[ad_1]

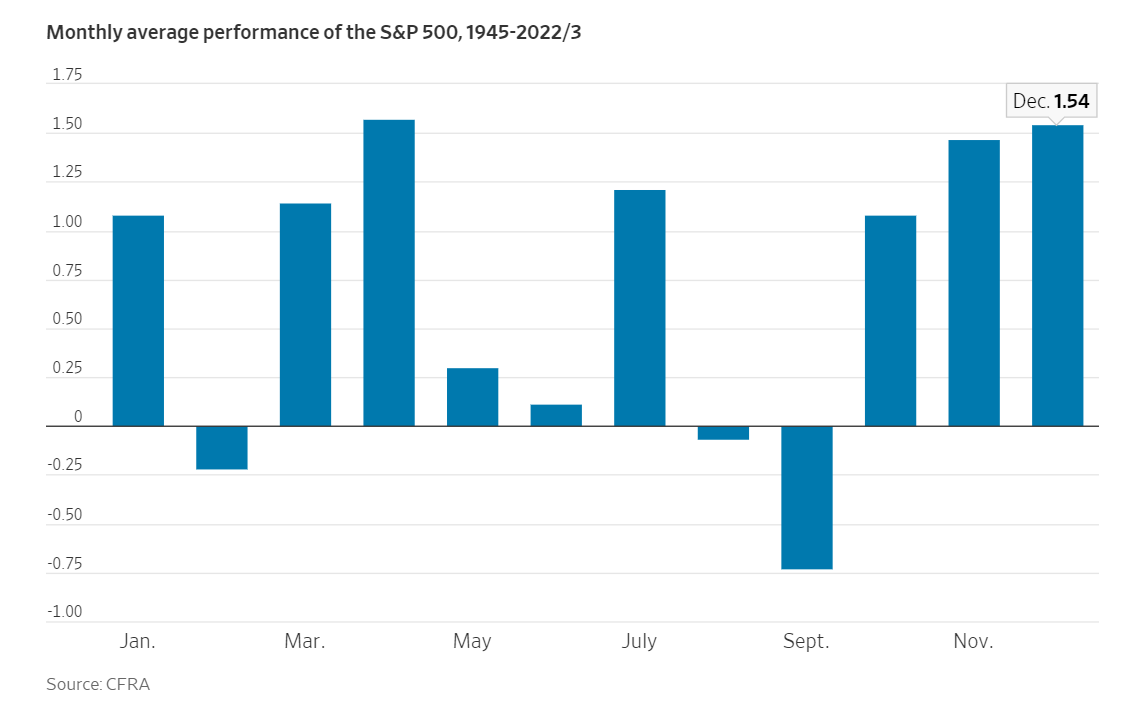

After a comparatively sturdy begin to the 12 months in January, historical past says traders ought to brace for recent turmoil in February, which has a status for being one of many worst months of the 12 months for the inventory market.

Since 1945, the has suffered a mean lack of round -0.3% in February.

That compares to a mean achieve of roughly +0.8% for the opposite months of the calendar. The benchmark index fell -2.6% final February as traders apprehensive concerning the Federal Reserve’s aggressive fee hike plans.

Certainly, the Fed continues to be the principle driver of investor sentiments and inventory worth motion, with many speculating just lately about when the U.S. central financial institution would possibly begin chopping rates of interest.

As of this writing, after right this moment’s surprisingly above-estimate jobs report, which confirmed that the U.S. financial system had added 353,000 jobs towards an estimate of 187,000 in January, monetary markets noticed a couple of 65% likelihood of the Fed leaving charges at present ranges in March, in comparison with a 35% chance of a quarter-point fee lower.

Talking on the post-meeting press convention on Wednesday, Fed Chair Jerome Powell famous the labor market and financial development could have to sluggish to finally obtain the Fed’s purpose of bringing inflation again right down to its 2% goal.

“The manager abstract can be development is stable to sturdy … 3.7% unemployment signifies the labor market is powerful,” the Fed chief mentioned. “Let’s be trustworthy, it is a good financial system,” he added.

Looking to Could, traders imagine there’s a roughly 90% likelihood charges are decrease by the top of that assembly, as per the Investing.com .

With traders persevering with to gauge the outlook for rates of interest, , and the financial system, so much will probably be on the road within the month forward.

