[ad_1]

Up to date on October twenty fifth, 2023

One funding theme that has captured extra investor consideration in recent times, is the concept of environmental friendliness. There are lots of methods for a corporation to be thought-about environmentally pleasant, with renewable power and recycling being apparent decisions.

Traders can purchase high-quality dividend development shares such because the Dividend Aristocrats individually, or by way of exchange-traded funds. ETFs have grow to be rather more in style previously 5 years, particularly when in comparison with dearer mutual funds.

With this in thoughts, we created a downloadable Excel listing of dividend ETFs that we imagine are probably the most engaging for earnings traders. Now we have additionally included the dividend yield, expense ratio, and common price-to-earnings ratio of the ETF (if obtainable).

You may obtain your full listing of 20+ dividend ETFs by clicking on the hyperlink under:

On this article, we’ll have a look a ten renewable power and recycling shares, all of which pay dividends to shareholders.

We rank them under by whole anticipated returns within the coming years for these traders that wish to maintain corporations which have a hand in preserving the setting.

Waste Administration (WM)

Our first inventory is Waste Administration, an organization that gives waste administration environmental companies to residential, business, industrial, and municipal prospects, primarily within the U.S. The corporate affords assortment and transporting of waste and recyclable supplies, owns landfill gas-to-energy amenities, and operates switch stations.

The corporate was based in 1987, employs 48,500 individuals, produces nearly $20 billion in annual income, and trades with a market cap of $62 billion.

Waste Administration made the listing as a result of it’s a large participant in the case of recycling. The corporate is the biggest waste assortment and recycling agency within the U.S., so it has unmatched scale. It additionally focuses on making extra environment friendly use of the recyclables it collects, along with its landfill gas-to-energy efforts, which attempt to show in any other case wasted fuel into usable power.

The corporate’s dividend streak stands at 20 consecutive years of will increase, and at present yields 1.8%.

Click on right here to obtain our most up-to-date Positive Evaluation report on Waste Administration (preview of web page 1 of three proven under):

