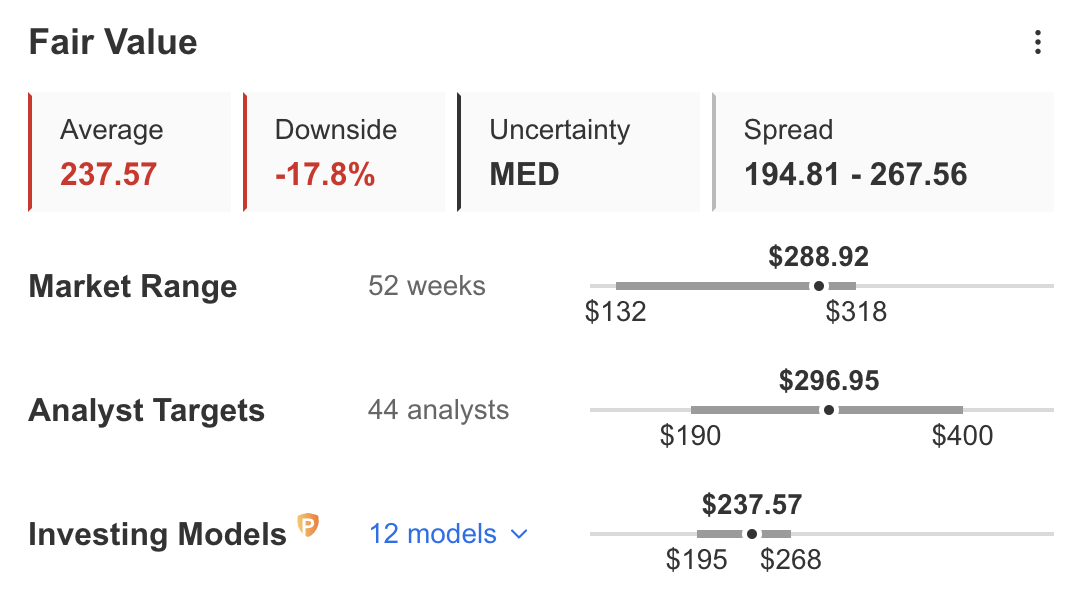

InvestingPro Truthful Worth: -17.8%

After a formidable 111% rally in 2023, Palo Alto Networks (NASDAQ:) has hit overbought ranges that aren’t in step with ProPicks’ threat profile.

Though the macro atmosphere nonetheless seems favorable to the corporate, many basic elements are screaming ‘promote.’ With a PE ratio of 148.4x, which is excessive even for the fast-growing cybersecurity area, the inventory is anticipated to drop within the upcoming months as its short-term obligations exceed liquid belongings.

That’s the principle cause why the corporate holds a -17.8% goal on InvestingPro, as seen within the chart beneath.  Supply: InvestingPro

Supply: InvestingPro

As a matter of truth, ProPicks customers who offered the inventory on January 1 (when the minimize was first introduced) managed to flee Palo Alto’s lackluster begin to the 12 months, with the inventory dropping a hefty 2% on the primary buying and selling day of the 12 months.

Wishing you had offered it as properly? InvestingPro customers can see all of the adjustments in methods by subscribing right here.

Be a part of now for as much as 50% off for a restricted time solely as a part of our New 12 months promo!

* Readers of this text can get pleasure from an unique 10% low cost on our yearly plan with the code JANREB1 and an analogous 10% low cost on the by-yearly Professional+ plan through the use of the coupon code JANREB2 at checkout.

[ad_2]

Source link