U.S. CPI Report: Tuesday, February 13

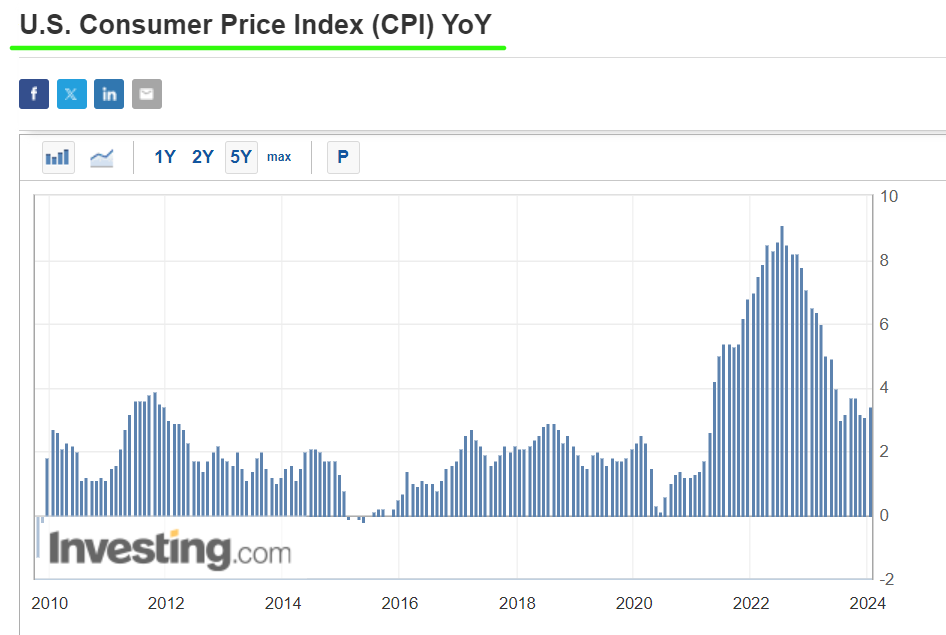

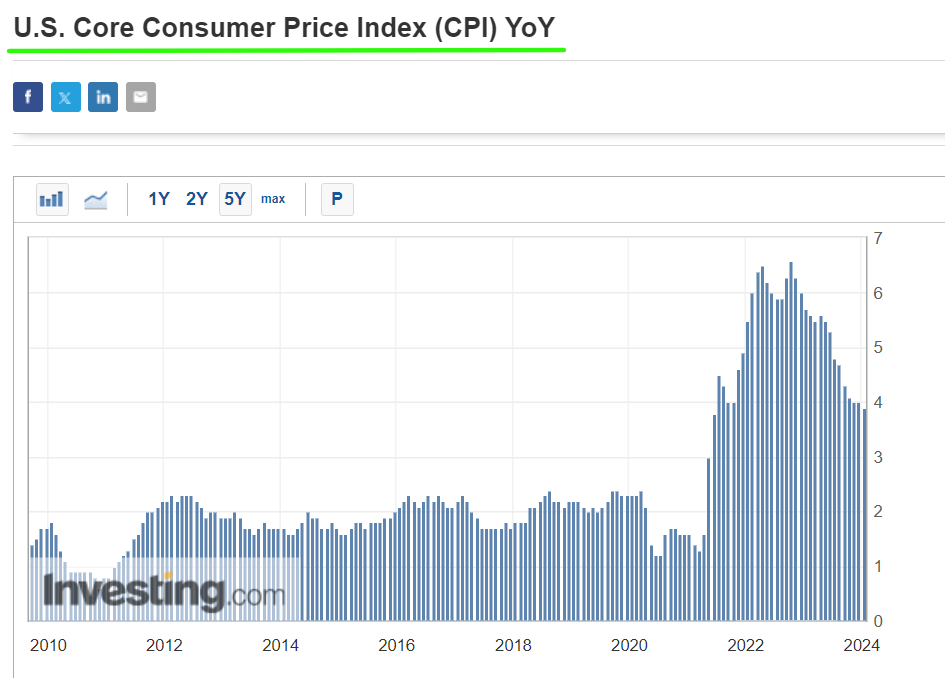

The U.S. authorities will launch the January report on Tuesday, February 13, at 8:30AM ET and the numbers will doubtless present that costs proceed to extend at a tempo almost twice the central financial institution’s goal.