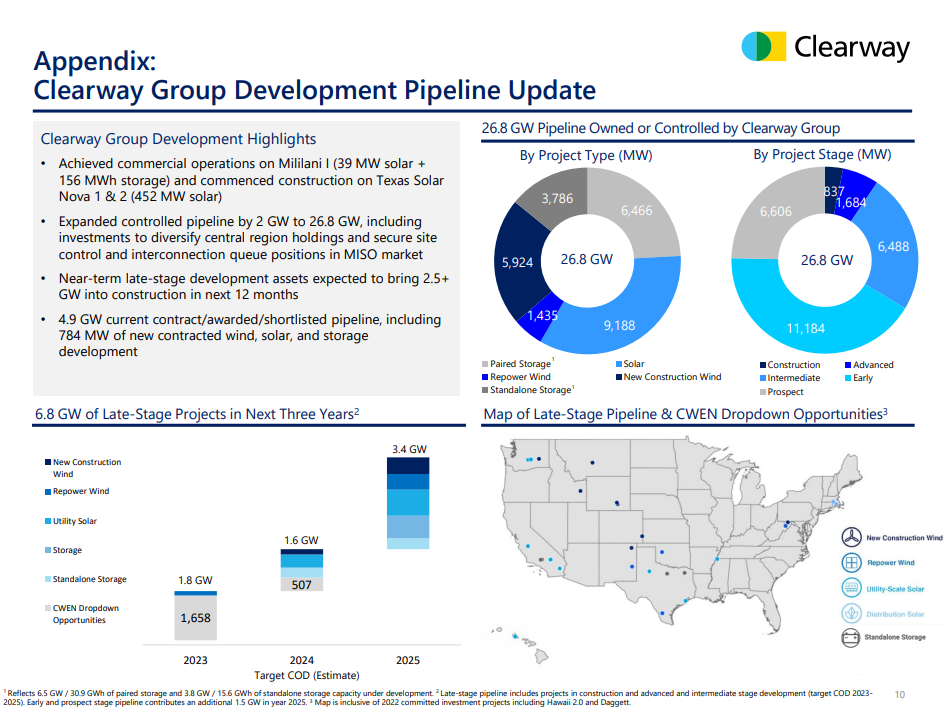

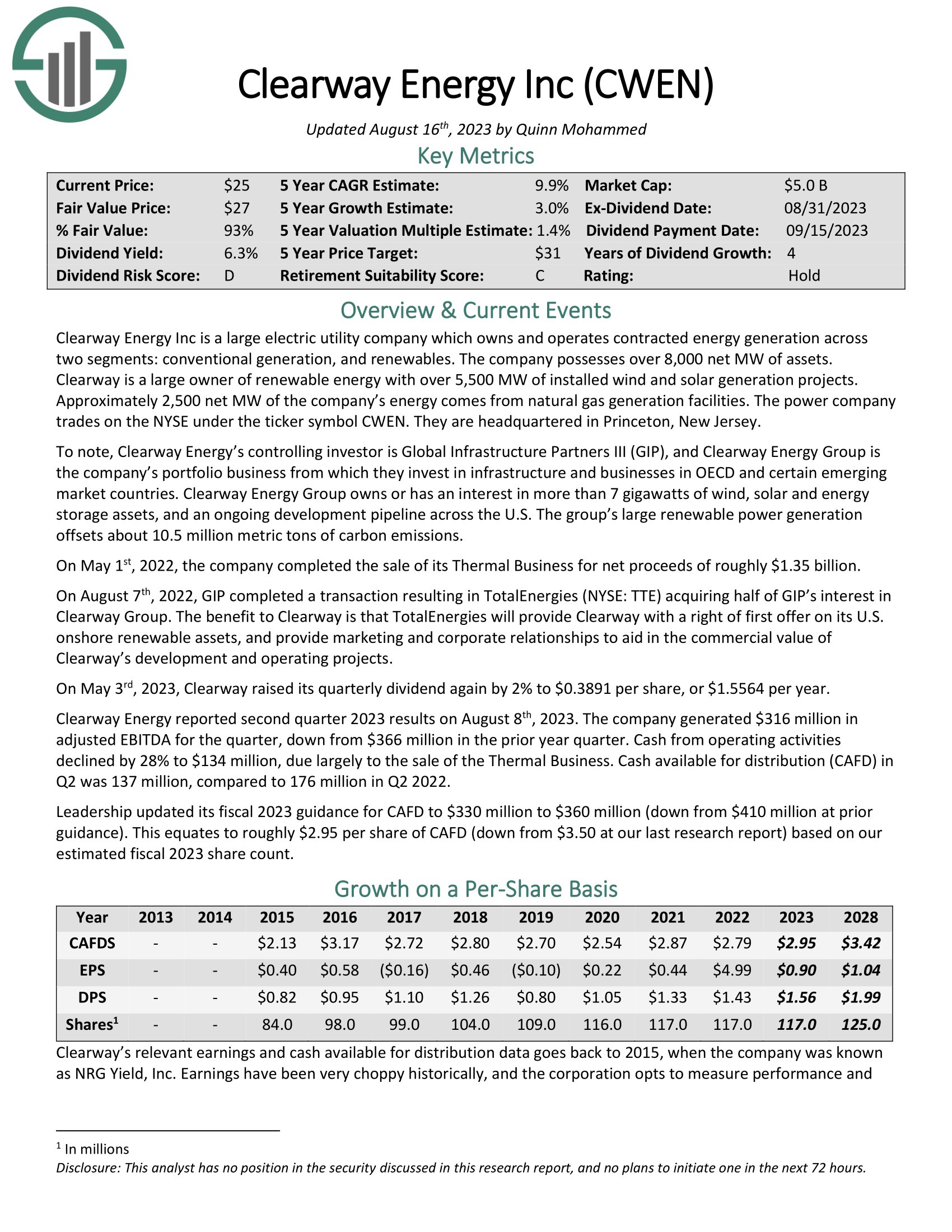

Clearway Vitality Inc. (CWEN)

Our subsequent inventory is Clearway Vitality, which is a renewable power enterprise based mostly within the U.S. The corporate has about 5,000 web megawatts, or MW, of put in wind and photo voltaic technology tasks. As well as, it has 2,500 web MW of pure fuel technology amenities. The corporate was based in 2012, produces about $1.2 billion in annual income, and trades with a market cap of $4.2 billion.

