[ad_1]

CribbVisuals/iStock Unreleased through Getty Photos

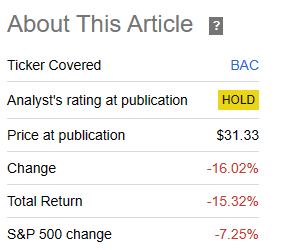

On our final work on Financial institution of America (NYSE:BAC) we centered on the truth that margins have been previous their peak. These margins have been in fact the online curiosity margins and whereas we did like the worth, we felt a purchase score would simply not make sense. Whether or not or BAC’s margins have really peaked for this cycle or not, the inventory definitely agreed with our outlook and is now 16% decrease.

Searching for Alpha

We go over the Q3-2023 outcomes and inform you why we’re giving this a tentative purchase score.

Q3-2023

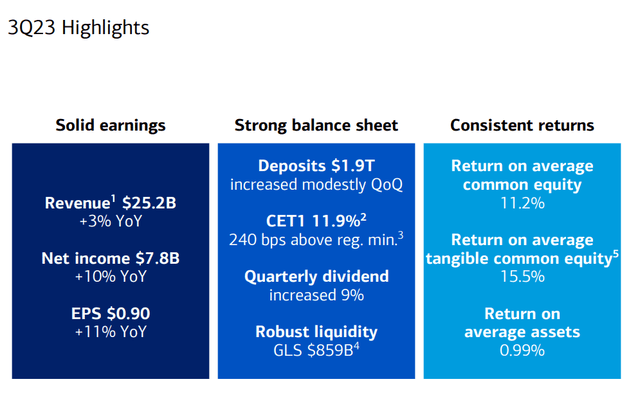

If bears wished some fodder from the earnings report, they obtained none. The revenues have been sturdy and web revenue elevated 10% yr over yr. Earnings per share elevated 11% on the again of small buybacks all through the final 12 months.

BAC Q3-2023 Presentation

Return on belongings was respectable and return on tangible fairness was unbelievable. The deposit flight which was the focus ever since regional banks began falling like dominos, was really not a difficulty in any respect. 200,000 extra new checking accounts have been added and complete deposits inside the group remained regular.

BAC Q3-2023 Presentation

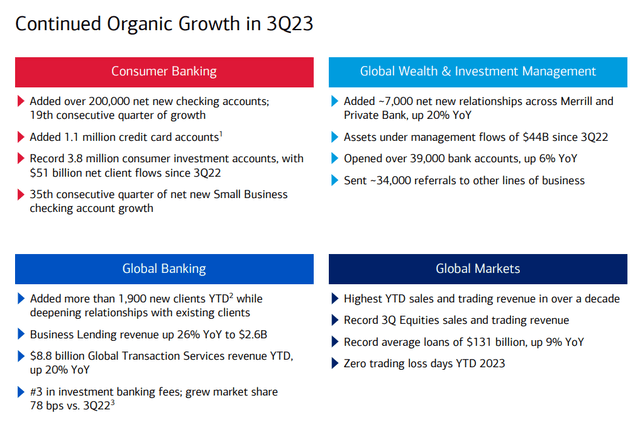

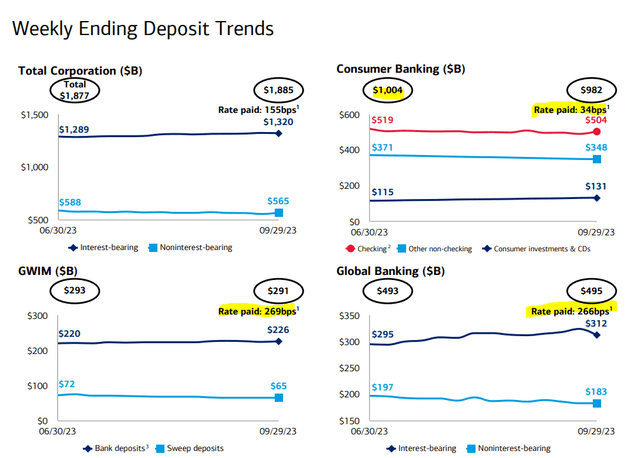

The important thing chart for the margin perspective was the quantity paid on the trillion {dollars} ($1.004 trillion really) of client banking deposits. This was shocking to say the least and it seems that traders solely like chasing yield within the inventory market. When given a selection of accessing 5.5% danger free they fairly hit the snooze button. Living proof, BAC laughed all the way in which to their very own financial institution as they paid 34 foundation factors to those geniuses.

BAC Q3-2023 Presentation

You’ll be able to evaluate that charge with what they paid on their different divisions (additionally highlighted above). Certain, some minimal deposit quantities are required for the comfort of free banking. However there are quantities means in extra of that incomes nothing.

