[ad_1]

Galeanu Mihai/iStock by way of Getty Pictures

Zscaler (NASDAQ:ZS) has been one of many strongest tech shares as of late. It isn’t exhausting to see why: the cybersecurity firm has posted top-notch elementary outcomes over the previous yr regardless of a robust macro surroundings, producing best-in-class progress charges and exhibiting increasing working margins. Whereas the inventory is now not filth low-cost because it was one yr in the past, the corporate has arguably earned a premium valuation. ZS maintains a internet money steadiness sheet and seems on the verge of inflecting on GAAP profitability. That stated, the present inventory worth doesn’t look like providing sufficient potential reward for the present danger profile, even when we assume sturdy prime and backside line progress charges over the following decade. I’m downgrading the inventory to a impartial “maintain” ranking.

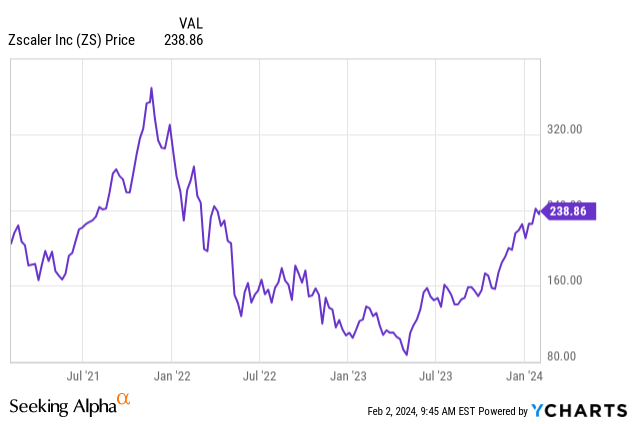

ZS Inventory Value

It’s humorous how rapidly sentiment can change. It was simply lower than a yr in the past when the market seemingly had all however given up on ZS, pondering that progress charges could be heading decrease. ZS has confirmed the doubters flawed, and people who caught by the inventory have been rewarded handsomely.

I final lined ZS in November the place I reiterated my purchase ranking on account of generative AI being a possible tailwind for cybersecurity shares. The inventory is up considerably since then however might have run slightly too far and slightly too quick.