Clearway has a really apparent tie-in to the setting because it owns an enormous put in base of wind and photo voltaic tasks which can be producing electrical energy right now. Along with that, the corporate has an enormous quantity of incremental energy coming on-line within the subsequent three years.

Supply: Investor presentation

The corporate is ramping its development trajectory into 2025, and is diversifying into a number of various kinds of renewable energy technology and storage.

The dividend streak stands at simply three years, however the yield is excellent at 7%. That makes Clearway a terrific earnings inventory, provided that’s greater than triple the yield of the S&P 500.

Complete anticipated returns are above 10%, due to anticipated EPS development of three%, a slight enhance from an increasing P/E a number of, and the 7% present dividend yield.

Click on right here to obtain our most up-to-date Positive Evaluation report on Clearway Vitality Inc. (preview of web page 1 of three proven under):

Ormat Applied sciences Inc. (ORA)

Subsequent up is Ormat Applied sciences, an organization that generates energy, in addition to promoting tools to others seeking to generate renewable energy. It operates within the U.S., Indonesia, Kenya, Turkey, Chile, Central America, Ethiopia, New Zealand, and Honduras.

By its segments, Ormat, develops, builds and owns geothermal, photo voltaic, and recovered power amenities and sells its electrical energy. Along with promoting tools, the corporate additionally operates an power storage enterprise.

Ormat was based in 1965, produces about $725 million in annual income, and trades with a market cap of $3.8 billion.

Supply: Investor presentation

The corporate plans to spice up its geothermal and photo voltaic power manufacturing by 21%-24% between by way of 2025, whereas its power storage enterprise is anticipated to develop by over 500%.

Ormat’s dividend enhance streak stands at seven years right now, however the yield is simply 0.7%. That makes Ormat unattractive from a pure yield perspective, however we see sturdy development potential on the horizon for each the inventory and the dividend.

LKQ Company (LKQ)

Our subsequent inventory is LKQ Company, an organization that distributes substitute components, elements and programs used within the restore and upkeep of automobiles. LKQ operates in North America and Europe. The corporate distributes all kinds of substitute components, however its tie-in to sustainability and environmental friendliness is its recycling enterprise.

The corporate offers sheet metallic and scrap metals to metallic recyclers, retaining these merchandise out of landfills and saving the uncooked materials that may in any other case must be mined and become new merchandise.

LKQ was based in 1998, generates just below $13 billion in annual income, and trades with a market cap of $12.3 billion.

The corporate’s dividend streak is simply two years, because it solely started returning money to shareholders in 2021. Nonetheless, it has a decent 2.3% yield right now, which is best than the S&P 500.

NextEra Vitality Inc. (NEE)

NextEra Vitality is an electrical utility with two working segments, Florida Energy & Mild (“FPL”) and NextEra Vitality Assets (“NEER”). FPL is the biggest U.S. electrical utility by retail megawatt hour gross sales and buyer numbers.

The speed-regulated electrical utility serves about 5.8 million buyer accounts in Florida. NEER is the biggest generator of wind and photo voltaic power on this planet. NEE generates roughly 80% of its revenues from FPL.

NextEra Vitality reported its Q2 2023 monetary outcomes on 7/25/23.

Supply: Investor Presentation

On a per-share foundation, adjusted earnings climbed 8.6% to $0.88. Notably, FPL continued to execute on capital investments in photo voltaic and transmission and distribution infrastructure, whereas NEER positioned ~1.8 GW into service. Moreover, NEER added ~1.7 GW of latest renewables and storage tasks to its backlog that totals ~20 GW.

We see NextEra as top-of-the-line Dividend Aristocrats.