Whereas no official forecasts have been set but, expectations for annual CPI vary from a rise of three.2% to three.6%, in comparison with a 3.4% annual tempo in December.

The intently watched shopper worth index has come down considerably because the summer time of 2022, when it peaked at a four-decade excessive of 9.1%, nonetheless, inflation continues to be rising much more rapidly than the two% fee the Fed considers wholesome.

In the meantime, estimates for the year-on-year determine – which doesn’t embrace meals and vitality costs – focus on 3.7%-4.0%, in comparison with December’s 3.9% studying.

The underlying core determine is intently watched by Fed officers who imagine that it supplies a extra correct evaluation of the long run course of inflation.

Prediction: I imagine the numbers will doubtless present that neither inflation nor core inflation is falling quick sufficient for the Fed to pause its inflation-fighting efforts.

Throughout Wednesday’s post-FOMC assembly press convention, mentioned that fee cuts wouldn’t be acceptable till there’s “larger confidence that inflation is transferring” in direction of the central financial institution’s 2% goal.

“Inflation continues to be too excessive. Ongoing progress in bringing it down shouldn’t be assured,” Powell warned.

Due to this fact, I maintain the opinion that the present setting shouldn’t be indicative of a Fed that might want to pivot on coverage and there’s nonetheless a protracted option to go earlier than policymakers are able to declare mission completed on the inflation entrance.

This autumn Earnings Season Continues

Traders await a flood of earnings in February as Wall Road’s fourth quarter reporting season continues.