ZS Inventory Key Metrics

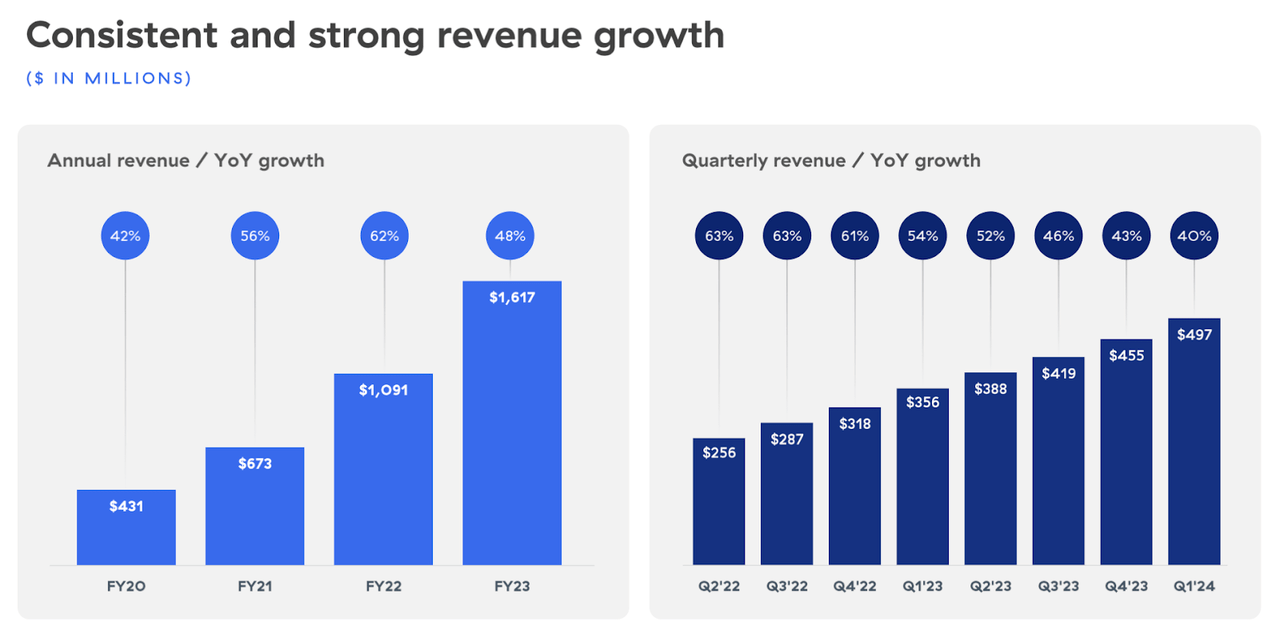

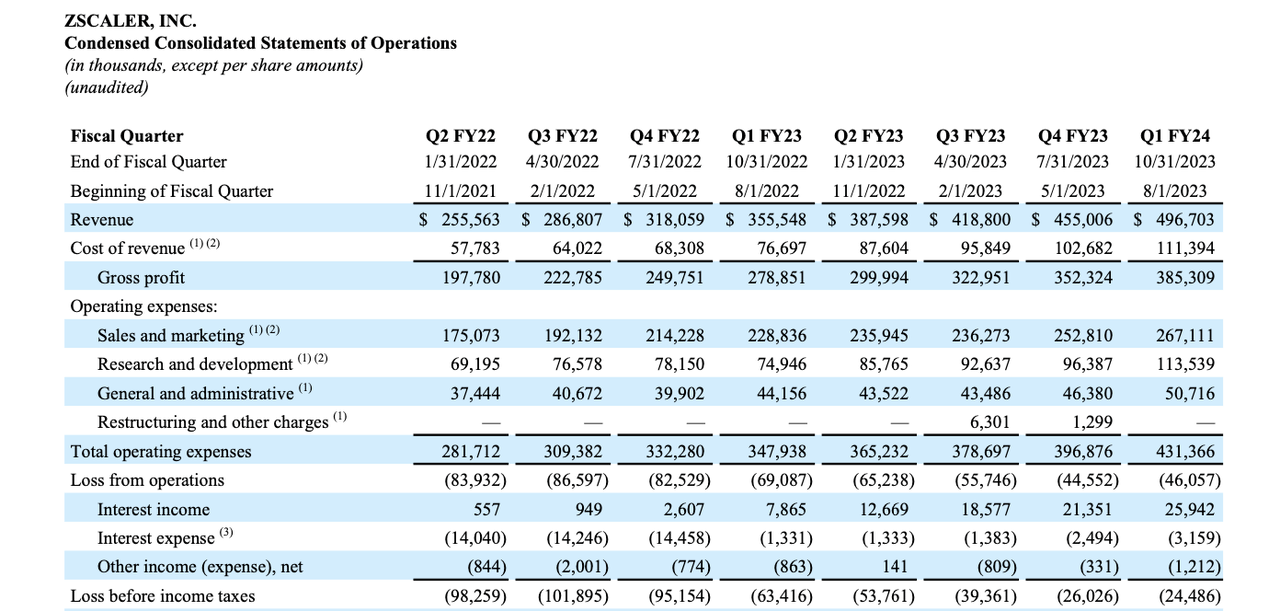

In its most up-to-date quarter, ZS generated 40% YoY income progress to $497 million, smashing steerage of $474 million.