Click on right here to obtain our most up-to-date Positive Evaluation report on NEE (preview of web page 1 of three proven under):

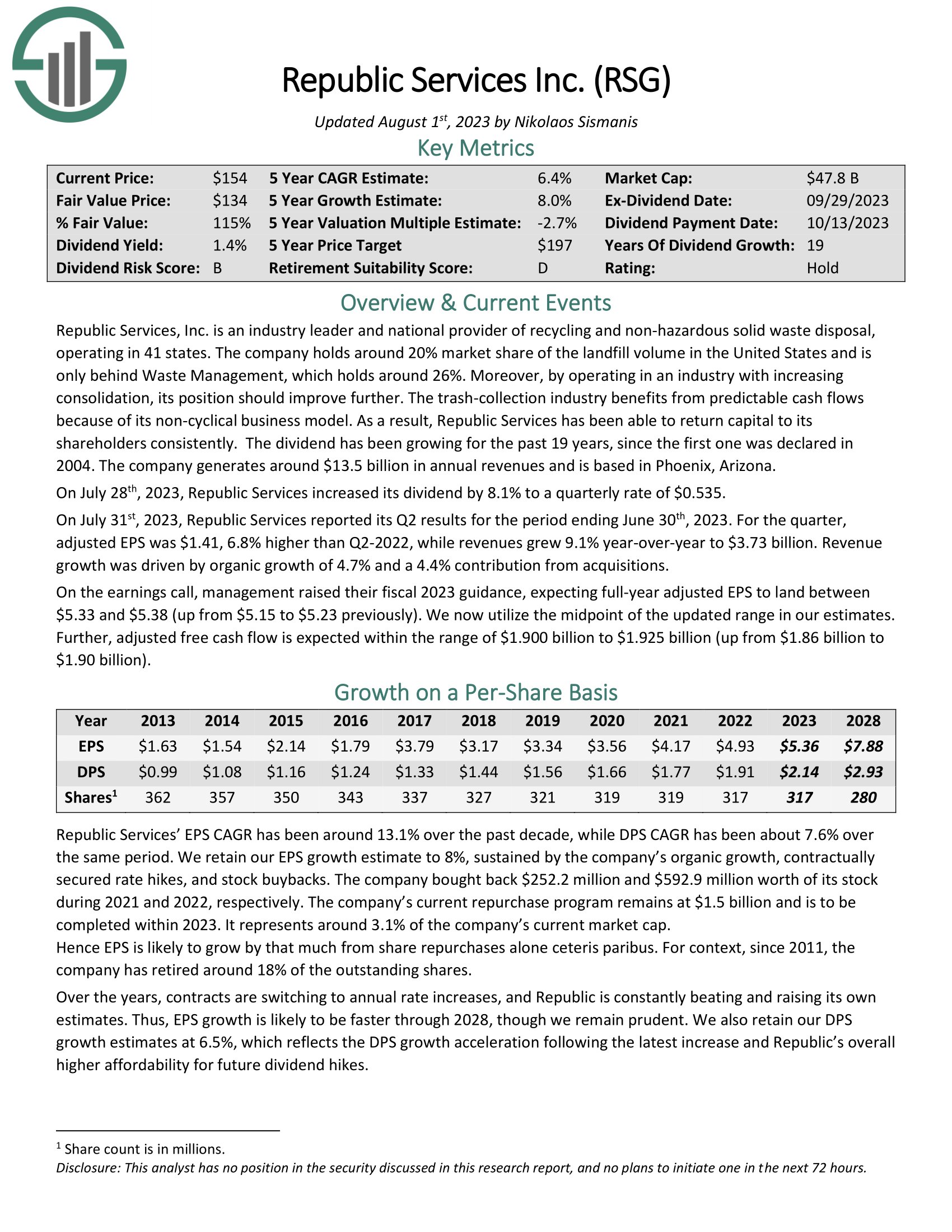

Republic Providers Inc. (RSG)

Republic Providers is our subsequent inventory, an organization that gives waste assortment and recycling by way of a large community of assortment stations and landfills within the U.S. Like Waste Administration, Republic Providers has a big recycling enterprise, in addition to landfill-to-gas power assortment amenities within the U.S.

Republic was based in 1996, produces about $13.5 billion in annual income, and trades with a market cap of $41 billion.

Supply: Investor presentation

Republic has a giant concentrate on sustainability, which is why it ended up on this listing. The corporate has distinct local weather objectives round restoration of power, and powering its fleet of vans in cleaner methods, as examples.

