[ad_1]

Bitcoin mining is the cornerstone of the crypto trade and the crypto market. At its core, the profitability of mining comes all the way down to a single, essential metric — the price of producing every bitcoin.

The significance of this value turns into even higher relating to publicly traded Bitcoin mining corporations, because it’s basically what retains them operational and in the end worthwhile. On this report, CryptoSlate will give attention to Marathon Digital and Riot Blockchain, two of the most important public Bitcoin miners.

Marathon Digital (MARA) and Riot Platforms (RIOT) are two of the most important public Bitcoin mining corporations by market cap. Their operational capability and financials provide vital insights into the state of Bitcoin mining at its highest and most organized degree.

Whereas all public Bitcoin mining corporations, together with Marathon and Riot, present knowledge on their mining prices, there’s usually extra to the numbers they publish. Some corporations use totally different accounting remedies for digital belongings, which impacts their carrying worth. Some corporations have a number of mining websites throughout varied geographical areas, every with totally different electrical energy costs and mining capacities.

To higher perceive the common value to mine one bitcoin, CryptoSlate adopted another method — dividing the full prices of revenues for every firm by the variety of Bitcoins they produced. This methodology, albeit extra speculative, guarantees a extra telling reflection of precise mining prices.

Dividing the full prices of revenues by the variety of Bitcoins produced supplies a complete view of the bills incurred within the mining course of. This method goes past simply the electrical energy or operational prices, together with all direct and oblique prices related to mining, akin to gear depreciation, upkeep, staffing, and administrative bills.

By aggregating these prices, this methodology exhibits what it really prices an organization to mine every Bitcoin. It precisely displays the financial actuality, capturing the complete spectrum of bills that influence the underside line. This helps us perceive the effectivity and profitability of Bitcoin mining operations and is a invaluable device for analysts and buyers searching for to know mining corporations’ monetary well being and operational efficacy.

Marathon Digital (MARA)

Marathon had a really profitable 2023, increasing its operational capability by means of acquisitions and new mining gear. The corporate additionally introduced that its acquisitions enabled it to lower operational prices by as a lot as 30%, drastically influencing its profitability.

Nonetheless, there’s little concrete info coming straight from Marathon in regards to the firm’s mining prices. A September evaluation from Motley Idiot put Marathon’s value to mine 1 BTC at just below $19,000. The corporate’s newest month-to-month replace for December 2023 solely states the will increase in hash price capability and technical particulars about its mining efficiency however comprises no details about its mining prices.

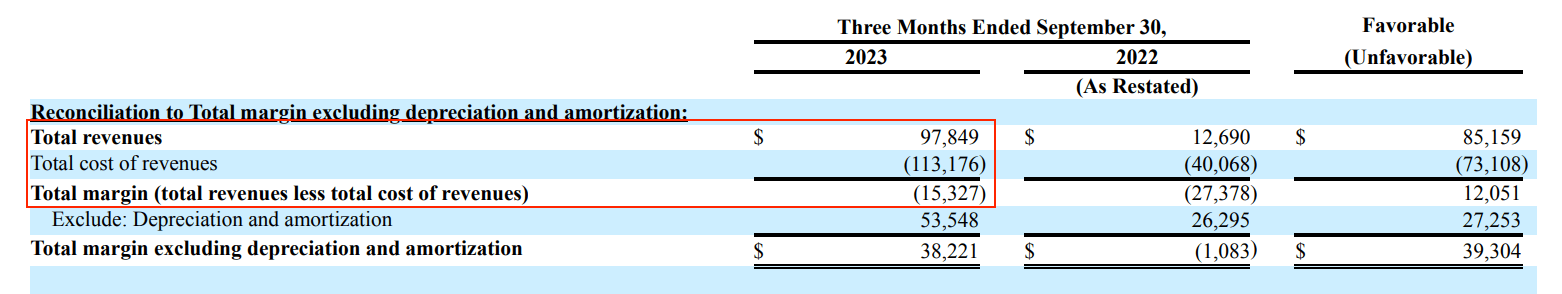

Our major knowledge supply is the corporate’s 10-Q report for the third quarter of 2023. To find out the common value of mining 1 BTC, we’ll make use of the alternate methodology of dividing the full prices of revenues by the variety of Bitcoins produced within the three months ending Sep. 30, 2023. Knowledge from the report exhibits the full value of revenues as $113.176 million. Subtracting the full margin from the price of revenues places it at $97.849 million.

With the corporate producing 3,490 BTC through the quarter, dividing the price of revenues by the variety of produced bitcoins brings us to a price of mining of roughly $28,036.96.

Riot Platforms (RIOT)

Riot has spent the higher a part of 2023 implementing a long-term strategic plan to assist the corporate keep worthwhile after Bitcoin’s halving in April 2024. In its replace for the third quarter of 2023, the corporate’s CEO mentioned its energy technique enabled it to scale back its YTD value to mine to $5,537 per Bitcoin.

This extraordinarily low value will be attributed to Riot’s particular enterprise technique, which concerned incomes energy credit from the Electrical Reliability Council of Texas (ERCOT). Riot participates in ERCOT’s demand response program, which reduces electrical energy consumption throughout peak demand durations in alternate for energy credit. These credit cut back Riot’s electrical energy prices, a significant element of Bitcoin mining bills.