FY24 Q1 Presentation

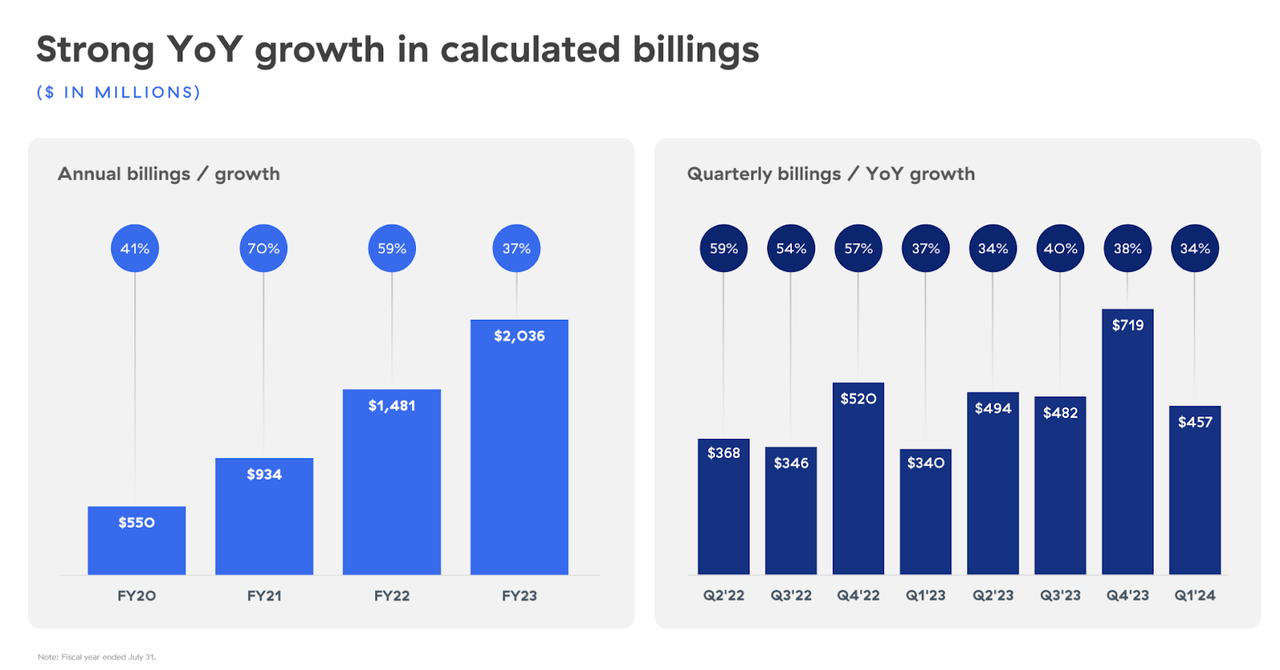

The corporate paired that sturdy income progress with 34% YoY billings progress.

FY24 Q1 Presentation

On the convention name, administration famous that the present remaining efficiency obligations (‘cRPOs’) grew 3.5% QoQ and 32.7% YoY. Between the sturdy billings and cRPOs progress, I anticipate ZS to maintain fast top-line progress over the approaching yr.

