[ad_1]

SDI Productions/E+ by way of Getty Pictures

Northrim BanCorp (NASDAQ:NRIM) is a small financial institution that capitalizes solely $300 million and operates in Alaska. Though not well-known amongst retail buyers, I discover this financial institution very attention-grabbing and apparently the market thinks the identical: its worth per share is close to an all-time excessive.

This financial institution has totally recovered from the disaster that resulted from the failure of SVB and has a serious aggressive benefit dictated by its geographic location. In truth, the highest 4 banks in Alaska (together with Northrim) have 90% deposit market share. Linking to my earlier article on NRIM, the strengths of this financial institution stay unchanged as do its future prospects. It’s a rising market and has the potential to capitalize on this development.

Regardless of lacking EPS estimates in This autumn 2023 by $0.05, I view this quarterly as optimistic total.

Mortgage portfolio and NPLs

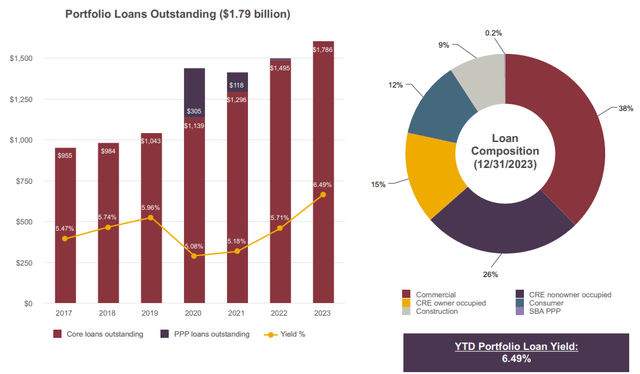

Investor Presentation Fourth Quarter 2023 Nasdaq: NRIM

The mortgage portfolio reached $1.79 billion, up a whopping 19.50% from the earlier yr. It is a nice end result and is supported by a nonetheless low LTD: solely 72%. So, administration nonetheless has an excellent margin to lend at present market charges. The YTD portfolio mortgage yield was 6.49%, an excellent determine however one that would change quite a bit within the coming months given the maturity construction.

31% of loans mature or reprice within the subsequent three months, 15% of loans mature or reprice in three to 12 months, and 16% of loans mature or reprice in a single to 2 years. 18% of incomes belongings reprice instantly when prime or different fee indices change.

Principally, solely 38% of whole loans can be repriced after the 2 years, all others can be repriced earlier. This exposes the financial institution to appreciable fee threat ought to the Fed lower charges greater than anticipated. As well as, a lot of the loans belong to the business class, which might make this financial institution’s earnings fairly cyclical.

In any case, the energy of deposits and low NPLs reassure shareholders in the meanwhile.

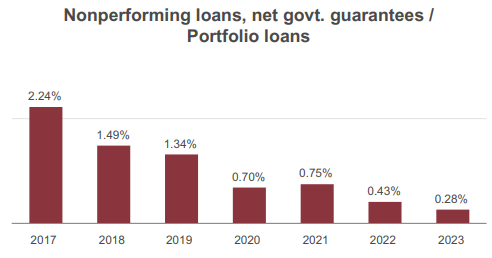

Investor Presentation Fourth Quarter 2023 Nasdaq: NRIM

Sometimes, NPLs rise when charges are excessive, because it coincides with the time when debtors start to wrestle to pay their installments. Nevertheless, this isn’t the case for NRIM, whose NPLs are at an all-time low since 2017, solely 0.28%. It is a signal that the mortgage portfolio is high-quality.

Deposits and NIM

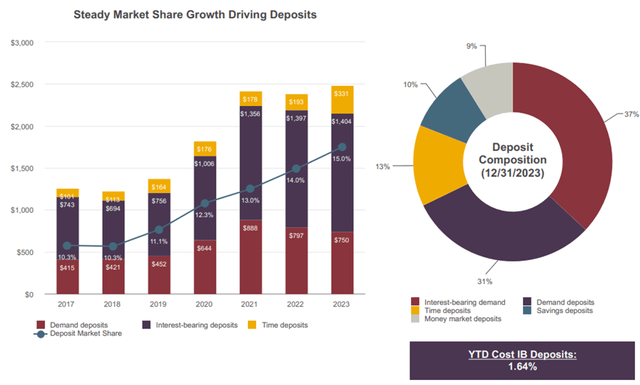

Investor Presentation Fourth Quarter 2023 Nasdaq: NRIM

Complete deposits reached $2.48 billion, a rise of 4.20% over final yr. The composition of deposits remained about the identical, with non-interest bearing deposits accounting for about one-third of whole deposits. Curiosity-bearing deposits and time deposits have taken on better weight however the YTD value IB deposits nonetheless stays very low: 1.64%.

That is the principle benefit of NRIM, particularly having the ability to get hold of assets at a comparatively low worth in comparison with present market charges. In spite of everything, there are only a few opponents in Alaska and it’s not stunning: suffice it to say that 6 branches can solely be reached by boat or airplane. Working on this territory means accepting increased working prices than the typical regional financial institution, however simply as there are disadvantages there are additionally benefits, on this case low competitors.