Republic’s dividend enhance streak stands at 19 years, however its yield is below-market at 1.4%.

Nonetheless, given the yield, sturdy 8% projected development, and a ~2% headwind from the valuation that’s barely over honest worth, we see respectable ~8% annual returns within the years forward.

Click on right here to obtain our most up-to-date Positive Evaluation report on Republic Providers (preview of web page 1 of three proven under):

Aris Water Options Inc. (ARIS)

Our subsequent inventory is Aris Water Options, an environmental infrastructure and options firm. Aris offers water dealing with and recycling answer to prospects within the U.S. This contains gathering, transporting, and recycling water from oil and pure fuel manufacturing amenities.

The corporate helps make the manufacturing of power – and the water it makes use of – extra environmentally pleasant by avoiding merely losing that water.

The corporate was based in 2015, and in a short while has grown to $320 million in annual income, and a market cap of $475 million.

Aris solely started paying dividends to shareholders in early-2022, but it surely already raised the payout from the preliminary dividend of seven cents per share. Which means its present yield is 4.3%, effectively forward of the S&P 500’s common yield right now.

Waste Connections Inc. (WCN)

Waste Connections is a waste assortment, switch, disposal, and useful resource restoration enterprise within the U.S. and Canada. It affords varied recycling companies, together with stable waste, in addition to fluids used within the oil and fuel drilling business, serving to to extend the sustainability of these sectors.

The corporate was based in 1997 and is predicated in Canada, with ~$7 billion in annual income, and a market cap of $34 billion.

As we are able to see, Waste Connections has sturdy ESG targets for the long-term, as it’s seeking to enhance its personal sustainability, in addition to these of its prospects.

Waste Connections has boosted its dividend for 7 consecutive years, however the sturdy efficiency of the inventory means the yield could be very low at simply 0.7%. Nonetheless, we see sturdy dividend development prospects for the inventory within the years to come back.

We count on ~8% whole annual returns, accruing from the 0.7% yield, 12% projected development, and a ~4% headwind from the valuation.

Brookfield Renewable Companions L.P. (BEP)

