[ad_1]

Robert Means

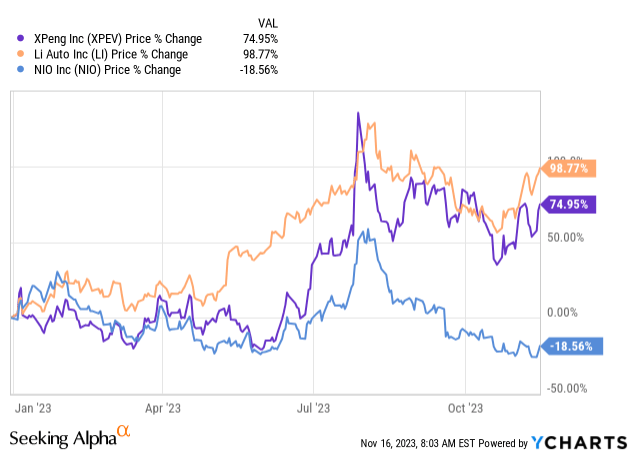

XPeng (NYSE:XPEV) submitted a blended earnings sheet for its third-quarter on November 15, 2023, however guided for important supply and high line development within the last quarter of the yr. Whereas XPeng noticed a considerable enhance in third-quarter deliveries resulting from a return of shopper demand, the Chinese language electrical automobile was not capable of translate rising gross sales into stronger earnings. With competitors within the electrical automobile market ramping up, XPeng’s margins remained below stress as properly. Since Li Auto (LI) is extensively outperforming XPeng by way of supply development and automobile margins, I consider XPeng will not be essentially the most enticing, nor least expensive, Chinese language electrical automobile start-up that buyers can buy proper now!

Earlier score

In August, I rated XPeng a maintain after the EV firm acquired DiDi World (OTCPK:DIDIY)’s sensible automobile unit and stated that it might use its acquired tech to start out a brand new electrical automobile model subsequent yr. I consider the margin pattern, though it barely improved within the third-quarter, continues to be not enticing… particularly in gentle of significantly better choices within the Chinese language electrical automobile start-up market.

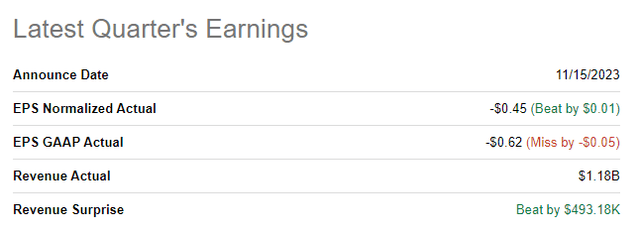

XPeng’s third-quarter earnings beat expectations

XPeng beat earnings and income expectations for the third-quarter: adjusted EPS got here in at $(0.45) which was $0.01 per-share higher than the typical prediction. The highest line beat was marginal with XPeng out-performing the consensus estimate by $0.5M.

Supply: Looking for Alpha

Robust supply development fails to translate into earnings development

XPeng delivered 40,008 electrical automobile within the third-quarter, exhibiting 35% yr over yr development. In October, XPeng delivered 20,002 electrical autos which was a brand new month-to-month supply document for the EV maker. Nevertheless, EV rival Li Auto is crushing XPeng by way of supply development: it delivered greater than twice as many autos, 40,422, in October and Li Auto’s third-quarter supply quantity totaled 105,108 EVs, representing 296% yr over yr development.

Li Auto, resulting from its stronger supply development, greater month-to-month output quantity and significantly better margin image stays my high guess on the Chinese language EV market. One other firm that’s crushing it proper now by way of deliveries and which is ready to overhaul Tesla (TSLA) in world supply quantity, is BYD Firm (OTCPK:BYDDF).

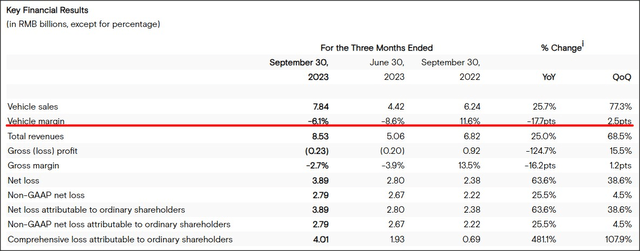

XPeng generated whole revenues of 8.53B Chinese language Yuan ($1.17B) in Q3’23, exhibiting 25% yr over yr development. Regardless of greater revenues, XPeng’s losses expanded to three.89B Chinese language Yuan ($0.53B) in comparison with 2.38B Chinese language Yuan ($0.33B) within the year-earlier interval. Though XPeng generated greater deliveries and revenues in comparison with final yr, the EV pricing atmosphere remained weak… and it has been mirrored in XPeng’s margins.

XPeng’s automobile margins for Q3’23 improved quarter over quarter from (8.6)% to (6.1)%, however margins remained deeply unfavorable which stands in stark distinction to Li Auto which reported a third-quarter automobile margin of 21.2%. Li Auto grew its margins 0.2 PP quarter over quarter whereas XPeng improved its automobile margins 2.5 PP Q/Q, however the truth that margins remained unfavorable is why I can’t see a sensible case for a score improve for shares of XPeng in the meanwhile.

