[ad_1]

Up to date on October thirty first, 2023 by Bob Ciura

Revenue buyers may be reluctant even to contemplate shopping for shares of an organization that doesn’t pay a dividend. Then again, capital allocation selections aren’t written in stone.

Whereas tech large Meta Platforms, Inc. (META)–previously often called Fb–doesn’t provide a dividend at this time, we imagine it may provoke a dividend in time. Meta Platforms has grown so massive that it’s now extremely worthwhile, with super free money stream and a large amount of money on the steadiness sheet.

Consequently, it may be a part of many different know-how shares which have begun paying dividends to shareholders in recent times.

You possibly can obtain a free spreadsheet of our whole know-how shares checklist (together with essential monetary metrics comparable to price-to-earnings ratios and dividend yields) by clicking on the hyperlink under:

This text will talk about Meta Platform’s enterprise mannequin, development prospects, and why a dividend shouldn’t be an unreasonable expectation in some unspecified time in the future sooner or later.

Enterprise Overview

Meta Platforms is a social media large with a market capitalization of ~$770 billion. Fb is the unquestioned chief in social media. Its choices embody Instagram, WhatsApp, Messenger, and extra.

Fb started as many start-ups do, with rising income however a scarcity of profitability. Nonetheless, all that modified when the corporate successfully monetized its huge consumer base.

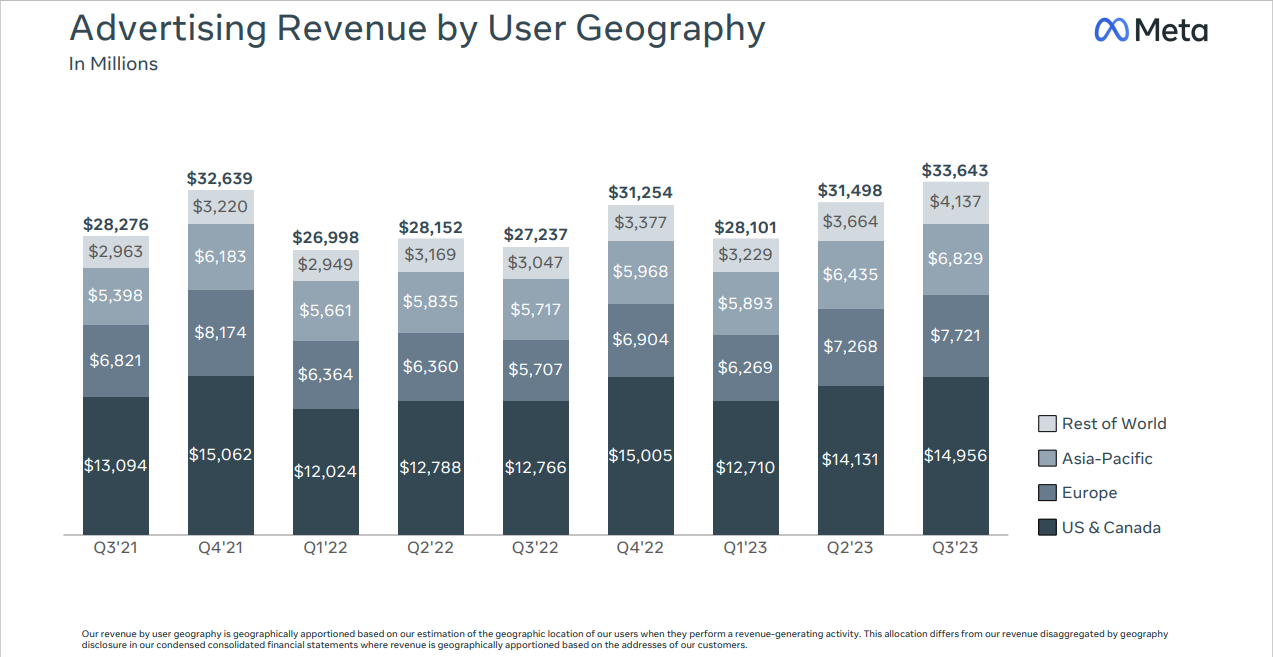

Fb and its varied properties characterize huge promoting platforms.

