[ad_1]

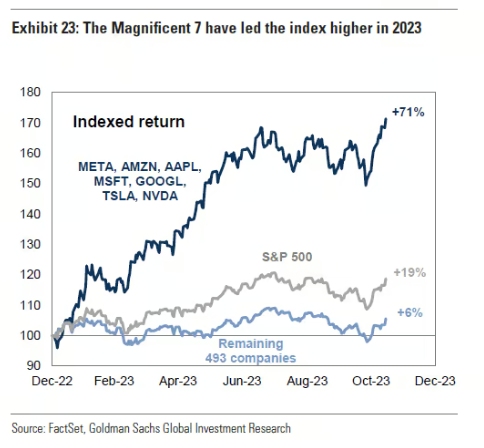

The S&P 500’s efficiency this 12 months has primarily been pushed by the ‘Magnificent 7’ shares,

In the meantime, the opposite 493 shares have lagged with Goldman Sachs forecasting that the highest 7 may proceed outperforming

Whereas November was an incredible month for shares, this efficiency may simply prolong into December

Missed out on Black Friday? Safe your as much as 60% low cost on InvestingPro subscriptions with our prolonged Cyber Monday sale.

Regardless of the gaining 19% because the 12 months’s begin, many particular person traders’ YTD efficiency has probably fallen brief.

A more in-depth examination of the index’s efficiency reveals a considerably misleading pattern, primarily pushed by the seven shares with the very best market capitalization focus within the index.

The efficiency of the ‘Magnificent 7’ shares in opposition to the remaining 493 underscores this.

Magnificent 7 Vs. Others Efficiency

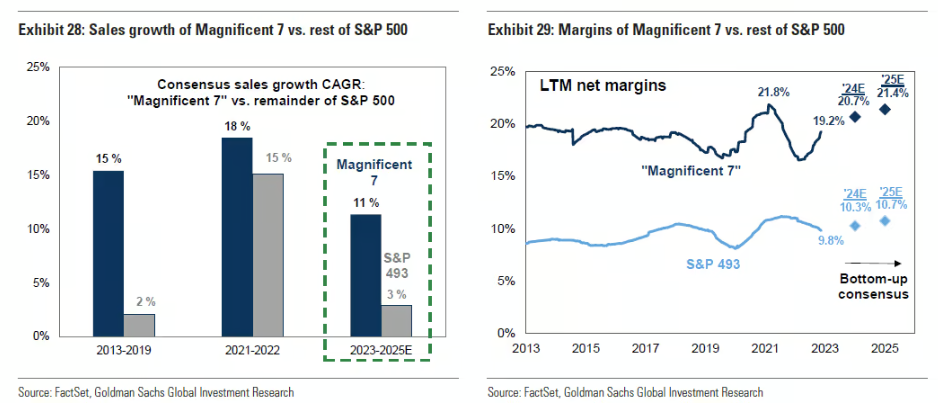

Based on Goldman Sachs, the Magnificent 7 will proceed to outperform the remainder of the basket.

Analysts’ estimates present that the large-caps are set to extend gross sales at a CAGR (compound annual progress charge) of 11% via 2025 in comparison with a mere 3% for the remainder of the shares.

These titans are additionally poised to do significantly better when it comes to the P/E in comparison with the remainder of the market

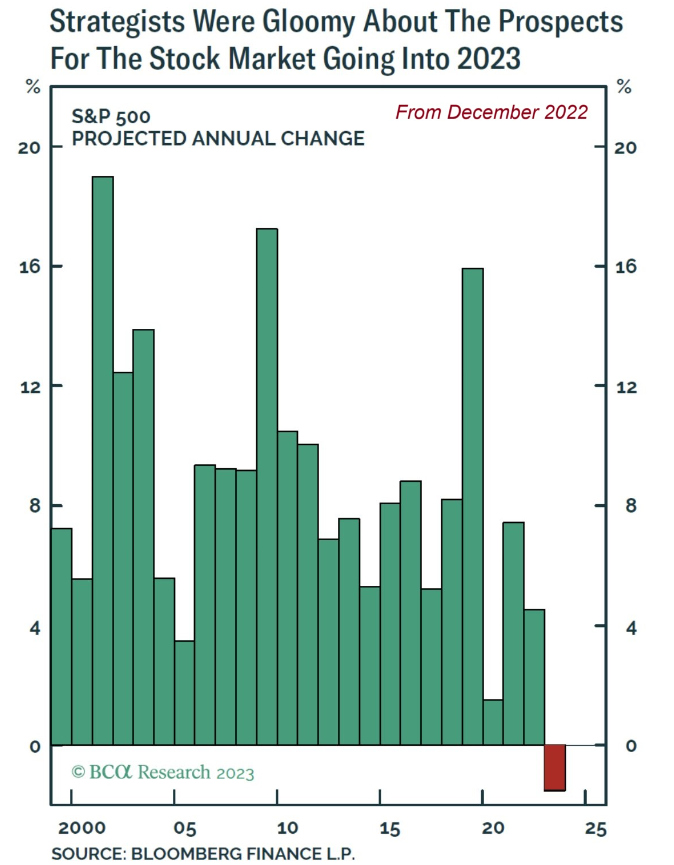

But a 12 months in the past the ‘strategists’ on the main funding banks had been predicting an actual collapse in shares in 2023, the primary time since 2000 that that they had predicted such a loss.

Apparently, the strategists, up up to now, have been incorrect. This may very well be a key issue supporting continued bullish sentiment in December, notably given the sustained constructive pattern over the previous few months.

The S&P 500 has achieved practically a 20% acquire, tripling its common annual return, whereas the Nasdaq is at present yielding over 36% YTD.

For a lot of traders, the extent of optimism or pessimism typically hinges on their particular person efficiency, particularly in direction of the tip of the 12 months.

Nonetheless, sustaining optimism in investments is essential, provided that pessimism can considerably diminish long-term returns.

It is advisable to deal with understanding the markets, disregard adverse media biases that may distort perceptions of downturns, and decide one’s capability to face up to volatility, adjusting the portfolio accordingly.

Key Ratios Are Sending a Bullish Sign

Inspecting the ratio of commodities to low-volatility shares (NYSE:) can present insights. When commodities underperform, it alerts energy within the broader market, notably the S&P 500.

At present, low volatility and commodity developments relative to the S&P 500 at all times level to new lows, as they’ve performed all 12 months.

The truth that these ratios are pointing downward ought to give us an preliminary constructive view: Threat belongings most likely nonetheless have room for progress between now and the tip of the 12 months.

***

You may simply decide whether or not an organization is appropriate on your danger profile by conducting an in depth basic evaluation on InvestingPro in response to your individual standards. This manner, you’re going to get extremely skilled assist in shaping your portfolio.

As well as, you possibly can join InvestingPro, one of the vital complete platforms out there for portfolio administration and basic evaluation, less expensive with the largest low cost of the 12 months (as much as 60%), by profiting from our prolonged Cyber Monday deal.

Declare Your Low cost At present!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or advice to speculate as such it isn’t supposed to incentivize the acquisition of belongings in any approach. I want to remind you that any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding resolution and the related danger stays with the investor.

[ad_2]

Source link