Supply: XPeng

Outlook for This fall’23

XPeng submitted a robust forecast for This fall’23 which was probably one of the best take-away from the third-quarter earnings launch. The EV maker expects to ship between 59,500 and 63,500 electrical autos in This fall’23 which within the high-case would suggest a yr over yr development fee of 186% (and 168% within the low-case). When it comes to revenues, XPeng guided for B12.7-13.6B Chinese language Yuan, implying yr over yr high line development of 147.1-164.6%.

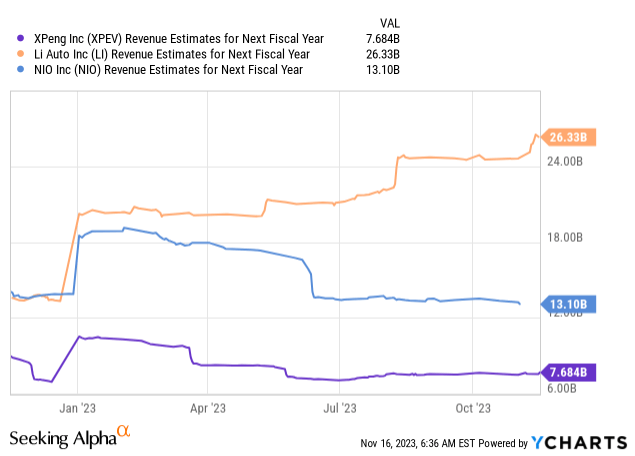

XPeng’s valuation, falling and regarding estimate pattern

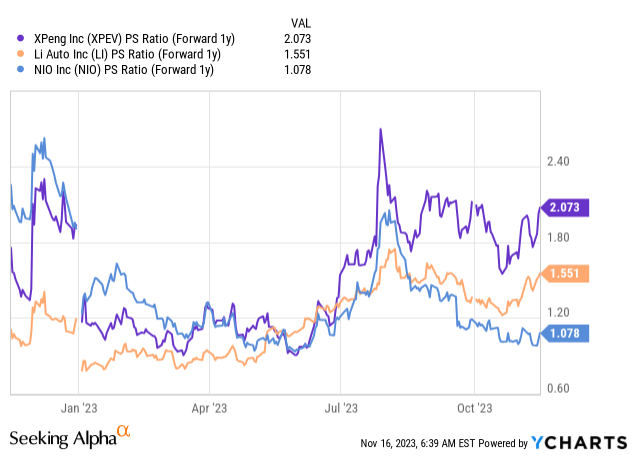

XPeng stays the highest-valued Chinese language EV start-up within the trade group, regardless of an unfavorable margin image. Li Auto, NIO and XPeng are anticipated to develop their high strains 57%, 55% and 75% subsequent yr, however as I’ve indicated in my work on Li Auto, XPeng’s estimates have constantly fallen (as did NIO’s)… whereas estimates for Li Auto have elevated steadily within the final yr.

Primarily based off of income expectations, XPeng is presently the EV maker within the trade group with the best income multiplier issue of two.1X. Contemplating that Li Auto is rising deliveries a lot sooner, I consider Li Auto must also be the highest-valued EV firm… nonetheless, Li Auto is promoting at simply 1.6X and is subsequently the significantly better EV deal for buyers, for my part.

NIO is seeing a rebound in supply development as properly and the corporate launched new EV merchandise in 2023 which is why I see an bettering setup for NIO in the meanwhile. NIO additionally presently affords the bottom price-to-revenue ratio of 1.1X which interprets into a sexy danger profile. I’ve presently robust purchase scores on Li Auto and NIO, and a maintain score on XPeng.

Dangers with XPeng

XPeng is seeing robust supply development, however Li Auto continues to be manner forward of its EV rival by way of whole supply quantity. Li Auto’s margin image additionally appears significantly better than XPeng’s. With unfavorable automobile margins nonetheless prevailing within the third-quarter I consider XPeng faces a doubtlessly lengthy highway in direction of profitability whereas Li Auto is already anticipated to show its first full-year revenue this yr. XPeng is anticipated to generate its first full-year revenue in FY 2027… and that is if the margin scenario gained’t worsen. A delayed revenue timeline and persistently unfavorable automobile margins might threaten my maintain score going ahead.

Closing ideas

XPeng grew its revenues 25% yr over yr within the third-quarter, which was a stable accomplishment, however the EV firm continued to report unfavorable automobile margins and increasing losses relative to the third-quarter of final yr. Whereas automobile margins improved 2.5 PP Q/Q, the EV pricing atmosphere continues to be difficult and the margin scenario is unlikely to get materially higher within the close to time period. Contemplating that shares of XPeng are costly relative to Li Auto and NIO, I consider the danger profile will not be skewed to the upside for the EV maker proper now. If I had to decide on between both Li Auto or XPeng, I might go for Li Auto resulting from its stronger supply development, a fast-track to profitability this yr and optimistic automobile margins!

[ad_2]

Source link