[ad_1]

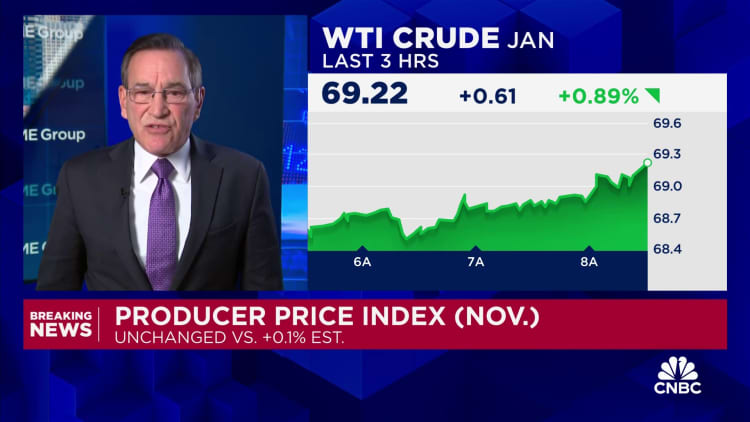

Wholesale costs have been flat in November, offering a number one indicator that inflation is easing, the Labor Division reported Wednesday.

The producer worth index, which measures a broad vary of costs on closing demand objects, was unchanged for the month, following a 0.4% lower in October however lower than the Dow Jones estimate for a 0.1% achieve. On a year-over-year foundation, headline PPI accelerated simply 0.9%, after peaking above 11.5% in March 2022.

Excluding meals and power, the index additionally was unchanged in opposition to an estimate for a 0.2% enhance. Excluding meals, power and commerce companies, PPI elevated 0.1%, posting a sixth straight enhance and good for a 12-month achieve of two.5%.

The discharge comes a day after the Labor Division stated its client worth index rose simply 0.1% in November and three.1% from a 12 months in the past. The PPI gauges the costs producers obtain for what they produce whereas CPI measures what shoppers pay and is taken into account a number one sign for costs within the pipeline.

Collectively, the easing inflation information, together with different financial alerts, probably will give the Federal Reserve sufficient room to carry benchmark rates of interest regular when its coverage assembly concludes Wednesday.

On the wholesale degree, indexes for each items and companies have been unchanged, although there have been some massive swings inside elements.

Gasoline, as an illustration, fell 4.1% whereas rooster eggs soared 58.8%. The index for closing demand power fell 1.2%, offsetting will increase of 0.6% for meals and 0.2% for items much less meals and power.

Do not miss these tales from CNBC PRO:

[ad_2]

Source link