[ad_1]

As Salesforce gears as much as reveal its This autumn earnings, the San Francisco-based firm’s strategic give attention to AI-driven options is underneath the limelight.

Salesforce’s monetary outlook factors to a possible turnaround, with expectations excessive for a worthwhile end in 2023.

ProTips evaluation signifies Salesforce’s noteworthy internet revenue progress and total sturdy efficiency, signaling that the constructive momentum might proceed for the inventory.

In 2024, make investments like the large funds from the consolation of your property with our AI-powered ProPicks inventory choice instrument. Be taught extra right here>>

Whereas a lot consideration has been given to Nvidia’s (NASDAQ:) success in using the AI wave, one other inventory poised to achieve from this tailwind is Salesforce (NYSE:).

The San Francisco, California-based firm has been prioritizing digital transformation in cloud-based buyer relationship administration options, specializing in enhancing its AI-powered services.

As Salesforce prepares to unveil its This autumn earnings report tomorrow after the market closes, expectations are excessive for the cloud-based software program firm to complete 2023 with a revenue, rebounding from the earlier yr’s losses, pushed by sturdy enterprise progress.

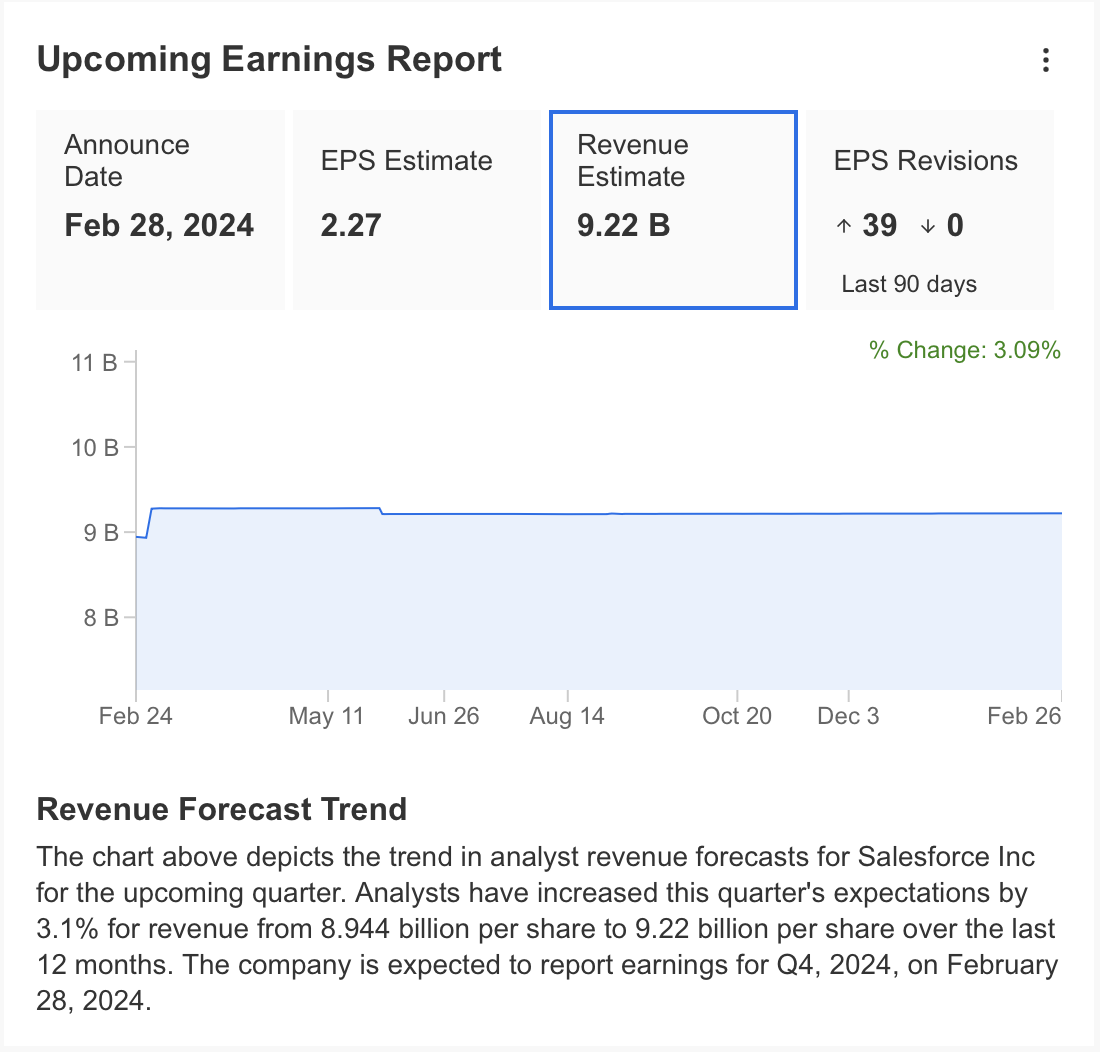

Supply: InvestingPro

Based on theInvestingPro forecast, Salesforce’s final quarter income is predicted to be $9.22 billion. Earnings per share (EPS) is estimated at $2.22. In the identical interval final yr, the corporate introduced a loss per share of $0.1.

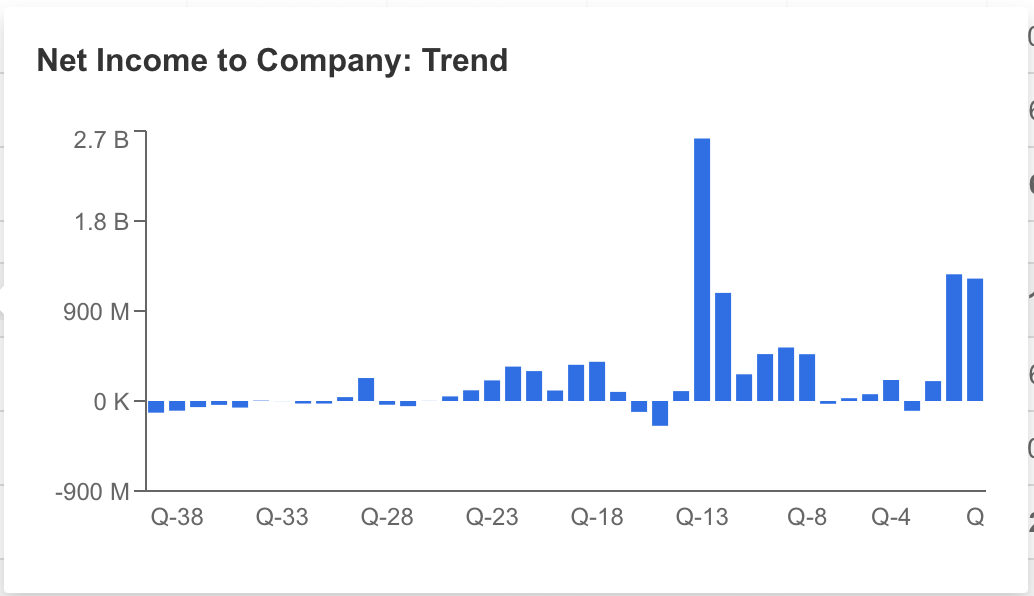

Supply: InvestingPro

The corporate managed to extend its internet earnings to $1.2 billion within the 2nd and third quarters of 2023 and is predicted to maintain its internet revenue at $1.2 billion within the final quarter.

Salesforce posted a lack of $98 million in the identical interval final yr and is predicted to proceed to extend its revenue margin this yr.

