[ad_1]

strelov

The shares of the US hashish operators had been hovering on Friday, with the favored MSOS ETF (NYSEARCA:MSOS) up round 10%. With the Drug Enforcement Administration (‘DEA’) present process a evaluate of the USA Division of Well being and Human Companies’ (HHS) advice to reschedule hashish, there have been no scarcity of headlines for the sector. Nevertheless, as we speak’s worth motion appeared extra sharp than regular as a few of the headlines appeared to hold extra weight. On this report, I dissect the assorted headlines, evaluate the importance of rescheduling, and talk about my high picks within the sector.

Why Are Hashish Shares Rising Right this moment?

There have been a handful of potential explanation why hashish shares had been hovering as we speak. First, HHS Secretary Xavier Becerra made feedback on Capitol Hill on Thursday in favor of following the “science.” Right this moment, Vice President Kamala Harris held a gathering with hashish pardon recipients the place she referred to as on the DEA to reschedule hashish “as rapidly as doable.”

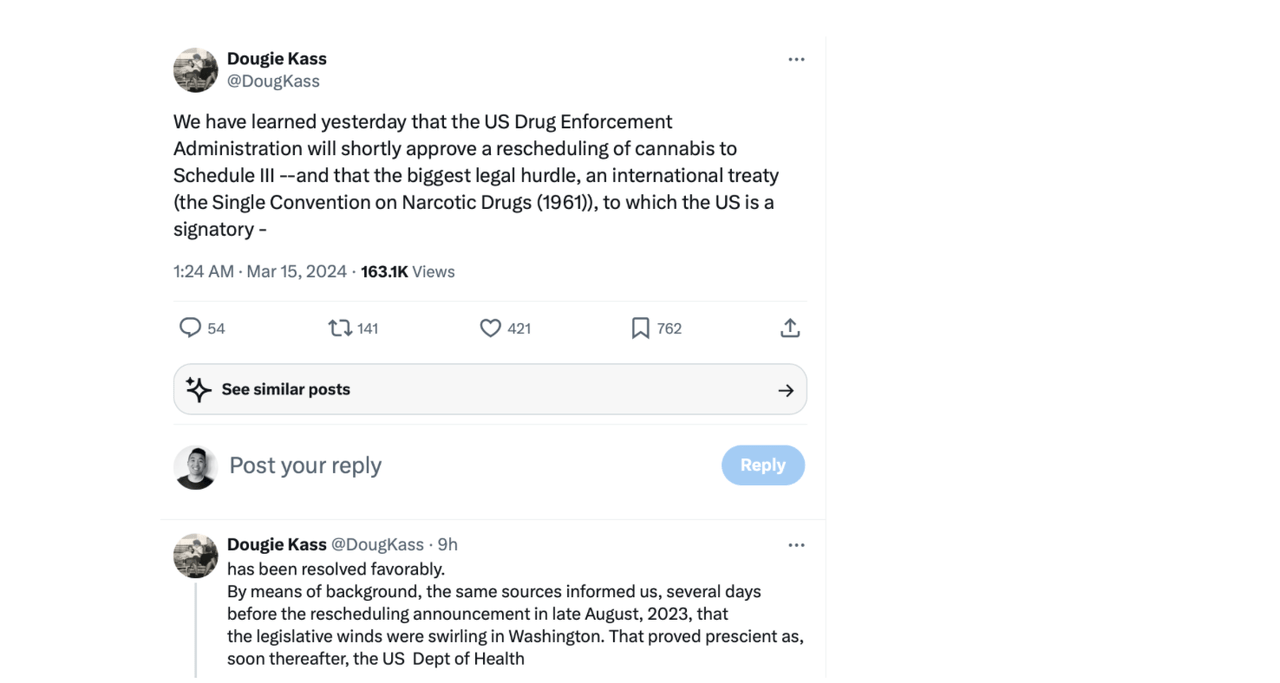

However for my part, probably the most important driver of as we speak’s rally was not from any official headline however as an alternative from varied tweets despatched from famed investor Dougie Kass of Seabreeze Capital Companions the place he notes that his sources have suggested that the DEA will “shortly approve a rescheduling of hashish to Schedule III.”

In one other one among his tweets, he references the next trade from an Ask A Pol reporter with Senator Cory Booker.

ML: “Have you ever heard something about DEA and the administration shifting?”

CB: “I’ve heard lots about it.”

ML: “I’ve heard rumors that it is likely to be April fifteenth — have you ever heard that?”

CB: “I don’t wish to touch upon that.”

Booker laughs as he hops onto the elevator along with his aide.

ML: “Ooooh — I am heat?”

CB: “Sure…”

Confusion as elevators are shutting and other people shuffling previous.

CB: “…you didn’t say ‘420.’”

ML: “Proper? Have a very good one.”

CB: “Huh?”

That trade seems to counsel an unintended acknowledgement that rescheduling of hashish could also be on the way in which. We clearly can not affirm Kass’ sources, however it’s exhausting to not share a few of the optimism.