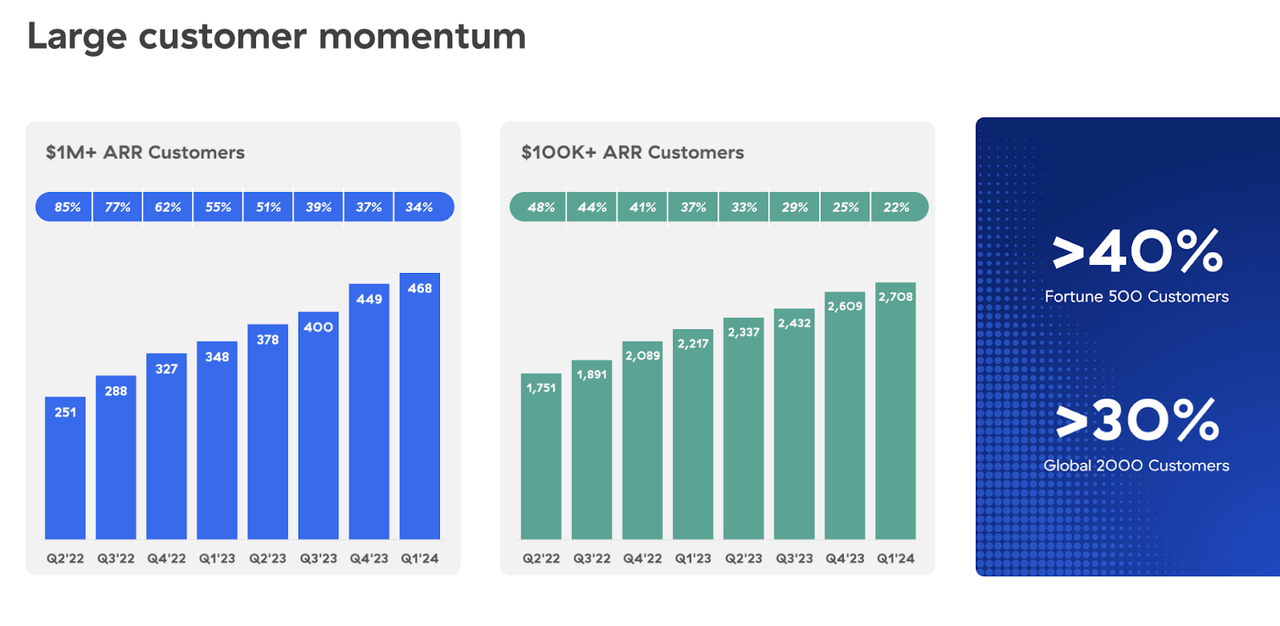

ZS has benefitted from its large product portfolio, because the 120% dollar-based internet retention price was a key driver of the aggressive top-line progress. ZS has one way or the other additionally delivered on aggressive buyer progress, a formidable achievement given the elevated scrutiny on IT bills.

FY24 Q1 Presentation

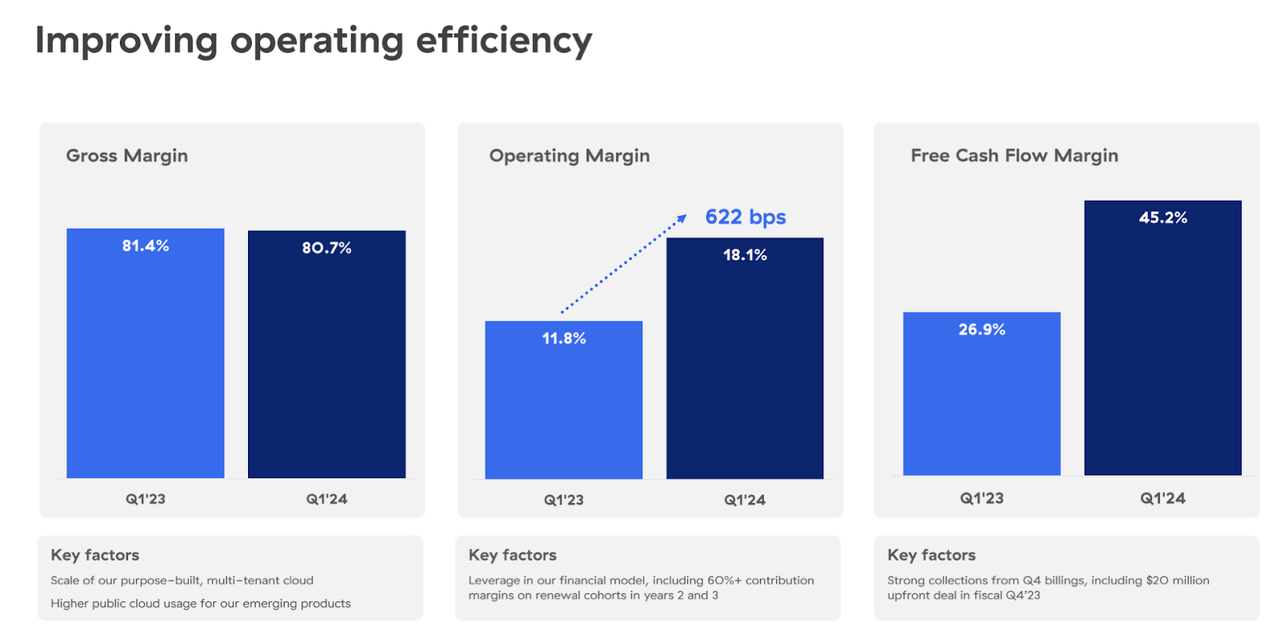

ZS additionally delivered strong profitability positive aspects, with non-GAAP working margins rising 622 bps to 18.1% and non-GAAP EPS coming in at $0.67, smashing steerage for $0.49.

FY24 Q1 Presentation

It’s price noting that ZS is now very near attaining GAAP profitability. The upper rate of interest surroundings has helped result in a surge in curiosity revenue, however even excluding curiosity revenue, ZS would wish to generate solely a 31% incremental working margin to realize GAAP profitability (assuming 30% ahead progress). In truth, in some unspecified time in the future I anticipate ZS to start producing incremental working margins in extra of 75% or increased as working leverage takes maintain. This can be a firm that might present GAAP income at any time when it chooses to.

FY24 Q1 Supplemental

ZS ended the quarter with $2.3 billion of money versus $1.1 billion of convertible notes. These convertible notes carry a 0.125% rate of interest, which helps to elucidate the excessive internet curiosity revenue. These notes mature subsequent yr.