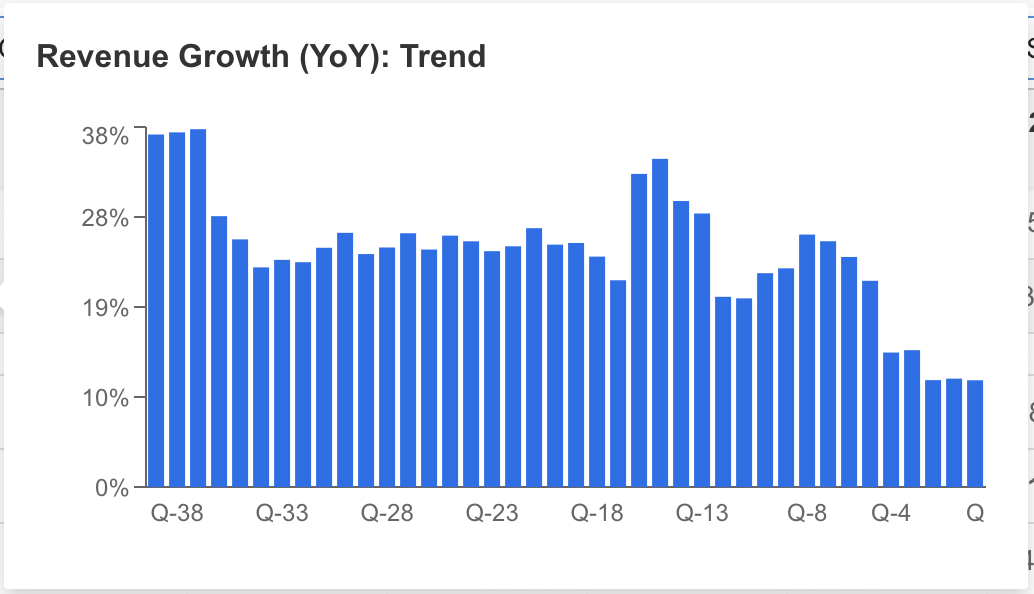

Supply: InvestingPro

Margins Rise, However Income Development Continues to Gradual: Can AI Assist Flip the Tide?

Though it’s anticipated to announce the very best quarterly income of all time, the downward development in income progress attracts consideration.

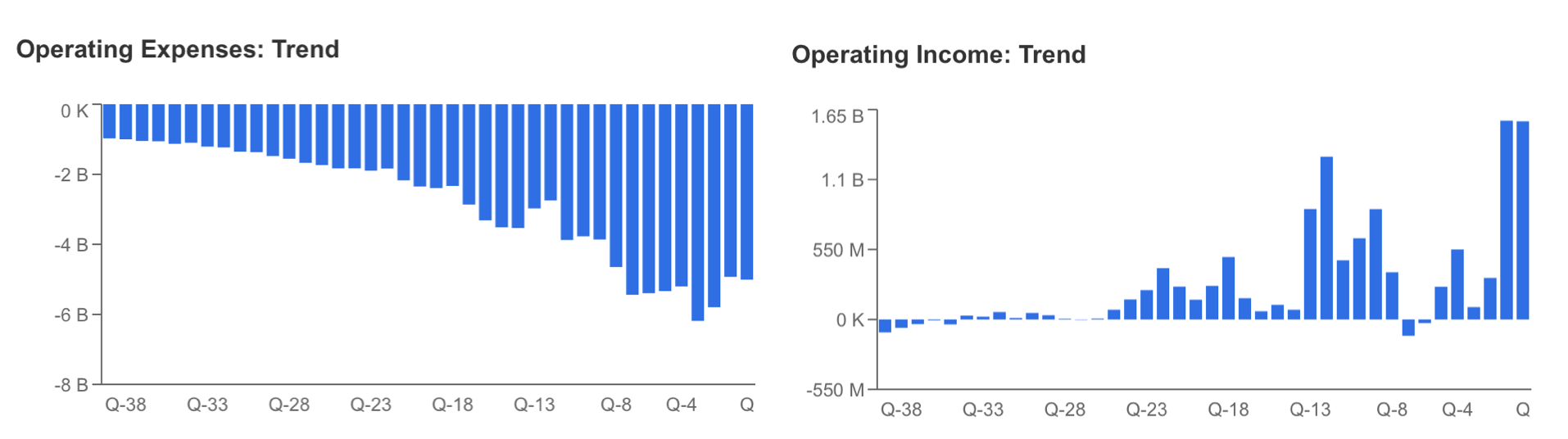

Salesforce managed to extend its internet revenue with a outstanding improve in working earnings whereas efficiently implementing its value coverage.

Supply: InvestingPro

Final yr, Salesforce launched Einstein GPT, its first synthetic intelligence instrument in buyer relationship administration, and targeted on growing its AI-powered providers.

Thus, the corporate began to handle the demand for AI properly and began to extend its working revenues quickly as the worldwide demand for the sector continued.

In consequence, Its information cloud providers have turn out to be the fastest-growing section with the assist of synthetic intelligence, and it’s anticipated to generate the very best income within the final quarter.

Salesforce introduced two important acquisition plans and simultaneous layoffs as a part of its cost-cutting coverage in 2023.

In latest months, Salesforce has unveiled plans to amass Airkit.ai and Spiff, two firms specializing in synthetic intelligence.

These bulletins underscore the corporate’s dedication to increasing its presence within the rising AI sector.

