[ad_1]

Megapixel8

Whereas 2023 was difficult for US industrial actual property (CRE) buyers, we consider that it’s “off the ground in 2024,” with actual property poised to start out its value restoration someday within the second half of the yr.

Assume of it as a series response, which begins with fed fund fee reductions. That ought to assist to decrease actual property debt prices, which ought to, in flip, cut back upward strain on cap charges. An eventual raise in cap charges ought to drive larger actual property costs.

Decrease rates of interest begin a series response

The December 2023 Federal Open Market Committee (FOMC) assembly despatched the message that actual property buyers have been ready for. Confidence in decrease inflation is solidifying, and financial tightening is nearing an finish.

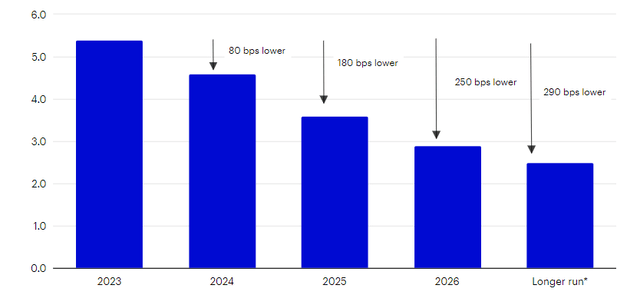

The fed funds fee is predicted to be minimize 3 times in 2024 and several other extra occasions into 2027. Whereas inflation and financial development have stunned to the upside since then, on the March 20 assembly, the FOMC bolstered that they count on to start out lowering the fed funds fee someday this yr with further cuts to comply with.

Decrease fed funds fee projected forward

FOMC median projections of the fed funds fee at year-end

Sources: Invesco Actual Property, using information from the Federal Open Market Committee’s (FOMC) March 24, 2024 median projection of the fed funds fee. Previous efficiency shouldn’t be a assure of future outcomes. Ahead-looking statements usually are not ensures of future outcomes. They contain dangers, uncertainties, and assumptions; there might be no assurance that precise outcomes won’t differ materially from expectations. Bps = foundation level, a unit that is the same as one one-hundredth of a p.c.

First response: Decrease actual property debt prices

Decrease coverage charges are a obligatory catalyst for lowering rates of interest extra broadly, together with CRE debt prices. The historic relationship between coverage charges and debt prices has been effectively established.

Actual property debt prices are priced at a ramification above sure base rates of interest, together with the fed funds fee. The unfold varies over time. When coverage charges are escalated, the unfold to actual property debt prices narrows, which ultimately causes actual property debt prices to rise with the intention to preserve a premium over base coverage charges.

In contrast, when coverage charges are decreased, so is strain on debt prices, ultimately leaving room for them to fall, which in the end impacts actual property cap charges.

Subsequent response: Decrease cap charges

Reductions in actual property debt prices have traditionally led to decrease cap charges and value development. As a result of industrial actual property investing usually consists of financing, actual property debt prices traditionally have been intently associated to actual property cap charges (the connection between a property’s web working earnings divided by the property’s buy value).

For the reason that begin of 2000, the correlation between market cap rates2 and stuck debt costs3 has been a really robust 0.85.4 A decline in debt prices is extremely more likely to end in a decline in cap charges, which usually displays rising costs.

Subsequent response: Rising costs

The historic relationship between year-over-year modifications in cap charges and CRE costs has been very robust. A discount in cap charges and an increase in costs sometimes go hand-in-hand, and vice versa, for a structural purpose.

Actual property value is a part of the cap fee equation (i.e., web working earnings divided by value). From the beginning of 2000 to the top of 2023, the correlation between the annual motion of cap charges versus costs has been -0.81, indicating a really robust inverse relationship.6

So traditionally, falling coverage charges led to falling debt prices, which led to falling cap charges, which led to rising costs. We count on this chain response to unfold over the following a number of months.

Plus, plunge in new begins

Slower leasing velocity by means of a lot of 2023 largely mirrored tenants’ warning in a better rate of interest surroundings. Whereas workplace buildings and malls proceed to face long-term structural demand pressures, the leasing tempo in different property varieties is predicted to speed up as rates of interest ease and confidence in sustained financial development recovers.

Ideally, the restoration of leasing demand will coincide with the anticipated decline of recent provide deliveries later this yr and into early 2025.

New development financing has stalled for greater than a yr resulting from larger rates of interest, resulting in a fast discount of recent development begins from the top of 2022 to the current.5

Since new initiatives sometimes require one to 2 years to finish, a dearth of recent begins in 2023 signifies that new deliveries will shrink in 2024 and into 2025.

As soon as leasing demand ultimately picks up, a scarcity of recent provide ought to present room for rents to develop. And rising rents would offer affirmation to buyers {that a} new development cycle had certainly commenced, which might entice capital and drive actual property costs larger.

Some dangers

Simply because the shift in Fed coverage may very well be the first catalyst for actual property value restoration, elements that might redirect that coverage shift are a threat. Inflation might unexpectedly escalate and trigger the Fed to delay the loosening of financial coverage.