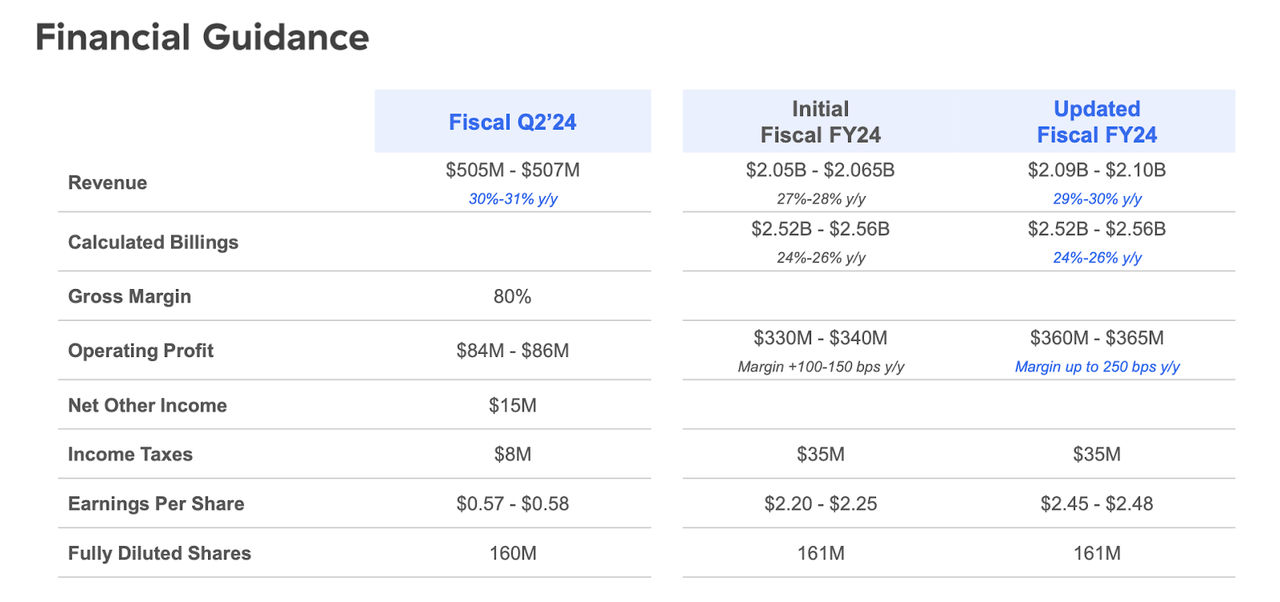

Trying forward, administration has guided for the second quarter to see as much as 31% YoY income progress. Consensus estimates have the corporate coming in on the center of income steerage at round $506 million and on the excessive finish of earnings steerage at $0.58 in non-GAAP EPS. Administration raised full-year steerage to see as much as 30% YoY income progress and 26% YoY billings progress.

FY24 Q1 Presentation

On the convention name, administration famous that the macro surroundings remained difficult although “buyer sentiment appears to be stabilizing.” Given commentary from Microsoft’s (MSFT) current earnings name that cloud optimization headwinds have eased dramatically, it’s doable that ZS might profit from an enhancing macro surroundings transferring ahead. The robust macro surroundings had impacted ZS’ enterprise via slowing headcount progress at its prospects (even when ZS nonetheless generated sturdy outcomes). As typical, Wall Avenue has invested forward of the elemental information as this optimism is being priced into the inventory.

Is ZS Inventory A Purchase, Promote, or Maintain?

