[ad_1]

NurPhoto/NurPhoto through Getty Pictures

Funding Thesis

Zillow (NASDAQ:Z) delivered This autumn 2023 outcomes that took traders without warning. There isn’t any doubt that Zillow is lastly on the cusp of turning round its prospects. The one downside right here is that paying shut to 29x ahead EBITDA for Zillow would not depart traders with a number of upside on the inventory.

Consequently, though I have been steadfastly bullish on this inventory for a very long time, my bullishness is beginning to wane as I acknowledge that Zillow’s turnaround is taking too lengthy to realize traction.

In abstract, I am solely tepidly bullish on this inventory.

Fast Recap

Again in December, in a bullish evaluation, I mentioned,

Zillow’s outlook forward would not encourage a number of hope. There are ample blemishes to this funding, as we’ll quickly focus on. Nonetheless, I stay bullish on Zillow inventory, as I imagine that this on-line actual property platform has a powerful moat and ample potential to show round its prospects.

The truth is, I imagine that though shares look costly proper now at 30x ahead free money flows, this sturdy model has the capability to enter 2024 with a a lot stronger footing.

Writer’s work on Z

Together with the premarket leap, Zillow is again in keeping with the worth of my advice, but it surely has nonetheless lagged the S&P 500 (SPY). As we glance forward, I stay bullish on Zillow’s prospects.

Zillow’s Close to-Time period Prospects

Zillow’s near-term prospects seem promising. Residential income, standing at $349 million, marked a 3% y/y development, outperforming the broader actual property trade by 700 foundation factors. The success is attributed to Zillow’s strategic deal with enhancing buyer funnels, connecting demand to their companion community, and driving conversion. Notably, their push into the rental market noticed accelerated income development of 37% year-over-year, showcasing power in multifamily property growth and the corporate’s standing as probably the most visited leases platform. Zillow’s modern strategy to the mortgage sector, with a 100% enhance in buy mortgage origination quantity in This autumn, and the mixing of Zillow House Loans with Premier Agent companions, additional positions them for development.

Nonetheless, Zillow faces challenges too. Regardless of its monetary successes, the broader actual property trade is present process vital modifications, marked by authorized challenges and debates round trade practices. Zillow, whereas indirectly implicated, should navigate the evolving regulatory panorama and potential trade shifts.

Furthermore, Zillow’s development technique includes remodeling your complete actual property expertise, from shopping for and promoting to financing and renting, by way of its housing Tremendous App idea. The complexity of this transformative journey and the need to combine numerous companies seamlessly pose operational challenges.

Moreover, whereas Zillow outlined a $30 billion complete addressable market, it presently captures solely a fraction of it, emphasizing the necessity to successfully monetize this huge alternative.

It is as if there’s potential for Zillow to show round its prospects. However this identical assertion I might have mentioned this at any level up to now 12 months. Given this framework, let’s now focus on fundamentals in additional element.

Income Development Charges May Attain 10% for 2024

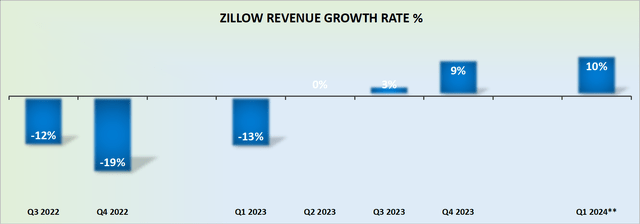

Z income development charges

Zillow’s steerage for Q1 2024 factors to a ten% CAGR. That is clearly a strong enchancment from any level up to now 12 consecutive quarters. Therefore, the massive query now could be can this form of acceleration be maintained in 2024?

In spite of everything, Q1 can shine strongly for the reason that macro surroundings has just lately stabilized and the hurdle with the prior yr is markedly straightforward. Due to this fact, can Zillow proceed to plow forward with this development price for the rest of 2024, because the comparables steadily turn into more difficult? Therein lies the last word query.

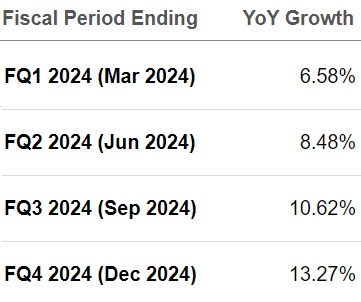

SA Premium

For his or her half, analysts are typically of the opinion that there is going to be a gradual quantity of acceleration within the coming 4 quarters. Consequently, a technique or one other, all my insights seem to level in the identical path. Specifically, that Zillow’s income development charges in 2024 ought to approximate 10% CAGR.

Given this context, let’s now focus on its valuation.

Z Inventory Valuation — 29x Ahead EBITDA

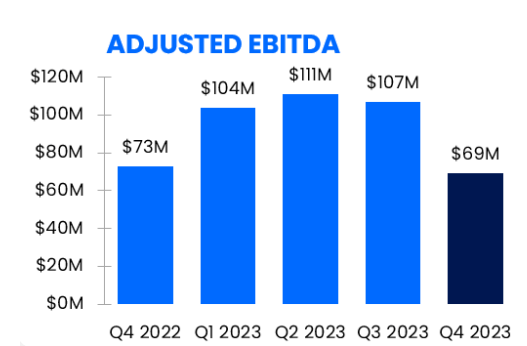

As we sit up for 2024, I estimate that Zillow’s EBITDA might attain $460 million. As a degree of reference take into account the next.

Z This autumn 2023

Excluding a one-time partial lease termination expense, This autumn Adjusted EBITDA would have been $83 million or roughly 100 foundation factors margin growth from This autumn 2022, nonetheless, take into account that This autumn is often off-season for Zillow.

What’s extra, the steerage for Q1 factors in the direction of $105 million on the excessive finish. Due to this fact, realistically, this suggests that Zillow will in all probability ship near $110 million in Q1, supporting my competition that in all chance Zillow is on a path towards $460 million of EBITDA in 2024.

Due to this fact, this leaves the inventory priced 29x ahead EBITDA. A a number of that I imagine is considerably prolonged.

The Backside Line

In reflection, Zillow outcomes have caused a shift in my sentiment. Whereas the corporate has demonstrated commendable strides in its This autumn outcomes, with promising indicators in residential income and profitable ventures into the rental and mortgage markets, my preliminary bullishness is now tempered by the belief that the inventory is buying and selling at a excessive ahead EBITDA a number of of 29x.

Regardless of acknowledging the constructive development charges projected for 2024, questions linger concerning the sustainability of this acceleration all year long, particularly because the comparables turn into more difficult.

Whereas the potential for a turnaround exists, the prolonged valuation and uncertainties surrounding the timeline of Zillow’s transformation have led me to undertake a extra cautious stance.

[ad_2]

Source link