[ad_1]

Whereas many speculate a few market bubble, historic information reveals that is not the case this time.

On this piece, we are going to try to analyze the distinction between an precise bubble and present market situations.

In 2024, make investments like the large funds from the consolation of your property with our AI-powered ProPicks inventory choice software. Study extra right here>>

Shares reaching new highs typically recommend that extra highs could possibly be on the best way. Nevertheless, often, the market takes a break, much like a runner stopping after protecting a protracted distance.

A decline, ultimately, is taken into account wholesome throughout a raging bull market. Nevertheless, these are simply assumptions; no person can precisely predict corrections.

The has surged by greater than 25% since late October final 12 months and a correction could possibly be within the playing cards.

Corrections, in contrast to recessions, might prolong as much as declines of 20%. Here is a listing of market corrections since 2000:

In 2002, a decline of 14.7% occurred over 100 days.

In 2010, there was a 16.0% decline spanning 70 days.

In 2011, the market skilled a 19.4% decline lasting 150 days.

In 2015, there was a 13.3% decline over 100 days.

In 2018, a decline of 10.2% occurred in simply 12 days.

Additionally in 2018, a 19.8% decline occurred over 95 days.

In 2023, a ten.3% decline occurred over 85 days.

Are We in a Market Bubble?

Nevertheless, individuals are actually calling it a bubble, though they initially dismissed this upward pattern as only a momentary market rally in late October 2023.

Individuals are inclined to misread the definition of a market bubble. Here is what occurs on the finish of a bubble: an entire collapse. Technically, there have been only a few cases of such collapses.

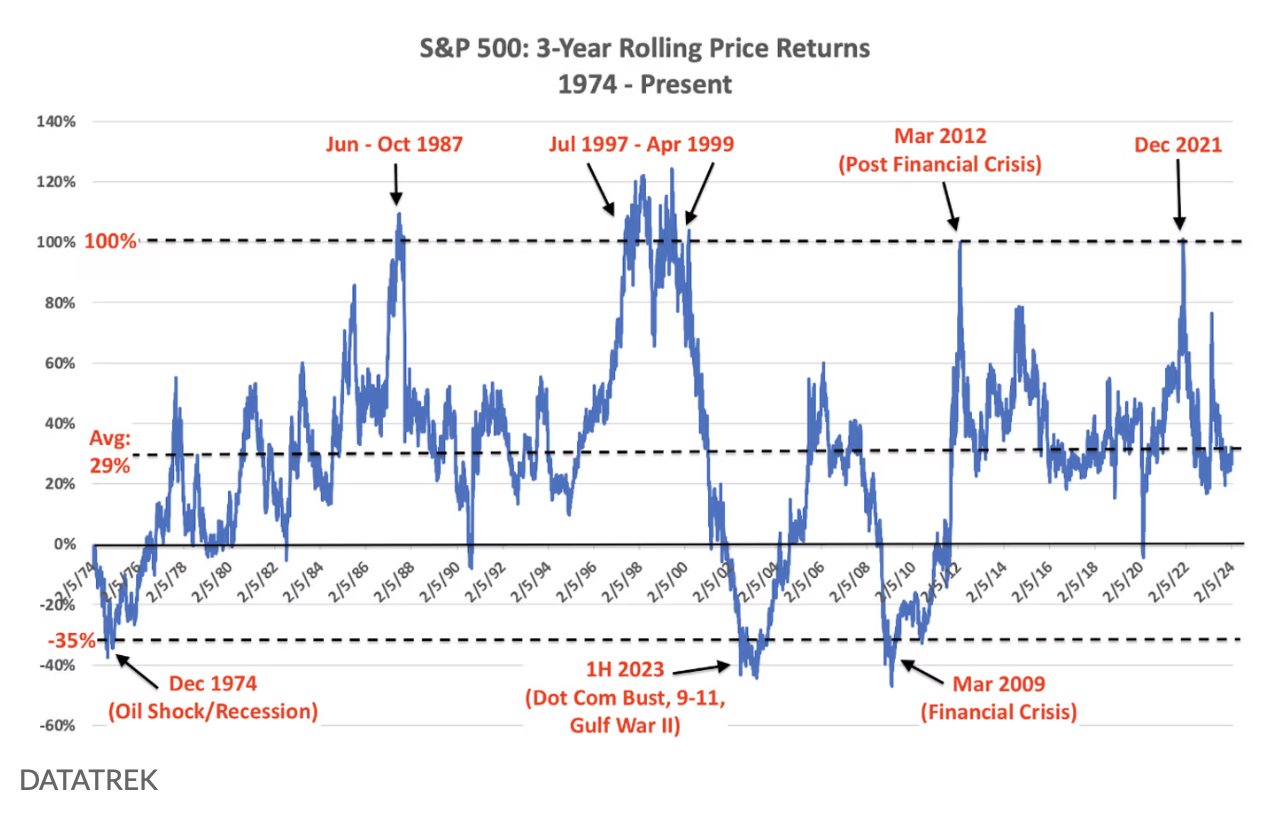

Since 1974, when the S&P 500 yielded returns of at the very least 100% over three years, historic information signifies cases of market bubbles (noticed in 1987, 1999, 2012, and 2021).