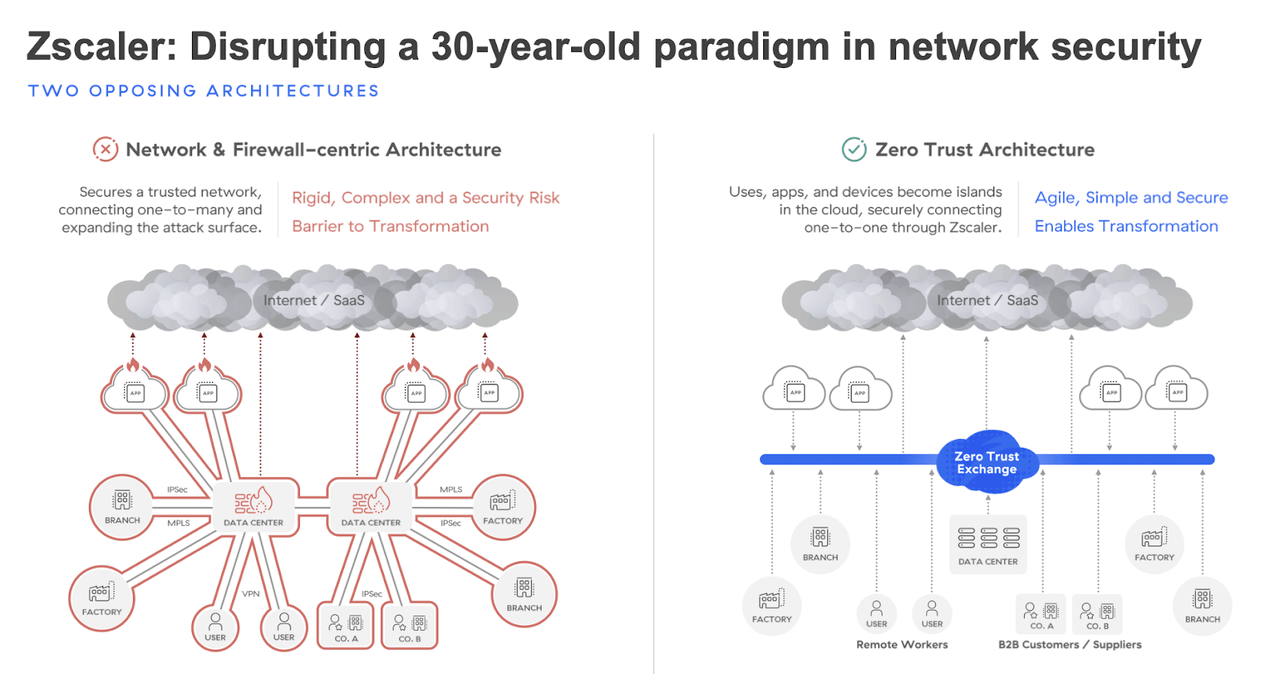

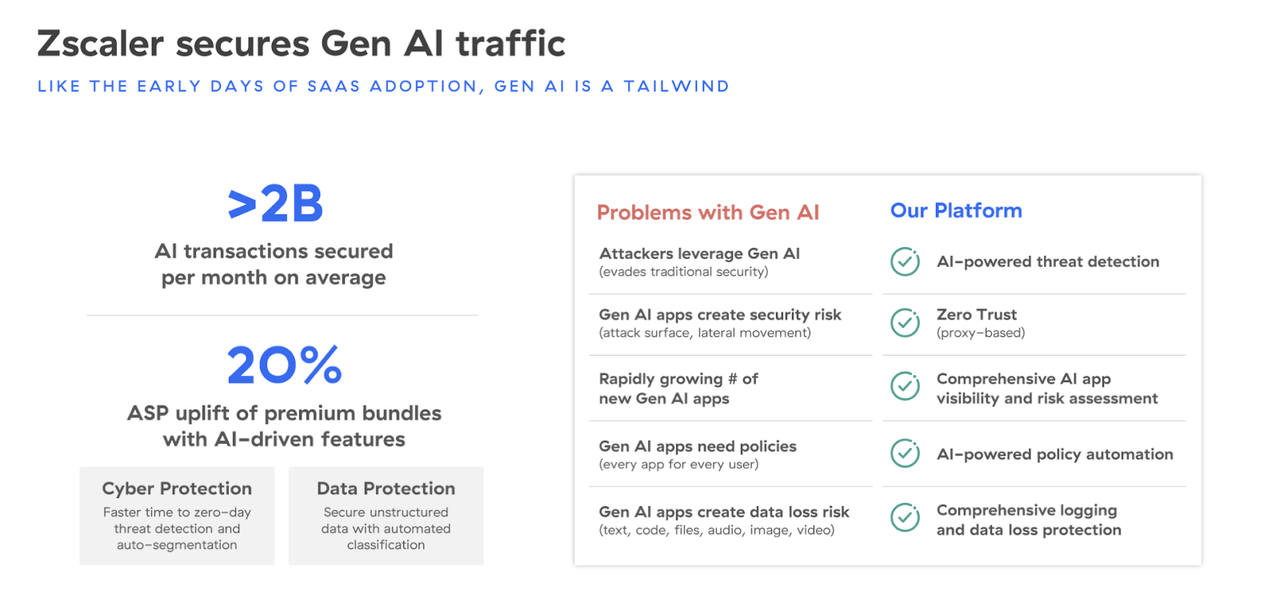

ZS is a cybersecurity inventory that’s disrupting the normal firewall safety mannequin. ZS’ zero belief structure protects knowledge and apps on the consumer stage, resulting in sturdy safety in a cloud-driven world.