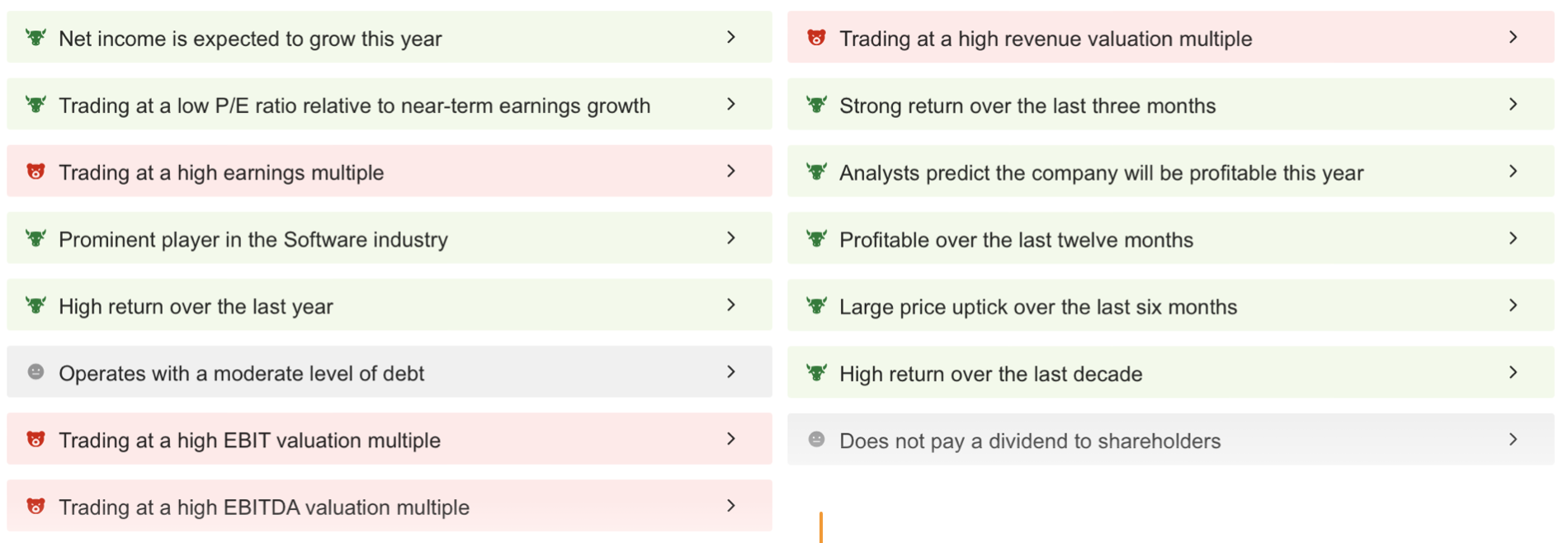

Salesforce: What Does ProTips Point out?

Persevering with to evaluate the corporate primarily based on its monetary information earlier than the earnings report, we are able to achieve clear insights into Salesforce utilizing ProTips.

Supply: InvestingPro

Salesforce’s internet revenue progress this yr stands out, whereas the corporate’s sturdy efficiency within the quick and long run paints a reassuring image for its buyers.

Moreover, be careful for top P/E and EBITDA valuation ratios—they may sign a possible situation.

Nevertheless, if the corporate can maintain its income progress and successfully deal with its progress technique, this may not hurt the inventory worth.

The absence of dividend funds from Salesforce may very well be seen as a downside for long-term buyers.