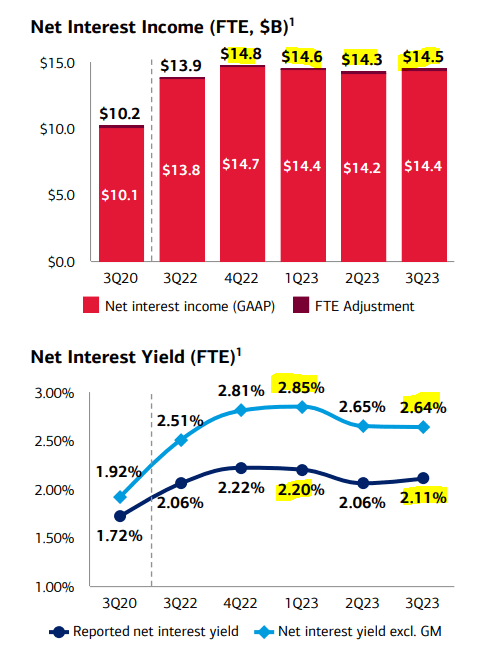

Regardless of the comparatively sluggish rise of the price of funds, BAC’s web curiosity revenue didn’t get the total advantage of the speed hikes.

BAC Q3-2023 Presentation

As now we have beforehand made the case, BAC’s web curiosity margins are previous their peak, although the decline to date has been sluggish in comparison with our expectations.

Outlook

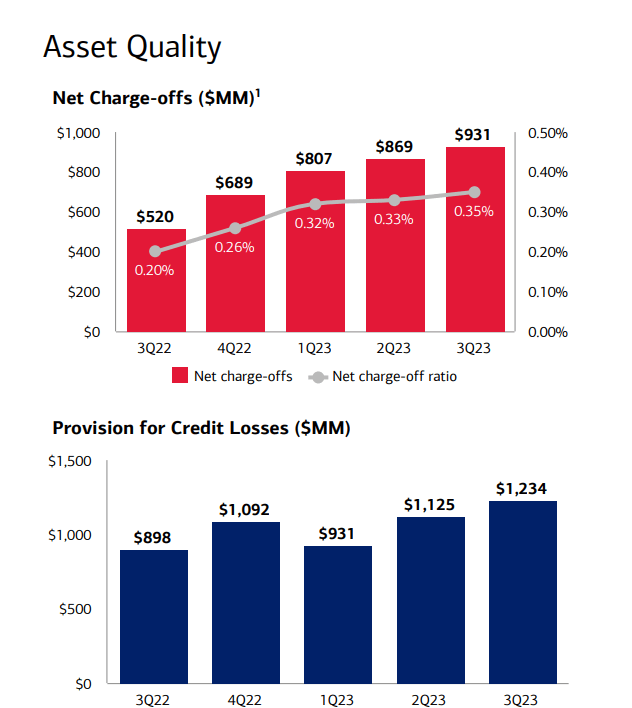

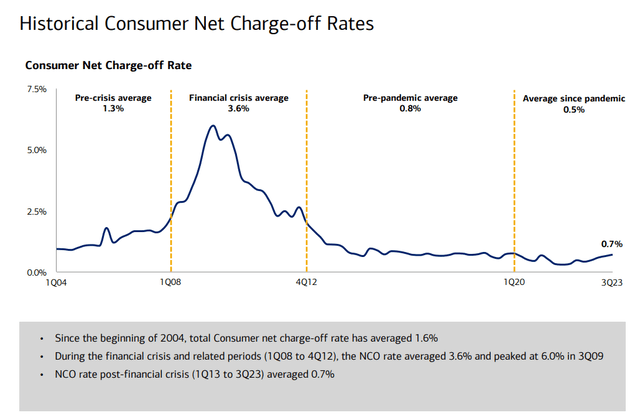

Web charge-offs have been rising however they’re nonetheless comparatively low.