FY24 Q1 Presentation

Generative AI might profit society, however it could additionally improve the prevalence and class of cyberattacks. That ought to speed up demand for new-generation cybersecurity corporations like ZS.

FY24 Q1 Presentation

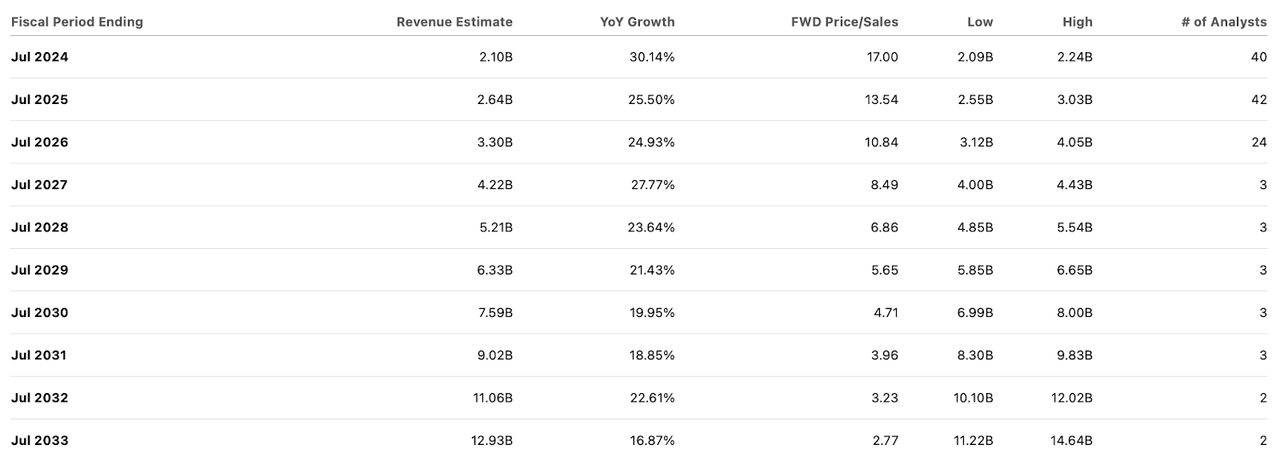

As of current costs, ZS was now not buying and selling “dirt-cheap” because it did for a lot of 2023. The inventory not too long ago traded arms at round 17x gross sales.

Searching for Alpha

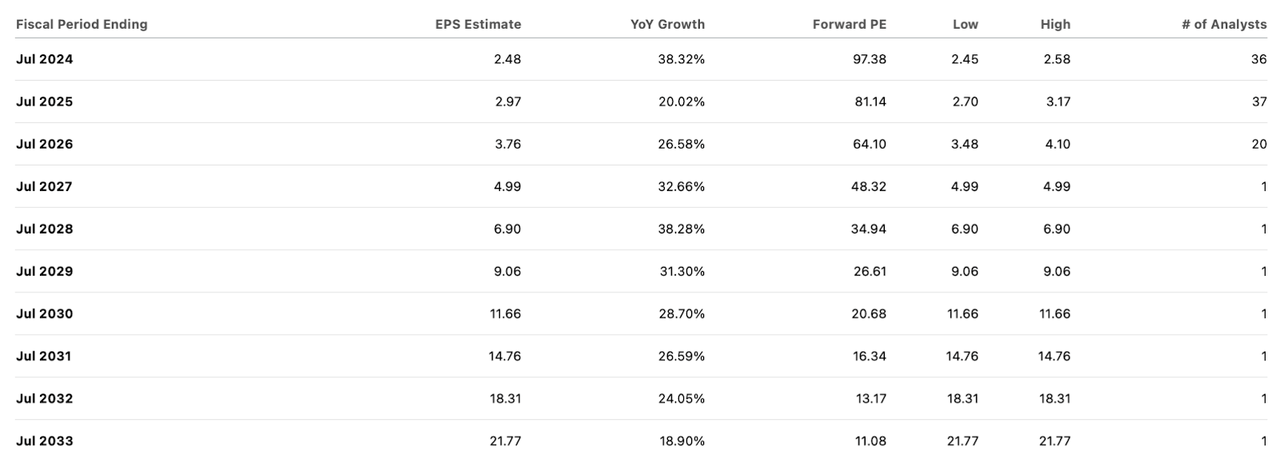

Consensus estimates name for ZS to point out sturdy working leverage over the approaching decade.