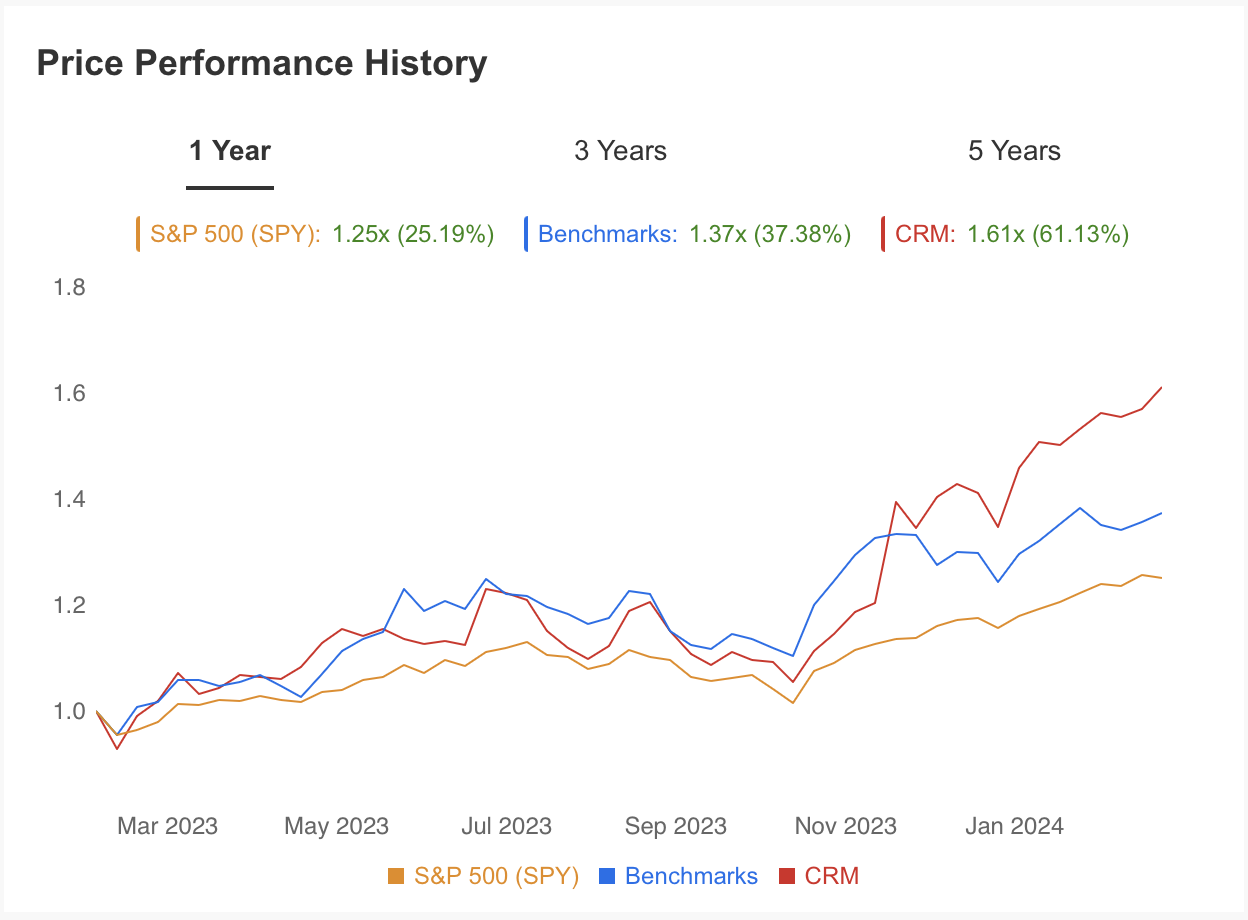

Supply: InvestingPro

The final one-year efficiency of CRM inventory additionally helps its financials. Salesforce inventory has risen 61% within the final yr, in comparison with the common return of 25% for the and 37% for its friends.

