[ad_1]

Wholesale costs unexpectedly declined in December, offering a constructive sign for inflation, the Labor Division reported Friday.

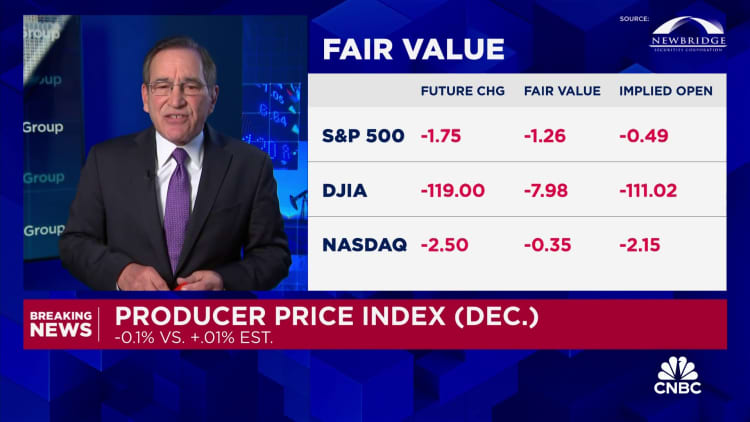

The producer worth index fell 0.1% for the month and ended 2023 up 1% from a yr in the past, the Labor Division reported Friday. Economists surveyed by Dow Jones had been anticipating a month-to-month acquire of 0.1%. The index had surged 6.4% in 2022.

Excluding meals and vitality, core PPI was flat in opposition to the estimate for a 0.2% improve. Excluding meals, vitality and commerce companies, PPI additionally was up 0.2%, consistent with the estimate. For the complete yr, the ultimate demand measure much less meals, vitality and commerce companies rose 2.5% for all of 2023 after being up 4.7% in 2022.

The PPI launch comes a day after much less encouraging information from the Labor Division, which reported Thursday that the costs customers pay for items and companies rose 0.3% in December and had been up 3.4% on the yr. That was larger than Wall Avenue expectations and nonetheless an excellent deal away from the Fed’s 2% inflation goal.

Nevertheless, PPI is usually thought-about a greater main index because it measures pipeline costs that firms get for intermediate items and companies.

Markets initially reacted positively to the PPI launch however turned decrease by morning buying and selling.

“What inflation dangers stay within the U.S. financial system clearly can’t be sourced to any upward stress in producers’ prices,” mentioned Kurt Rankin, senior economist at PNC. “Whether or not surveying from producers’ intermediate or ultimate demand perspective, there’s little to no pricing stress headed into the U.S. financial system from the provision aspect coming into 2024.”

Costs for ultimate demand items declined 0.4% in December, the third straight month of decreases, in response to the discharge. Diesel gasoline costs tumbled 12.4%, despite the fact that gasoline elevated 2.1%.

On the companies aspect, which Fed officers have been following extra carefully, costs held at unchanged for the third straight month. Costs in fields related to monetary recommendation rose 3.3%, whereas margins for equipment and automobile wholesaling dipped 5.5%.

PPI measures the costs that producers pay for items and companies, whereas CPI gauges what customers pay within the market. CPI additionally consists of imports whereas PPI doesn’t. PPI, nevertheless, covers a broader set of products and companies.

Markets are satisfied that waning inflation indicators will push the Fed to chop rates of interest beginning in March, even with inflation above goal.

Merchants within the fed funds futures market are pricing in a few 70% chance that the first-quarter proportion level minimize will come on the March 19-20 assembly of the Federal Open Market Committee, in response to the CME Group’s FedWatch tracker. From there, markets count on one other 5 charge cuts, taking the benchmark fed funds charge all the way down to a goal vary of three.75%-4%.

Nevertheless, varied Fed officers in current days have made statements that appear to counter the market’s aggressive view. Furthermore, JPMorgan Chase CEO Jamie Dimon on Friday warned that heavy authorities deficit spending together with different elements may trigger inflation to be stickier and charges to be larger than the market expects.

[ad_2]

Source link