[ad_1]

Michael Vi

Overview

I beforehand rated a purchase score for Yelp Inc. (NYSE:YELP) in September 2023 as I used to be bullish on the inventory’s near-term outlook; particularly, I anticipated margin to proceed increasing as income scales. Since then, the inventory has moved up as I anticipated, reaching $48.99 at one level, which is close to my goal worth. After reviewing the latest efficiency, my suggestion for YELP is a purchase score, as I see the risk-reward scenario as engaging right this moment. I consider the market has priced the share utilizing administration FY24 steering, which I feel is just too conservative. I do count on the climate scenario to get better as we transfer via the 12 months, and with the Fed chopping charges in 2H24, shopper spending ought to get better as nicely, each of which ought to drive upside to YELP’s steering.

Latest outcomes & updates

Giving a short replace on the latest 4Q23 efficiency, YELP reported complete income of $342 million, coming in on the excessive finish of steering. The notable takeaway was that YELP reported $96 million in adjusted EBITDA, which has crushed the excessive finish of steering by 6%, coming in at a 28.1% EBTIDA margin. This led to robust GAAP EPS development of 33% to $0.37. Simply by these key metrics, YELP has actually carried out very nicely, and I consider it may possibly proceed this momentum into FY24. Notice that YELP is reporting these development figures in a weak macro setting. The bears may name out that YELP has seen the threerd straight quarter of complete paying advert location decline (FYI, it’s a 0.2% decline), however I wish to shift readers’ focus to YELP’s robust execution in driving ARPU development—income development was pushed virtually solely by ARPU development of 13%. YELP’s efforts to extend worth to advertisers via more practical matching and the adoption of latest merchandise have been the driving drive behind this development in ARPU. What this tells me is that YELP’s shoppers are seeing higher advertising and marketing ROI (if not, there is no such thing as a motive for them to undertake extra of YELP’s merchandise). As such, I consider this ARPU goes to maintain itself at this degree (structurally increased than prior to now). Moreover, in 1Q24, administration will improve the search engine advertising and marketing [SEM] price range by $5 million sequentially, and within the quarters that observe, they’ll scale up even additional throughout all subcategories of house providers. This could assist income development as nicely. The pushback relating to the expansion in advertising and marketing spend is that EBITDA is predicted to say no by 8%/2% y/y on the midpoint in 1Q/FY24, which I consider is the first motive for the share worth response provided that this information comes when income is predicted to develop by ~7%. For comparative sake, this suggests 240 bps/200 bps of EBITDA margin compression.

Nevertheless, my view is that this information could be too pessimistic, because the income steering seems too conservative. Administration is asking for 1Q/FY24 income development of 6.5%–7.0% y/y on the midpoint, and the deceleration vs. FY23 12% development is because of weak spot within the Restaurant, Retail, and Different (RR&O). This section has seen weak spot starting in December and persevering with via January, attributable to a slowdown in site visitors from extreme climate, pressured advert budgets from enter price inflation, and challenged shopper spending developments. Administration is extrapolating this development via all the FY24, which I feel is overly conservative. Firstly, the unhealthy climate scenario (a number of winter storms) is an abnormality in comparison with the previous, and I consider it’s going to ease as we transfer via the 12 months (anticipated in early summer season). This could drive a restoration in shopper site visitors to dine out. Secondly, the influence of enter prices ought to begin to ease as inflation ought to steadily come down as commodity prices have been easing. The truth that different CPG firms are chopping again on worth hikes reveals that the underlying price construction is easing as nicely. Thirdly, on shopper spending, my view is that when the Fed cuts charges in 2H24 (as they indicated), it’s going to ship a robust message to customers relating to the state of the economic system, which paints a constructive outlook, thereby rising customers’ confidence in spending. If all these play out as I anticipated, we should always see administration revising steering upwards, and these incremental revenues (from the upwards steering revision) ought to carry a excessive incremental margin provided that administration already baked within the elevated market price in FY24 steering.

Valuation and threat

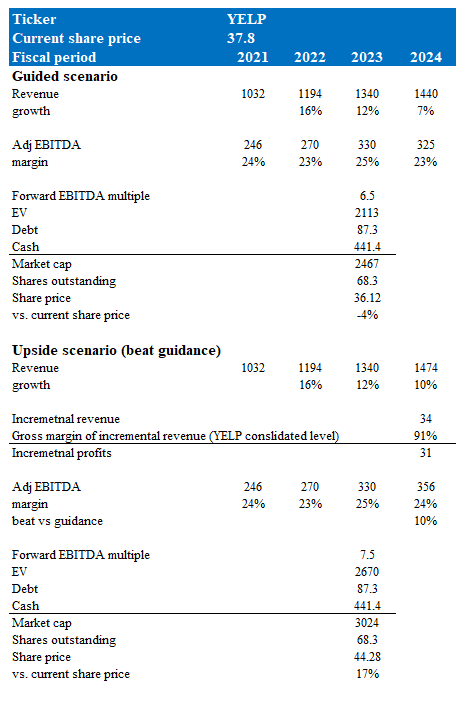

Creator’s valuation mannequin

Due to the decline in share worth, the risk-reward scenario has gotten engaging once more. In response to my mannequin, if YELP have been to carry out as administration guided and commerce on the present a number of, there can be a -4% draw back over a 1-year interval (goal worth of $36). Nevertheless, my view is that YELP has a excessive likelihood of beating steering provided that FY24 income steering relies on a weak 1Q24. In my upside situation, I count on YELP to develop income by 10% in FY24, in keeping with the 4Q23 development. The incremental income from this beat ($34 million) ought to move via to the EBITDA line at a excessive incremental margin (I used YELP’s gross margin to calculate this), which led to my EBITDA expectation of $356 million in FY24 (a ten% beat vs. steering). This 10% beat will not be an aggressive assumption, as YELP did the identical in 4Q23 (EBITDA beat the midpoint of steering by ~10%). If this performs out, then YELP ought to commerce at a premium to the place it’s buying and selling right this moment, which I assumed to imply a imply reversion. Assuming a 7.5x ahead EBITDA a number of, my upside goal worth is $44.30.

The danger is that the climate scenario continues for much longer than anticipated and that the macro-economy doesn’t see any restoration from right here. This will likely be very unfavorable for YELP, as administration may revise steering even decrease.

Abstract

I am reiterating a purchase score for YELP. I consider the market is underestimating YELP’s potential to beat near-term headwinds (climate, inflation, shopper spending). Restoration in these areas, coupled with YELP’s robust ARPU development, may result in steering revisions and upside potential. Total, I consider the potential rewards outweigh the dangers for YELP. The present valuation presents a very good alternative for traders to purchase or add to their positions and doubtlessly profit from steering revisions, a number of enlargement, and long-term development prospects.

[ad_2]

Source link