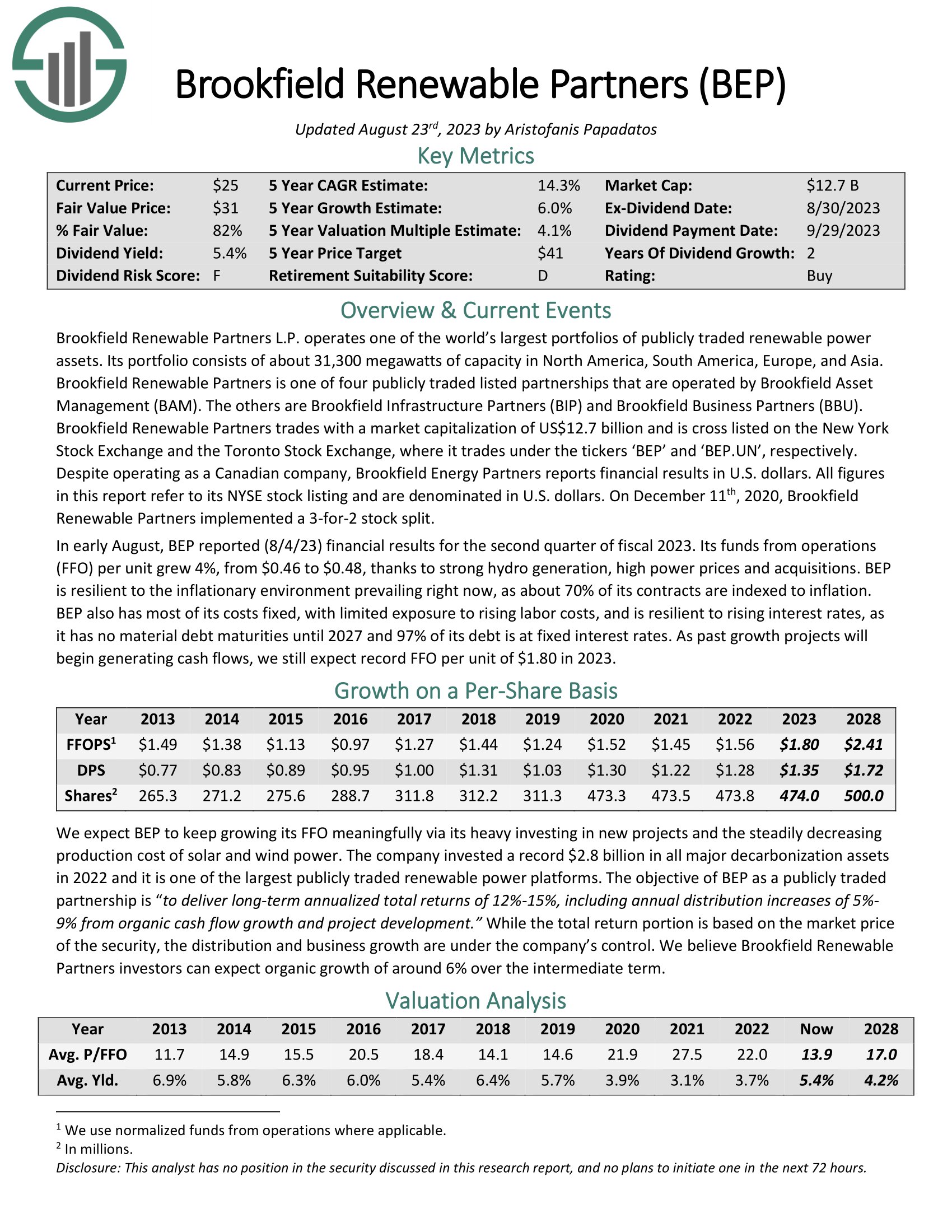

Brookfield Renewable Companions L.P. operates one of many world’s largest portfolios of publicly traded renewable energy property. Its portfolio consists of about 31,300 megawatts of capability in North America, South America, Europe, and Asia.

Brookfield Renewable Companions is certainly one of 4 publicly traded listed partnerships which can be operated by Brookfield Asset Administration (BAM). The others are Brookfield Infrastructure Companions (BIP) and Brookfield Enterprise Companions (BBU).

In early August, BEP reported (8/4/23) monetary outcomes for the second quarter of fiscal 2023. Its funds from operations (FFO) per unit grew 4%, from $0.46 to $0.48, because of sturdy hydro technology, excessive energy costs and acquisitions.

BEP is resilient to the inflationary setting prevailing proper now, as about 70% of its contracts are listed to inflation.

Click on right here to obtain our most up-to-date Positive Evaluation report on BEP (preview of web page 1 of three proven under):

Atlantica Sustainable Infrastructure plc (AY)

Our remaining inventory is Atlantica Sustainable Infrastructure, an organization based mostly in the UK that owns, manages, and invests in renewable power, storage, pure fuel, electrical transmission traces, and water property globally. The corporate makes the listing for its broad number of renewable power property, together with greater than 2,000 megawatts of renewable sources.

The corporate was based in 2013, generates $1.2 billion in annual income, and trades with a market cap of $2 billion.

Whereas Atlantica isn’t a pure play on renewable power property, given it has a big pure fuel enterprise, it has a concentrate on producing energy by way of geothermal and different sustainable strategies for the longer term. The corporate additionally has water desalinization property that may course of 17.5 million cubic ft per day, including one other sustainability dimension to the corporate’s portfolio.

The dividend streak stands at seven years, and the yield is the perfect of the group at 10%, which means when it comes to a pure earnings inventory, Atlantica has little competitors.

Click on right here to obtain our most up-to-date Positive Evaluation report on AY (preview of web page 1 of three proven under):

Last Ideas

Investing for long-term returns can even embrace doing proper by the planet. Above, we recognized 10 sustainability shares, all providing various ranges of dividend longevity, present yield, development prospects, and whole returns.

Whereas we like Atlantica Infrastructure finest resulting from its huge yield and whole return prospects, we predict all 10 have one thing to supply traders taken with sustainability and dividends.

The next articles include shares with very lengthy dividend or company histories, ripe for choice for dividend development traders:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

[ad_2]

Source link