And, given the variety of time customers spend on the websites, Fb and Instragram are merely a gold mine for promoting potential. Cell promoting income represents the overwhelming majority of whole promoting income.

Supply: Earnings Presentation

The result’s that Meta is now enormously worthwhile.

Within the 2023 third quarter, the corporate generated income of $34.14 billion, a rise of 23% year-over-year. Earnings-per-share of $4.39 greater than doubled from the identical quarter final yr. Each income and earnings-per-share beat analyst estimates for the quarter.

Because the fourth quarter of 2021, Meta Platforms has reorganized its reporting segments. The corporate now has two reporting segments.

Its Household of Apps (FoA) section contains its conventional social media platforms comparable to Fb, Instagram, Messenger, WhatsApp, and different companies.

The Actuality Labs (RL) section contains augmented and digital reality-related shopper {hardware}, software program, and content material. In Q3, RL income decreased 26% year-over-year to $210 million.

Progress Prospects

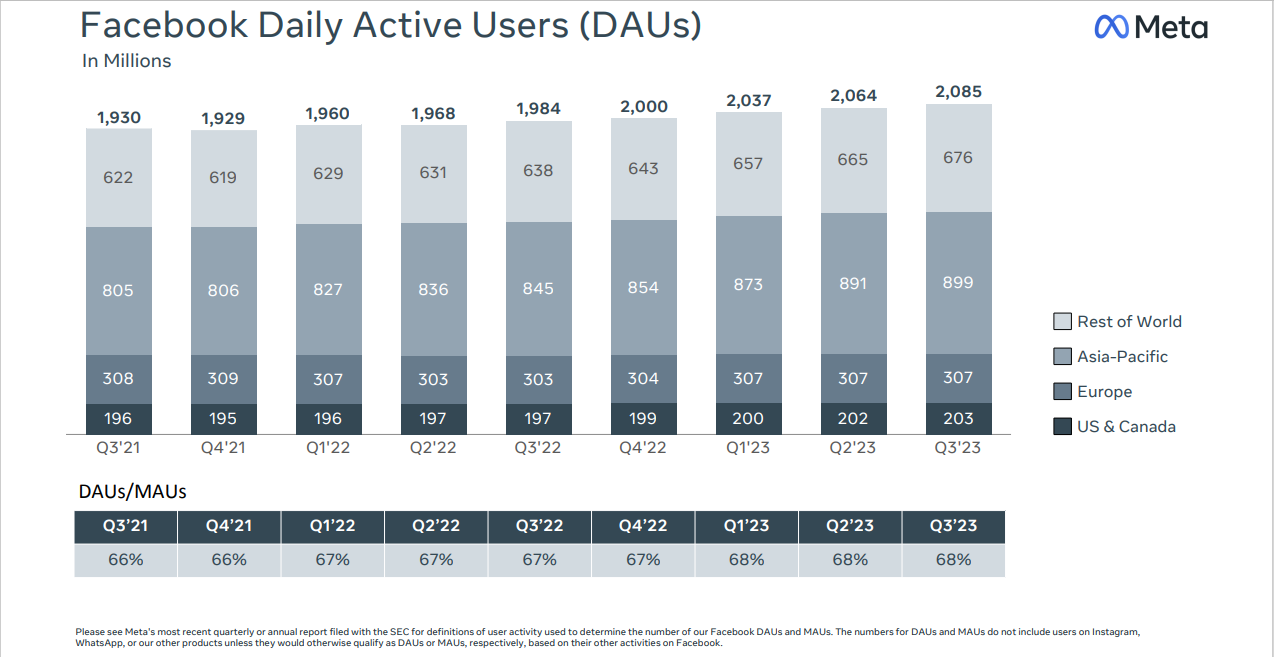

Fb’s development potential stays enticing. Whereas the corporate is nearing saturation within the U.S., the Fb group continues to develop.