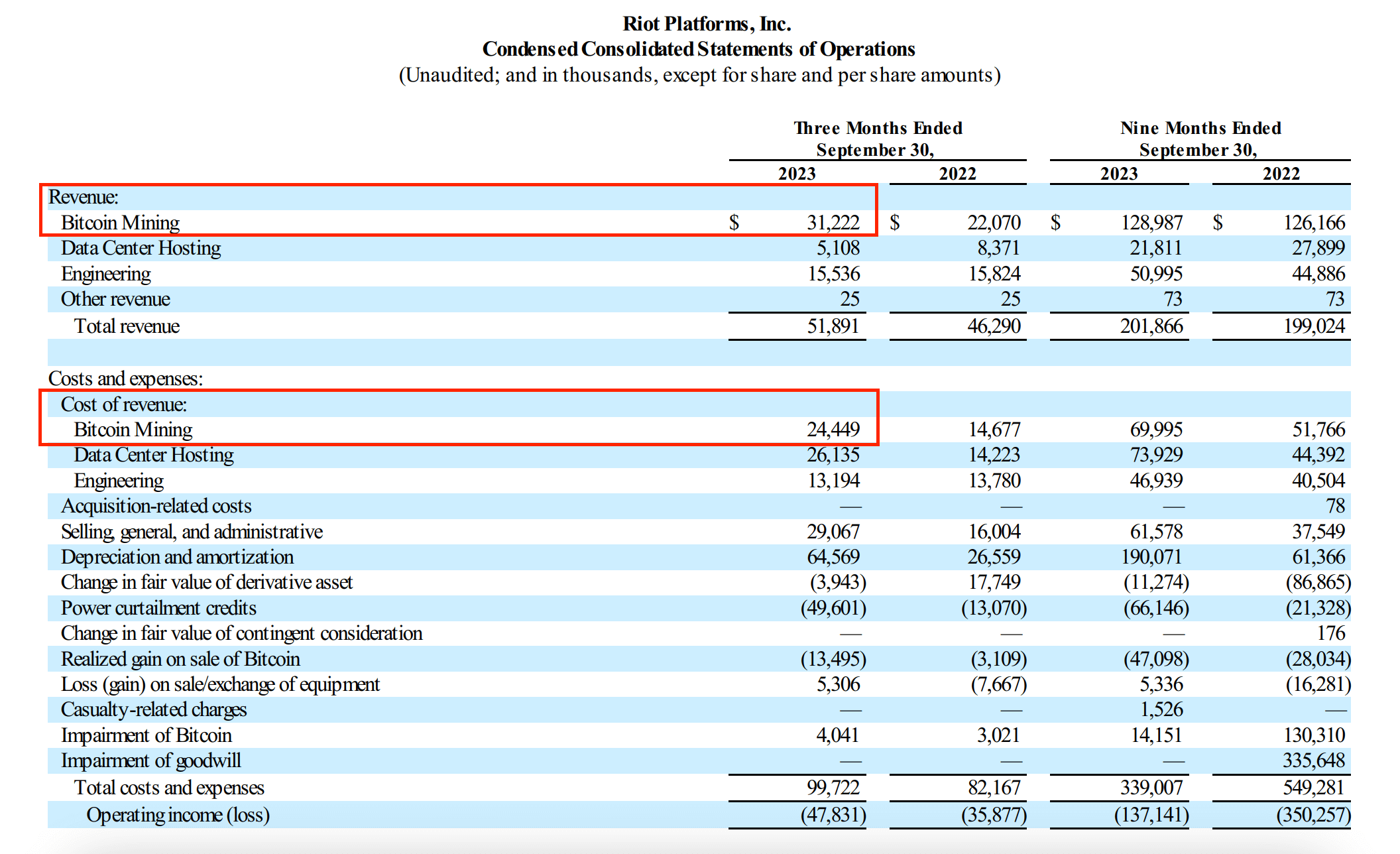

To get a median value of mining one bitcoin for Riot, we’ll apply the identical methodology to Marathon – dividing the price of income by the variety of bitcoins mined in a given interval. Based on Riot’s 10-Q submitting for the third quarter of 2023, Riot’s value of income for Bitcoin mining stood at $24.449 million. Throughout this era, Riot mined 1,106 BTC.

By dividing the full value of revenues particular to Bitcoin mining by the variety of mined BTC, we discover that Riot’s common value for mining one Bitcoin within the third quarter was roughly $22,105.78.

This places Riot’s value for mining near Marathon’s $28,036.96. Nonetheless, a essential element of Riot’s operational technique is its engagement with ERCOT. Throughout the third quarter of final yr, Riot acquired roughly $49.6 million in energy curtailment credit from ERCOT.

Based on its 10-Q submitting, if the $49.6 million in energy curtailment credit for the quarter have been straight allotted to Bitcoin mining value of income primarily based on its proportional energy consumption, it will lower by $31.2 million. On this case, the adjusted value of income would lead to a unfavourable worth of -$6.751 million, displaying that the credit would offset Riot’s authentic value.

Given this knowledge, the common value to mine one bitcoin can be roughly -$6,105.78. Whereas it is a extremely unlikely state of affairs, it exhibits how substantial the influence of the ability curtailment credit could possibly be on Riot’s mining operation and the way a lot it may contribute to general profitability.

The put up Marathon vs Riot: Analyzing the true value of mining 1 bitcoin appeared first on CryptoSlate.

[ad_2]

Source link