[ad_1]

ljubaphoto

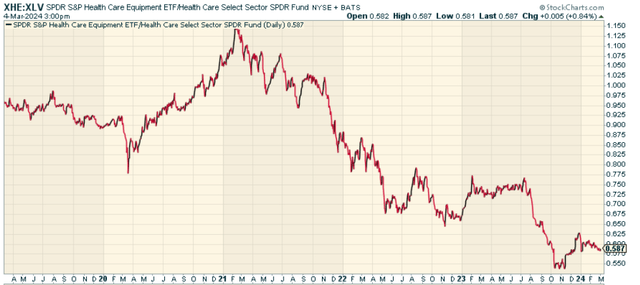

Whereas the highlight within the Healthcare sector at the moment shines brightly on a handful of pharmaceutical firms specializing in weight reduction, I feel there is a shift coming to sub-sectors that have not benefited as a lot from the bull market. In case you agree, the SPDR® S&P Well being Care Tools ETF (NYSEARCA:XHE) is price . This ETF goals to reflect the efficiency of the S&P Well being Care Tools Choose Trade Index, which itself is created to replicate the dynamics of the healthcare gear area throughout the broader S&P Complete Market Index (TMI). This contains key sub-industries like Healthcare Tools and Healthcare Provides, making it a doubtlessly invaluable consideration for traders trying to diversify throughout the healthcare sector.

XHE employs a modified equal-weighted index technique, providing traders the potential for unconcentrated {industry} publicity throughout giant, mid, and small-cap shares. This strategy permits traders to take strategic or tactical positions at a extra focused degree than conventional sector-based investing.

Relative to the broader Healthcare sector, this has been an amazing relative underperformer when put next towards the Well being Care Choose Sector SPDR ETF (XLV). Nonetheless in a downtrend, sure, however this might have some good momentum potential exactly as a result of it is an unloved a part of {the marketplace}.

stockcharts.com

A Look Below The Hood

XHE’s portfolio contains shares from quite a few firms working throughout the healthcare gear sector. Its holdings are well-diversified, investing a small proportion of XHE’s belongings in every inventory, with no inventory making up greater than 2.61% of the portfolio. This diversification technique helps mitigate the fund’s volatility. The fund has 68 holdings, and a Worth/Earnings ratio of 23.34. Holdings embody:

Silk Highway Medical Inc. – a healthcare firm specializing in growing medical gadgets for the therapy of illnesses affecting the carotid arteries. Glaukos Corp. – a pioneer within the medical know-how and pharmaceutical {industry}, specializing in revolutionizing the administration of glaucoma and enhancing corneal well being. Align Expertise Inc. – a number one world supplier within the medical machine sector, recognized for creating, manufacturing, and distributing the Invisalign system, iTero intraoral scanners, together with providing orthodontic, restorative, and beauty dentistry companies. Encourage Medical Techniques Inc. – an progressive medical know-how agency devoted to crafting and bringing to market minimally invasive options for people affected by obstructive sleep apnea. Tandem Diabetes Care Inc. – a healthcare enterprise dedicated to designing, engineering, and advertising merchandise catering to the wants of these dwelling with insulin-reliant diabetes.

Sector Composition and Weightings

As talked about, XHE tracks the S&P Well being Care Tools Choose Trade Index, which represents the healthcare gear phase of the S&P Complete Market Index (TMI). The TMI is designed to trace the broad U.S. fairness market. The healthcare gear phase of the TMI contains the next sub-industries: Healthcare Tools (which makes up 78.1% of the fund) and Healthcare Provides (which makes up the remaining 21.90%).

Peer Comparability

When in comparison with comparable ETFs within the healthcare sector, XHE reveals sure distinctive traits. As an example, whereas most healthcare ETFs are cap-weighted, that means they make investments extra closely in bigger firms, XHE makes use of an equal-weighted strategy. This technique ensures that smaller firms obtain the identical illustration as bigger ones, offering a extra balanced publicity throughout totally different firm sizes throughout the healthcare gear sector. Sure – XLV as a broad-based Healthcare sector play has meaningfully outperformed as, basically, this has been a cycle that has favored large-cap momentum. However I consider cycles are nonetheless a factor, and equal weighting inside a uncared for sub-industry can doubtlessly yield sturdy future outcomes.

Execs and Cons of Investing in XHE

Investing in XHE comes with its distinctive set of benefits and drawbacks.

Execs:

Diversification: XHE supplies broad publicity to the healthcare gear {industry}, which will help diversify an investor’s portfolio. Potential for Excessive Returns: The healthcare gear {industry} is thought for its progressive nature, which might result in substantial development and excessive returns.

Cons:

Sector Focus: Since XHE is targeted solely on the healthcare gear {industry}, it might be extra vulnerable to market volatility particular to this sector. Danger of Underperformance: Like another funding, there’s at all times a danger that the fund might underperform as a consequence of varied market elements.

Conclusion: Ought to You Make investments?

As populations age, the demand for medical gadgets and gear escalates, guaranteeing a gentle marketplace for these merchandise. Investing in XHE generally is a strategic transfer for traders trying to capitalize on this demand long-term. The fund gives a diversified portfolio and the potential for top returns as a result of {industry}’s progressive nature. This to me, seems to be like a relative catch-up commerce to broader Healthcare momentum, and is price contemplating an allocation to.

Markets aren’t as environment friendly as typical knowledge would have you ever consider. Gaps usually seem between market indicators and investor reactions that assist give a sign of whether or not we’re in a “risk-on” or “risk-off” atmosphere.

The Lead-Lag Report may give you an edge in studying the market so you may make asset allocation selections based mostly on award profitable analysis. I’ll provide the signals–it’s as much as you to determine whether or not to go on offense (i.e., add publicity to dangerous belongings comparable to shares when danger is “on”) or play protection (i.e., lean towards extra conservative belongings comparable to bonds/money when danger is “off”).

[ad_2]

Source link