The US authorities’s upward revision of 2023 job development launched in January invitations questions concerning the potential for wage enlargement to gas inflation.

Protecting rates of interest larger for longer would delay the discount of actual property debt prices and, in flip, the easing of cap charges and development of CRE costs.

It might even trigger cap charges to rise additional and costs to fall additional. Moreover, sustained larger rates of interest would probably trigger tenants to stay cautious and delay leasing selections.

Our expectation of actual property costs discovering a trough within the second half of 2024 is contingent on the Fed’s confidence that inflation is on a path towards normalization.

Assuming it does begin to cut back coverage charges this yr as anticipated, the time required to in the end have an effect on cap charges might doubtlessly stretch into 2025.

Conclusion: Rise in costs in second half of 2024

The Fed despatched a transparent message about inflation and financial coverage in December and bolstered it in March. The shift in Fed coverage, in our view, will begin a series response that can result in decrease actual property debt prices and cap charges and, in flip, an increase in CRE costs someday within the second half of 2024. And whereas there are dangers to this outlook, we consider that actual property buyers are poised to behave on a rising conviction of fee discount.

Footnotes

* The median forecast for the longer-run fed funds fee by the Federal Open Market Committee (FOMC) represents every committee participant’s evaluation of the place the speed “could be anticipated to converge, over time, below acceptable financial coverage and within the absence of additional shocks to the financial system.” (Supply: FOMC Abstract of Financial Projections, December 13, 2023). The St. Louis Fed defines the FOMC “longer run” projections as follows: “The longer-run projections are the charges of development, inflation, unemployment, and federal funds fee to which a policymaker expects the financial system to converge over time within the absence of additional shocks and below acceptable financial coverage. As a result of acceptable financial coverage, by definition, is geared toward reaching the Federal Reserve’s twin mandate of most employment and value stability within the longer run, policymakers’ longer-run projections for financial development and unemployment could also be interpreted, respectively, as estimates of the financial system’s longer-run potential development fee and the longer-run regular fee of unemployment; equally, the longer-run projection of inflation is the speed of inflation which the FOMC judges to be most according to its twin mandate in the long term.” Per the December 13, 2023 FOMC projections, their “longer-run” projections begin after December 31, 2026.

2. Inexperienced Road’s Industrial Property Value Index (CPPI) is used because the proxy for industrial actual property pricing. Knowledge for the collection begins in Q1-2000 (starting January 1, 2000).

3. Knowledge from the American Council of Life Insurers (ACLI) is used because the proxy for fastened debt charges. On the time of this writing, ACLI debt fee information have been out there by means of Q3-2023, that’s, by means of September 30, 2023.

4. Sources: Invesco Actual Property, using information from Inexperienced Road (market cap charges) and the American Council of Life Insurers (fastened fee debt prices as of March 2024. Knowledge cowl the time interval from January 1, 2000 to December 31, 2023.

5. Supply: Invesco Actual Property, using information from CoStar as of February 2024. Knowledge cowl the previous 10 years of accessible information from January 1, 2014 to December 31, 2023.

6. Sources: Invesco Actual Property, using equal-weighted figures for each cap charges and the Industrial Property Value Index from Inexperienced Road as of February 2024. Knowledge cowl the time interval from January 1, 2000 to December 31, 2023. Previous efficiency doesn’t assure future outcomes.

Essential info

NA3421009

The worth of investments and any earnings will fluctuate (this may occasionally partly be the results of trade fee fluctuations), and buyers could not get again the complete quantity invested. Property and land might be troublesome to promote, so buyers could not be capable to promote such investments after they need to. The worth of property is usually a matter of an unbiased valuer’s opinion and might not be realized. Typically, actual property belongings are illiquid in nature. Though sure sorts of investments are anticipated to generate present earnings, the return on capital and the belief of features, if any, from an funding will usually happen upon the partial or full disposition of such funding.

Investing in actual property sometimes entails a average to excessive diploma of threat. The potential of partial or whole lack of capital will exist.

The federal funds fee is the speed at which depository establishments lend to one another.

Capitalization charges (cap charges) are the quotient of a property’s web working earnings divided by the property’s estimated worth.

Unfold is the distinction between two monetary charges. This text discusses the distinction, or unfold, between fastened debt prices (fastened debt fee) and the fed funds fee. American Council of Life Insurers (ACLI) is used because the proxy for fastened debt charges.

Correlation signifies the diploma to which two investments have traditionally moved in the identical course and magnitude.

A development begin is the bodily graduation of recent development exercise, often represented by “breaking floor” to organize the land for work on a constructing’s basis. Development begins are one measure of development quantity and, due to this fact, are usually measured by way of bodily house (e.g., sq. footage for industrial buildings or variety of items for residential buildings).

Inexperienced Road’s Industrial Property Value Index (CPPI) is a time collection of unleveraged U.S. industrial property values that captures the costs at which industrial actual property transactions are at the moment being negotiated and contracted.

Why we count on a value restoration in industrial actual property by Invesco US

[ad_2]

Source link