By the best way, NRIM is getting a bigger and bigger share of the deposit market in Alaska: in 2018 it was 10.30%, in 2023 it reached 15%. So, this financial institution doesn’t have a tough time discovering low-cost liquid assets, which is why the LTD ratio is so low. On the identical time, it’s troublesome for brand new opponents to enter this area of interest market so filled with pitfalls: the final one was Wells Fargo in 2000 shopping for Nationwide Financial institution of Alaska.

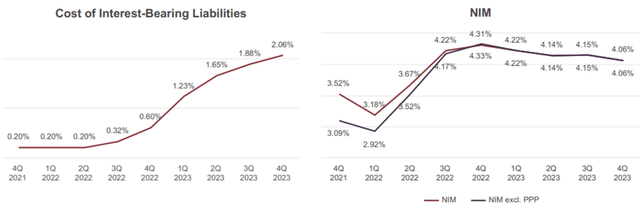

Investor Presentation Fourth Quarter 2023 Nasdaq: NRIM

Given the low value of interest-bearing liabilities, the NIM in consequence is kind of excessive, particularly 4.06%. It has been steadily declining since This autumn 2022, however nonetheless stays a robust efficiency.

Shareholder remuneration

Along with deposits, the opposite placing facet of NRIM is shareholder remuneration. From this standpoint, this financial institution virtually appears to be like like a non-financial firm. Dividends and buybacks are the priorities and the outcomes achieved lately have been spectacular.

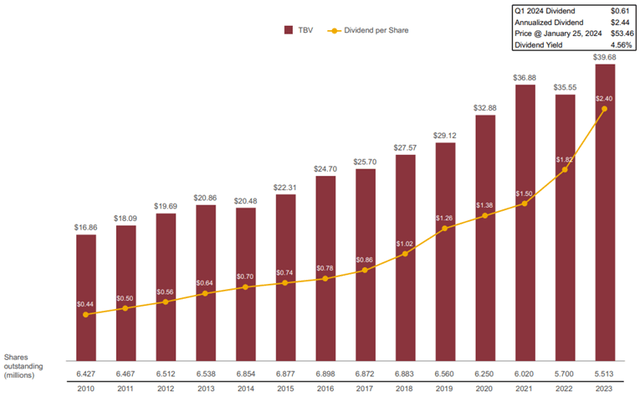

Initially, about 20% of the excellent shares have been purchased again within the final 5 years, and the buyback has not ended there. Just a few days in the past the Board licensed the repurchase of 110,000 further shares. As well as, this enormous buyback has not adversely affected the expansion of TBV per share, the principle issue on which the worth per share relies.

Investor Presentation Fourth Quarter 2023 Nasdaq: NRIM

Virtually yearly TBV per share has elevated, which explains why this financial institution is close to an all-time excessive. Additionally, the dividend has been elevated considerably, and few banks can sustain with such a development fee.

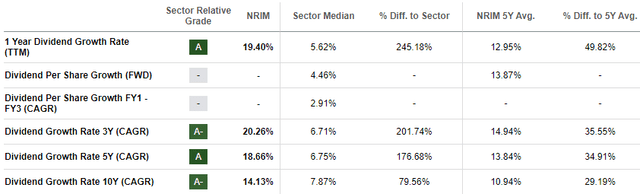

Searching for Alpha

As you possibly can see from this picture, over 3-5-10 years NRIM’s dividend development is way above the business median. Furthermore, no less than in the intervening time, its sustainability is out of the query.

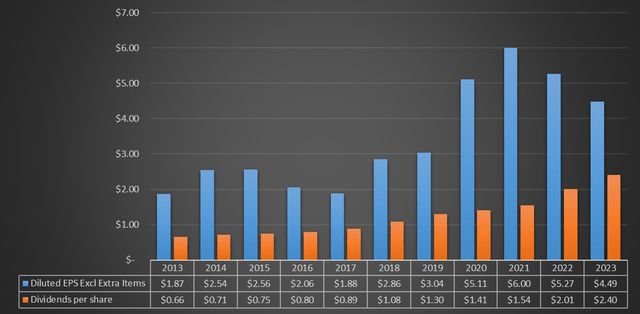

Chart primarily based on Searching for Alpha knowledge

EPS largely covers the dividends issued, albeit not as a lot as prior to now. The discount in EPS in comparison with 2021 could also be a priority, however for my part it is a momentary issue. In spite of everything, the macroeconomic setting has deteriorated quite a bit and NRIM has nonetheless proven resilience by retaining NIM excessive with out rising NPLs. In different phrases, as soon as there may be readability on the way forward for financial coverage, I count on that NRIM can proceed to develop as prior to now. However, the long-term development stays bullish on EPS, in addition to TBV per share and deposit market share.

Conclusion

Northrim BanCorp is a financial institution working in Alaska and its opponents might be counted on the fingers of 1 hand. Whereas that is good because it virtually results in an oligopoly regime, increased working prices dictated by hostile climate circumstances must be highlighted. Regardless, the tip result’s an NIM above 4% with extraordinarily low NPLs. EPS is struggling to develop, however the long-term development stays bullish as does TBV per share.

Lastly, shareholders have been effectively compensated over the previous 5 years, each by way of buybacks and double-digit dividend development. The latter’s development will most likely sluggish considerably within the coming years, no less than till EPS returns to development. Though NRIM is near an all-time excessive, the dividend yield stays fairly excessive at 4.40%.

[ad_2]

Source link