Fb’s day by day lively customers had been 2.085 billion on common on the finish of the third quarter, a rise of 5% year-over-year.

Supply: Earnings Presentation

On the identical time, billions of individuals worldwide nonetheless don’t use Fb or certainly one of its different platforms, leaving a large world development alternative for the corporate within the years forward.

To make sure, Meta Platforms must dedicate an enormous quantity of economic sources to acquire this development. Certainly, 2022 capital expenditures are anticipated to succeed in $27 billion to $29 billion.

The corporate’s huge aggressive benefits amplify Meta Platform’s development potential. Particularly, it has come to dominate social media. Shoppers love social media and seem unwilling to do with out it (evidenced by the day by day lively customers who use Fb day by day and each month).

It’s difficult for one more social media model to enter the house and efficiently take customers away from Fb, Instagram, or its different precious properties.

As well as, Meta Platforms invests in a number of new avenues for future development in digital actuality, synthetic intelligence, and the metaverse. These are thrilling potential development areas for the tech business, and Meta Platforms is poised to be on the forefront of those new applied sciences.

Why Meta Platforms May Pay A Dividend

There are good causes for an organization to announce a dividend.

Along with enhancing investor sentiment by rewarding loyal shareholders with dividend earnings, initiating a dividend payout opens up a brand new and enormous group of institutional buyers who handle income-oriented funds.

Revenue buyers who beforehand wouldn’t have invested in a non-dividend paying inventory, comparable to Meta Platforms, would doubtless be enticed by a dividend payout.

Meta Platform’s fundamentals appear to help a dividend fee, as the corporate is very worthwhile.

Primarily based on consensus analyst estimates, Meta Platforms is predicted to generate earnings-per-share of $14.12 for 2023. The corporate may theoretically announce a big dividend whereas leaving loads of money stream for reinvestment into development initiatives.

For instance, if Meta Platforms maintained a goal payout ratio of 25% of annual EPS, the corporate may declare an annual dividend payout of ~$3.53 per share primarily based on 2023 EPS estimates. This is able to characterize a dividend yield of ~1.2% primarily based on the present share worth.

Whereas this would definitely not qualify Meta Platforms as a excessive dividend inventory, buyers mustn’t anticipate excessive yields from the know-how sector.

For context, a dividend yield of 1.2% would give Meta Platforms a better yield than different dividend-paying tech giants comparable to Apple Inc. (AAPL) and Microsoft (MSFT).

And Meta Platforms may develop its dividend at a excessive charge every year, notably with a beginning payout ratio of simply 25% and the corporate’s future EPS development potential.

Initiating a dividend would hardly impression the corporate’s monetary place, as Meta Platforms ended the 2023 third quarter with money, money equivalents, and marketable securities of $61.1 billion.

By just about any measure, Meta Platforms has huge monetary sources and ample liquidity to distribute a portion of its money stream to shareholders with out jeopardizing its present monetary place or future development.

Remaining Ideas

An organization usually chooses to not pay dividends to shareholders as a result of it merely doesn’t have the monetary energy to take action. Small corporations in a high-growth stage, or cyclical corporations with inconsistent profitability, should protect as a lot money stream as potential.

Associated: Dividend shares versus development shares.

Nonetheless, Meta Platforms is clearly now not in its start-up section. It’s a huge firm and a money stream machine.

It additionally has a fortress steadiness sheet with an enormous amount of money. Essentially, there may be little cause for Meta Platforms to not pay a dividend. It has loads of money for development funding after which some.

Dividends have grow to be rather more commonplace within the know-how sector in recent times. Meta Platforms doesn’t but pay a dividend, however buyers shouldn’t be fully shocked to see a dividend payout introduced in some unspecified time in the future within the coming years.

Moreover, the next lists include many high quality shares that do pay dividends:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.

[ad_2]

Source link