Searching for Alpha

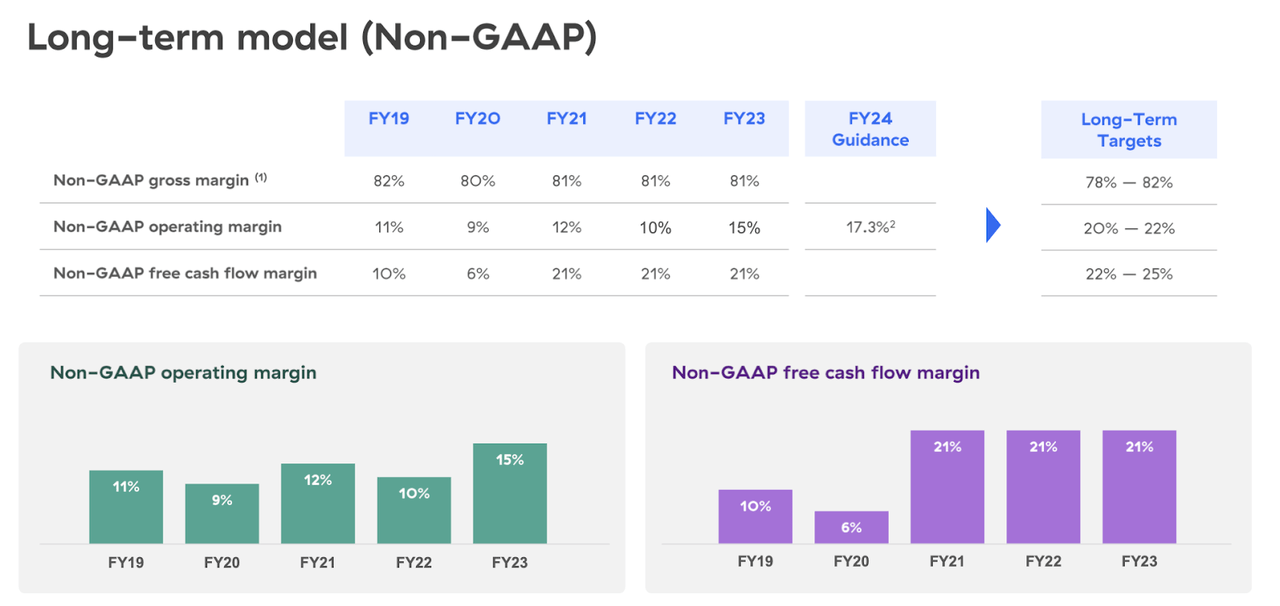

Administration has given long-term steerage for round 22% in non-GAAP working margins, although consensus estimates name for 25% non-GAAP internet margins by 2033.

FY24 Q1 Presentation

I’m of the view that ZS can get to 25% to 30% GAAP internet margins over the long run given the excessive 80+% gross margins. I can see ZS buying and selling at round 30x earnings by 2033, equating to a valuation of seven.5x to 9x gross sales. That means 11.7% to 14% compounded annual return potential over the following 9 years. That might possible beat the broader market, and consensus estimates don’t look too aggressive. Nevertheless, given the dearth of GAAP profitability, I’m of the view that these potential returns will not be excessive sufficient to justify shopping for the inventory over the broader market index. I would like a potential return potential of 14% to 18% for a reputation of this type of danger profile. If the corporate can execute on producing sustainable GAAP profitability and start rewarding shareholders with share repurchases, then I might be extra inclined to decrease my hurdle necessities.

Whereas ZS continues to fireside on all cylinders, I’m downgrading the inventory to a impartial ranking and promoting out of my place, as the present valuation isn’t constructive to dependable market-beating returns.

[ad_2]

Source link