Nevertheless, within the final three years, the return has been round 30%, aligning with the overall common return. This implies that the present market situation is probably not indicative of a bubble.

Tech Bubble Vs. Bull Market

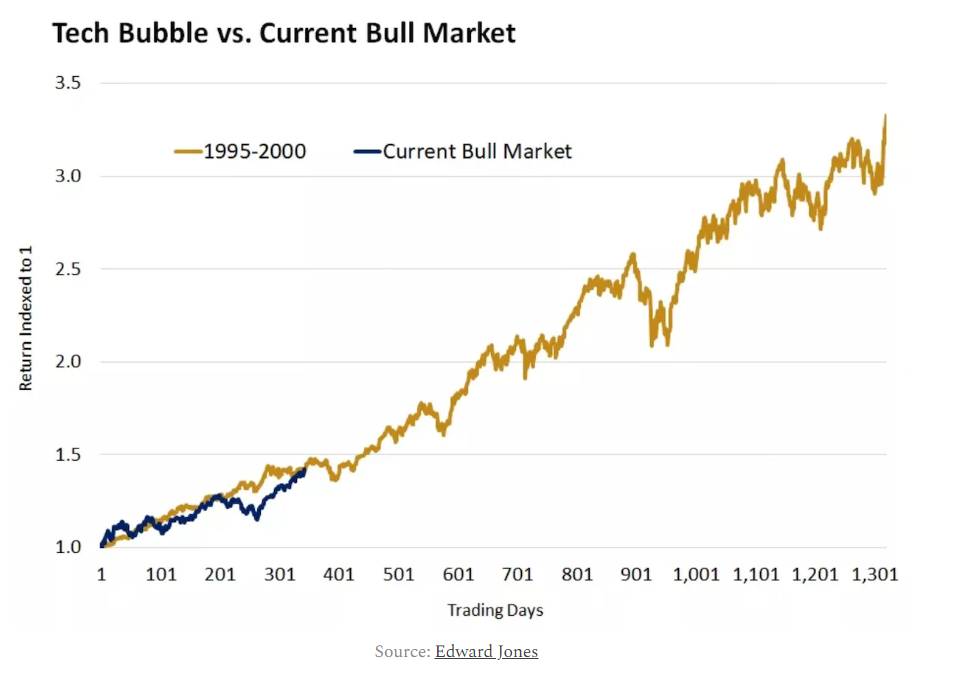

Evaluating the current bullish market and the present pleasure round synthetic intelligence to the dot-com bubble, typically cited for instance of a bubble, reveals a major distinction.

The current returns and developments available in the market point out that there’s nonetheless appreciable room for development earlier than reaching bubble-like situations.

The pattern is in keeping with the previous pattern however it is rather early, simply take a look at the variety of days which might be nonetheless speculated to go. Within the Nineteen Nineties there have been large beneficial properties in unprofitable dot-com firms, a lot of which had enticing development prospects however no viable or sustainable revenue base.

At this time the keenness is concentrated within the largest firms with prolific and defensible earnings. Nvidia (NASDAQ:), Meta (NASDAQ:), Apple (NASDAQ:), Amazon (NASDAQ:), Microsoft (NASDAQ:), Alphabet (NASDAQ:) and Tesla (NASDAQ:).

***

Take your investing recreation to the subsequent degree in 2024 with ProPicks

Establishments and billionaire traders worldwide are already properly forward of the sport in the case of AI-powered investing, extensively utilizing, customizing, and creating it to bulk up their returns and reduce losses.

Now, InvestingPro customers can do exactly the identical from the consolation of their very own houses with our new flagship AI-powered stock-picking software: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 1,183% during the last decade, traders have the very best number of shares available in the market on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Subscribe At this time!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or suggestion to take a position as such it’s not supposed to incentivize the acquisition of belongings in any approach. I want to remind you that any sort of asset, is evaluated from a number of factors of view and is very dangerous and subsequently, any funding determination and the related danger stays with the investor.

[ad_2]

Source link