Why Rescheduling Issues For Hashish Shares

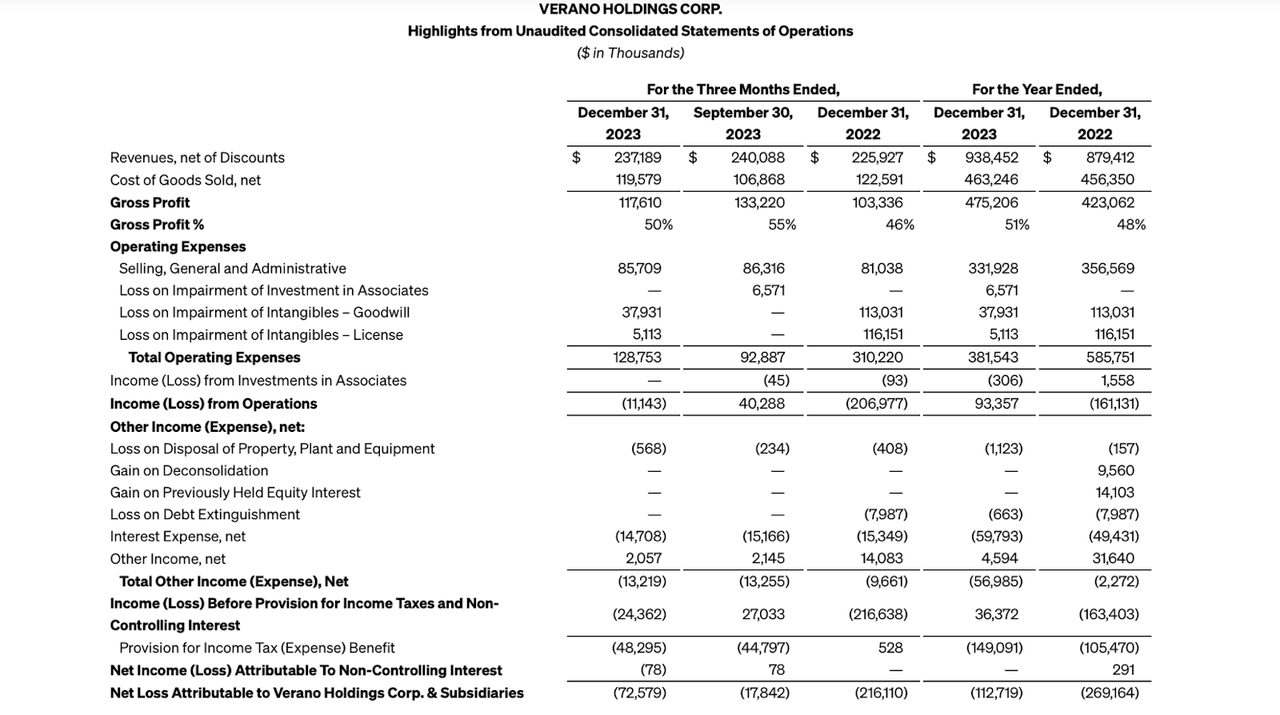

There are actual causes for this rally. US hashish operators are unable to deduct working bills from the calculation of taxable earnings. It could be simpler to have a look at an actual instance. We see under the earnings assertion for high operator Verano Holdings (OTCQX:VRNOF):

2023 This autumn Press Launch

We are able to see that the corporate recorded $149.1 million in earnings taxes in 2023 despite solely producing $36.4 million in earnings earlier than provision for earnings taxes. Administration estimates that the removing of 280e taxes, which can happen upon rescheduling hashish to Schedule III, would have saved the corporate over $80 million in taxes in 2023. Rescheduling hashish to Schedule III, whereas falling in need of decriminalization, could result in a sudden surge in money flows in addition to declining prices of capital for these operators.

Greatest Hashish Picks

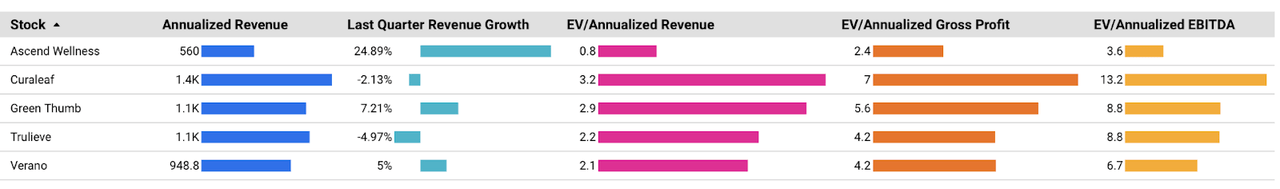

Let’s now talk about tips on how to probably make investments on this upcoming catalyst. Inexperienced Thumb Industries (OTCQX:GTBIF) is all the time a notable decide as a consequence of its GAAP profitability and cheap valuation. Trulieve (OTCQX:TCNNF) trades at related valuations and will provide publicity to potential adult-use legalization in its residence state of Florida. One can even look to the smaller operators like Ascend Wellness (OTCQX:AAWH), which are inclined to commerce at sizable reductions relative to the bigger operators.

Hashish Development Portfolio

I count on the shares of the MSOs to fare nicely within the occasion rescheduling is handed. That stated, I proceed to favor as an alternative investing within the hashish landlord NewLake Capital (OTCQX:NLCP), a internet lease REIT which is smaller than its extra well-known peer Revolutionary Industrial Properties (IIPR). NLCP yields 9.4%, has no internet debt on its steadiness sheet, and stands to see its tenants’ credit score profile enhance dramatically upon rescheduling. In my opinion, NLCP presents upside publicity to rescheduling whereas additionally representing stable worth even within the occasion that rescheduling doesn’t happen.

Conclusion

With a lot enthusiasm within the hashish sector, it bears reminding that many of those operators have excessive leverage on their steadiness sheets and will do poorly within the occasion that rescheduling doesn’t happen, as they grapple with the results of the upper rate of interest setting. Merchants would possibly recognize the catalyst-driven setup for hashish shares, and I emphasize that one doesn’t must put money into the operators themselves to get publicity to such upside.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.

[ad_2]

Source link