Supply: InvestingPro

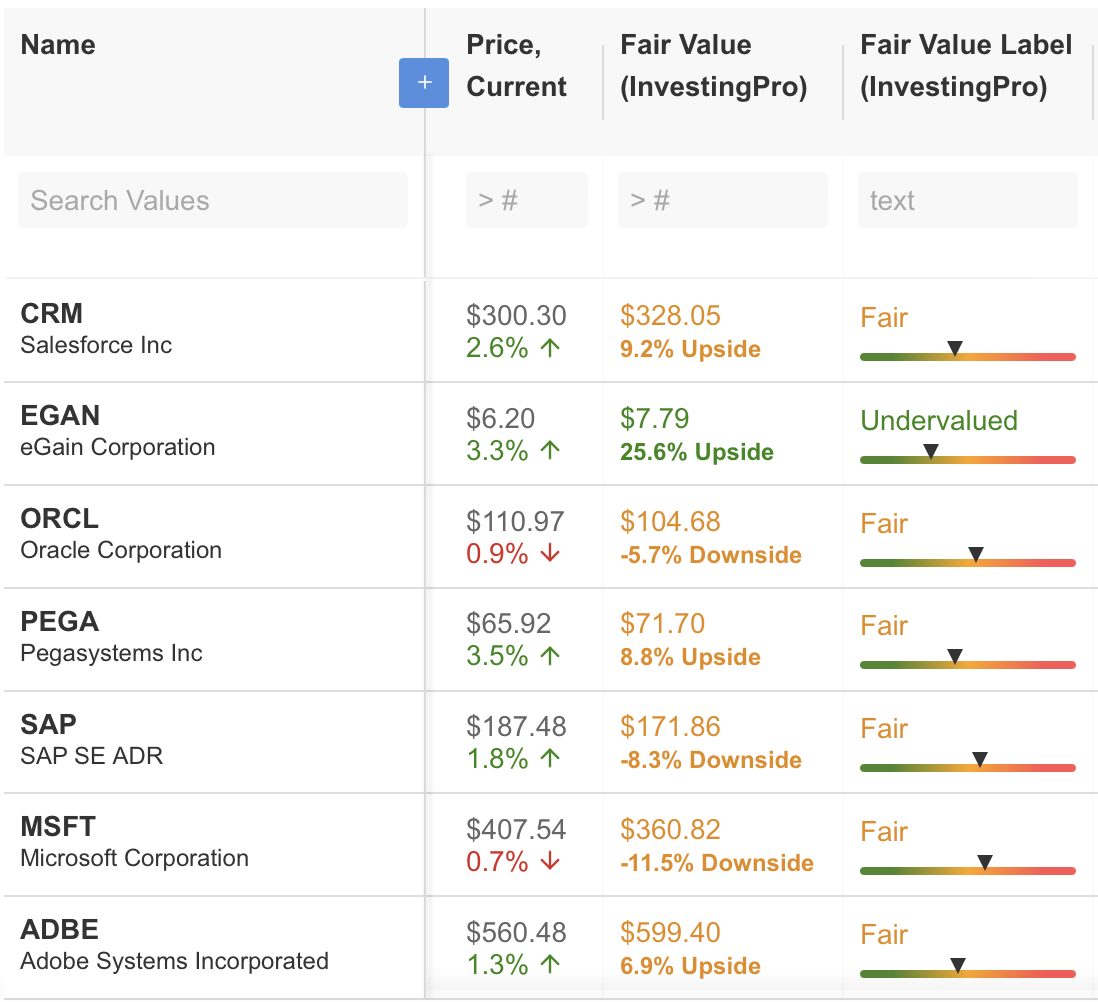

Evaluating CRM’s worth with the shares of peer firms with the assistance of InvestingPro, the inventory has a ten% upside expectation in accordance with the honest worth evaluation.

CRM, which moved at $300 earlier than the earnings report, has the potential to rise to $328 within the coming intervals in accordance with InvestingPro’s honest worth evaluation.

The corporate’s monetary well being is strong, with glorious progress and worth momentum efficiency. Money movement and profitability are additionally constructive.

General, the corporate’s monetary well being is sound, and it is value preserving an in depth eye on the continuing enhancements in profitability.

Salesforce: Technical Ranges to Watch

CRM has reached its November 2021 peak this week because of the uptrend that has been occurring for greater than a yr. This reveals that the $ 300 – 310 vary is a vital resistance space.

If the earnings report is available in above expectations, if the rise in demand for the inventory continues, the development can proceed as much as $ 355, which is the subsequent goal worth in accordance with Fibonacci ranges.

If CRM encounters resistance within the peak zone and the promoting stress accelerates at this level, a attainable retracement as much as a mean of $ 270 could also be thought of affordable.

Beneath this worth, the correction motion could also be triggered and the share worth could sag to the vary of $220 – 240.

Nevertheless, the general outlook reveals that the inventory is extra prone to proceed its uptrend in 2024, even when it sees restricted corrections.

***

Take your investing sport to the subsequent degree in 2024 with ProPicks

Establishments and billionaire buyers worldwide are already properly forward of the sport in the case of AI-powered investing, extensively utilizing, customizing, and growing it to bulk up their returns and reduce losses.

Now, InvestingPro customers can just do the identical from the consolation of their very own houses with our new flagship AI-powered stock-picking instrument: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 1,427.8% over the past decade, buyers have one of the best collection of shares out there on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Subscribe In the present day!

Do not forget your free reward! Use coupon code INVPROGA24 at checkout for a ten% low cost on all InvestingPro plans.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or suggestion to take a position as such it isn’t supposed to incentivize the acquisition of belongings in any means. I wish to remind you that any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding resolution and the related threat stays with the investor.

[ad_2]

Source link