[ad_1]

The US inventory market stays on observe to be the efficiency chief in 2023 for the most important asset lessons – by a large margin. The important thing purpose: Huge-tech shares are working sizzling. Take out these corporations from the combo and US equities’ year-to-date outcomes fade to a mediocre efficiency in keeping with the return on money-market funds.

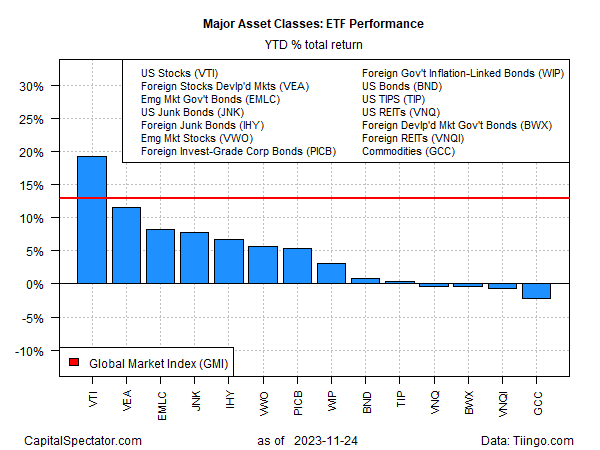

Market-cap-weighted equities within the US house, that are dominated by big-tech, are far and away the year-to-date chief, based mostly on a set of ETFs by means of Friday’s shut (Nov. 24). Vanguard Complete US Inventory Market Index Fund (NYSE:) is up 19.2% to this point in 2023, far forward of the remainder of the first slices of world markets.

The following-best performer this yr: developed-markets shares ex-US (), which is forward by a comparatively average 11.6%. The World Market Index (GMI) is forward by almost 13% this yr. (This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the most important asset lessons — besides money — in market-value weights and represents a aggressive benchmark for multi-asset-class portfolios.)

GMI ETFs YTD Complete Returns

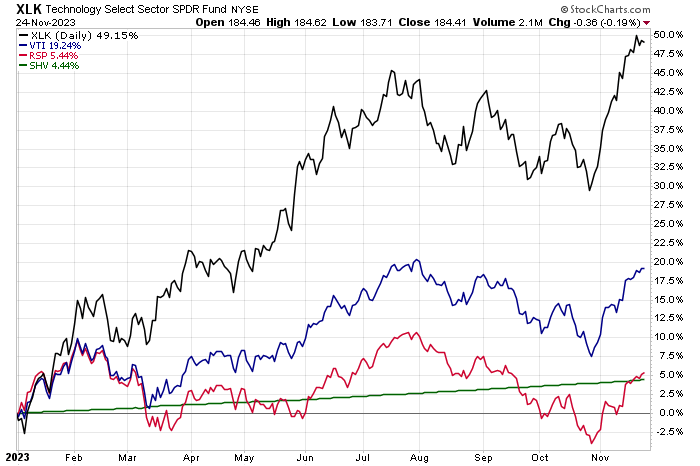

Inside the US equities house, big-tech is driving the horse race by a hefty diploma. iShares Know-how ETF (NYSE:), which is closely weighted within the likes of Microsoft (NASDAQ:), Apple (NASDAQ:) and Nvidia (NASDAQ:), has surged greater than 49% in 2023 – greater than double the acquire for US shares general (VTI).

A greater comparability tracks how the typical inventory is faring through an equal-weighted portfolio, which removes the big-tech issue. Notably, the 5.4% year-to-date return for Invesco S&P 500 Equal Weight ETF (NYSE:) is simply modestly above the efficiency for a money proxy ().

All of which units out a key query for asset allocation and funding technique in 2024: Will US shares (a.okay.a. massive tech) proceed to outperform? Nobody is aware of, in fact, however after such a stellar run there’s a case for warning in anticipating a repeat efficiency. But David Kostin, chief US fairness strategist at Goldman Sachs, stays optimistic.

“Our baseline forecast means that in 2024 the mega-cap tech shares will proceed to outperform the rest of the ,” he predicts. Rising gross sales are the rationale, he explains.

“Analyst estimates present the mega-cap tech corporations rising gross sales at a CAGR of 11% by means of 2025 in contrast with simply 3% for the remainder of the S&P 500. The web margins of the Magnificent 7 are twice the margins of the remainder of the index, and consensus expects this hole will persist by means of 2025.”

Add in rising expectations that the Federal Reserve will quickly reduce rates of interest and it’s simple to see the framework that might hold big-tech shares effervescent.

“Wall Avenue is gearing up for charge cuts,” reviews The Wall Avenue Journal. “Twenty months after the Federal Reserve started a historic marketing campaign in opposition to inflation, buyers now imagine there’s a a lot better likelihood that the central financial institution will reduce charges in simply 4 months than increase them once more within the foreseeable future.”

The hazard is that the longer term’s nonetheless unsure and no forecast is assured. The tailwinds in favor of massive tech definitely look bullish in the meanwhile, however the world stays full of hazards and the group has priced in nearly no margin for error re: the largest, most profitable company titans.

[ad_2]

Source link