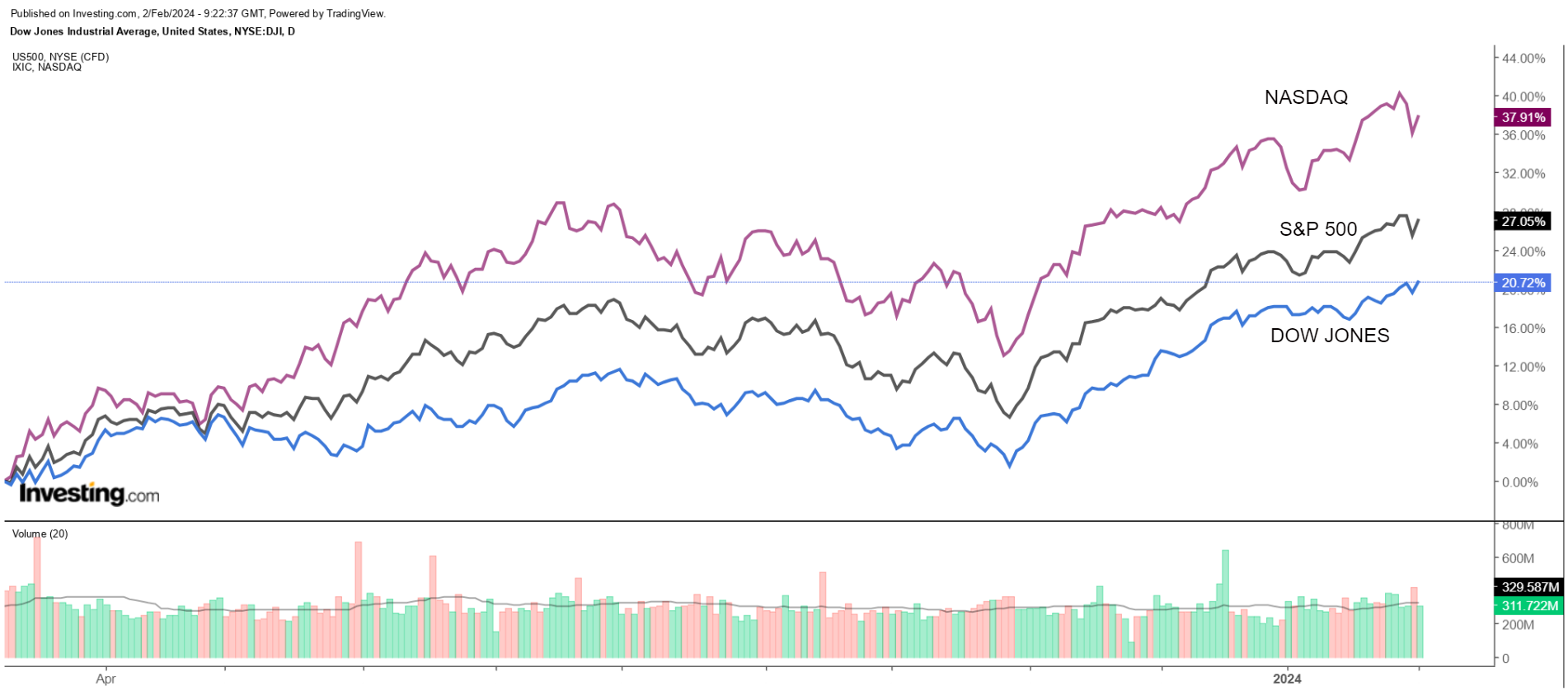

Three of the so-called ‘Magnificent Seven’ tech shares reported their outcomes final evening, with Fb-parent Meta Platforms (NASDAQ:), and e-commerce large Amazon (NASDAQ:) delivering blowout earnings and steerage, whereas iPhone maker Apple (NASDAQ:) supplied an outlook for the March quarter that disenchanted traders.

Looking to subsequent week, a few of the notable corporations reporting outcomes embrace Walt Disney (NYSE:), Caterpillar (NYSE:), McDonald’s Company (NYSE:), Pepsico (NASDAQ:), Eli Lilly (NYSE:), Ford (NYSE:), Uber (NYSE:), Palantir (NYSE:), Snap, Pinterest (NYSE:), and PayPal (NASDAQ:).

The next week sees high-profile names like Coca-Cola (NYSE:), Airbnb, Shopify (NYSE:), Coinbase (NASDAQ:), DraftKings (NASDAQ:), Roku (NASDAQ:), Cisco (NASDAQ:), Arista Networks (NYSE:), and Occidental Petroleum (NYSE:) report earnings.

Retailers then take heart stage within the second half of the month when heavyweights Walmart (NYSE:), Dwelling Depot (NYSE:), Goal, Lowe’s, TJX Firms (NYSE:), Macy’s, Finest Purchase (NYSE:), and Costco (NASDAQ:) ship their newest monetary outcomes.

One other key identify to observe will probably be Nvidia (NASDAQ:), whose This autumn outcomes are scheduled to come back out after the closing bell on Wednesday, February 21. Shares of the Santa Clara, California-based tech large have surged 222% over the previous 12 months, rising alongside spiking curiosity in synthetic intelligence (AI) developments.

It’s price mentioning that Nvidia shares seem like extraordinarily overvalued for the time being, as per the quantitative fashions in InvestingPro, which level to a possible draw back of -16% from their present market worth.

Supply: InvestingPro

The fourth-quarter earnings season is sort of midway by way of. Of the 208 S&P 500 corporations which have reported by way of Friday, about 80% have topped expectations, based on FactSet information.

In a typical quarter, 76% of S&P 500 corporations beat estimates.

What To Do Now

Whereas I’m at present lengthy on the S&P 500, and the by way of the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ), I’ve been cautious about making new purchases as we’re getting into one of many weakest months of the 12 months traditionally.

Due to this fact, a pullback in February wouldn’t be stunning for my part because the latest run to report highs will probably be onerous to maintain amid the present backdrop.

Total, it’s essential to stay affected person and alert to alternative. Not shopping for prolonged shares, and never getting too concentrated in a selected firm or sector are nonetheless essential.

***

Make sure you try InvestingPro to remain in sync with the market development and what it means on your buying and selling selections.

InvestingPro empowers traders to make knowledgeable selections by offering a complete evaluation of undervalued shares with the potential for important upside out there.

Be a part of now for as much as 50% off on our Professional and Professional+ subscription plans and by no means miss one other bull market by not understanding which shares to purchase!

Be a part of now for as much as 50% off on our Professional and Professional+ subscription plans and by no means miss one other bull market by not understanding which shares to purchase!

Declare Your Low cost Immediately!

Remember your free present! Use coupon code OAPRO1 at checkout to say an additional 10% off on the Professional yearly plan, and OAPRO2 for an additional 10% low cost on the by-yearly plan.

Disclosure: I frequently rebalance my portfolio of particular person shares and ETFs primarily based on ongoing danger evaluation of each the macroeconomic setting and corporations’ financials.

The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.

[ad_2]

Source link