BAC Q3-2023 Presentation

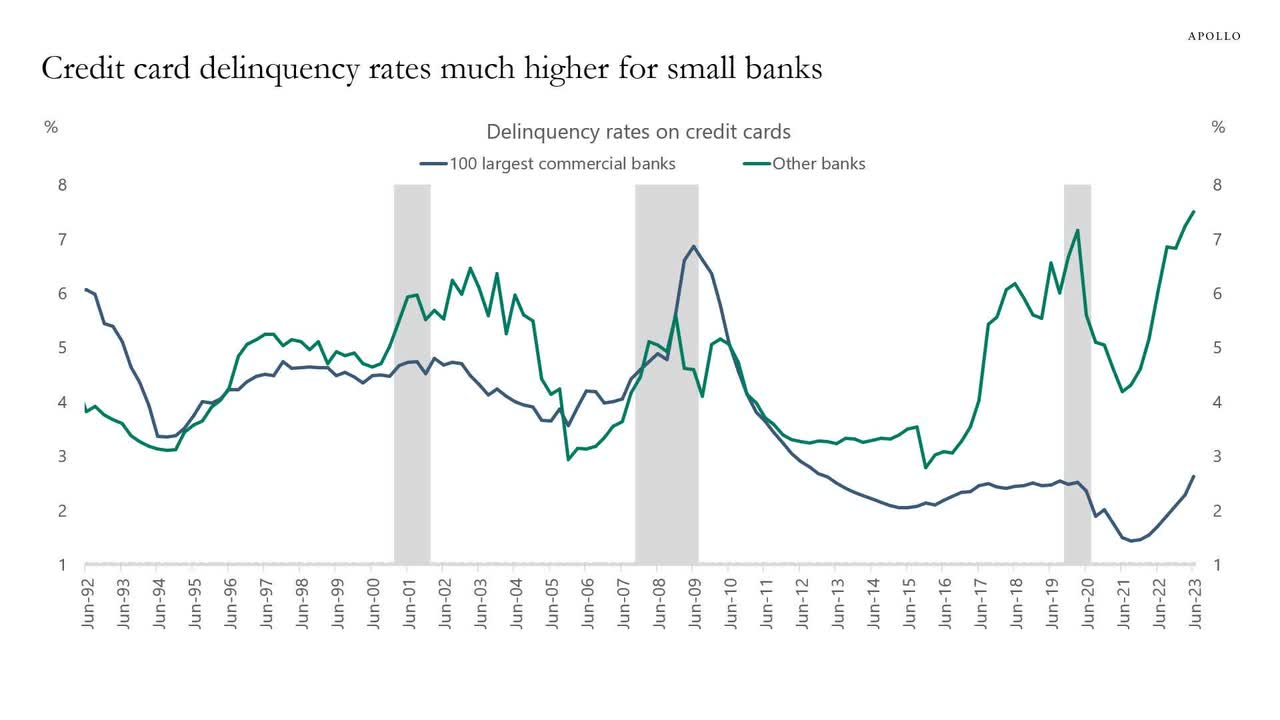

There’s a very excessive divergence right here while you evaluate the regionals with the massive banks.

Apollo Credit score Administration

Maybe the worldwide monetary disaster has completely modified the mega banks and their underwriting requirements. Maybe there may be some lag right here and write-offs will enhance dramatically even at BAC within the quarters forward. We are inclined to wipe out lots of constructed up fairness in banks in gentle recession and completely blow via the fairness cushion in a significant recession.

BAC Q3-2023 Presentation

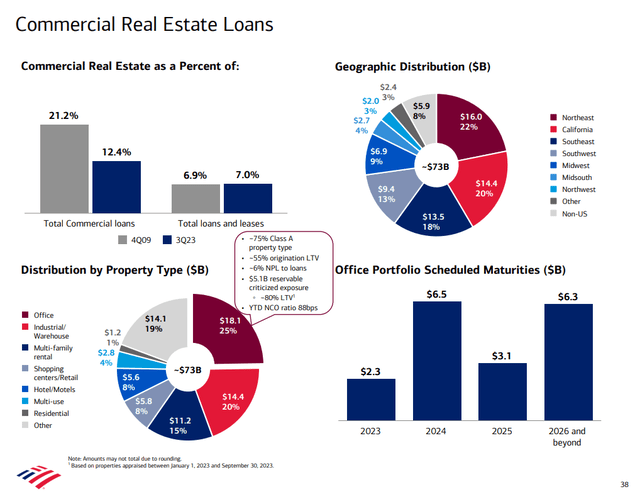

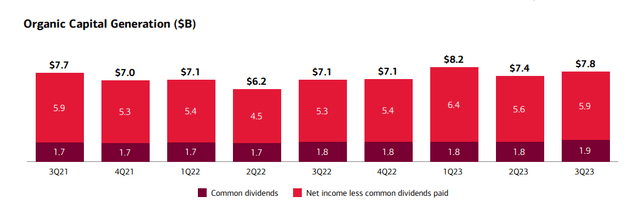

Once more, to date now we have not seen it, even within the sector the place we’re most afraid. The Industrial Actual Property or CRE space. Cost-offs have been gentle even right here and complete portfolio dimension could be very small relative to the extraordinarily excessive ranges of natural capital technology each quarter. You will get a way of what we’re speaking about in case you evaluate the BAC workplace sector complete publicity ($18.1 billion) with the quantity they generate after dividends each quarter.

BAC Q3-2023 Presentation

That latter quantity tallies to nearly $6 billion.

BAC Q3-2023 Presentation

So total, we do not see any issues on the standard metrics. However we nonetheless have to handle the elephant within the room.

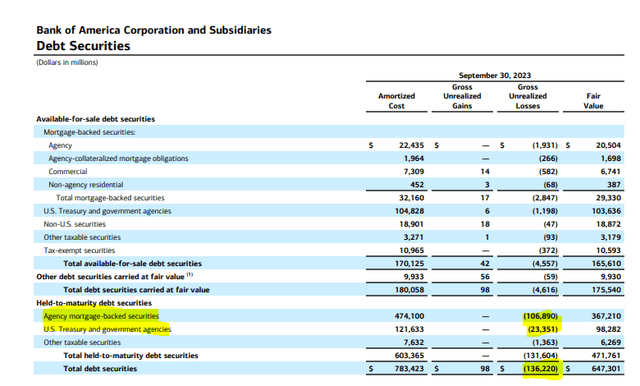

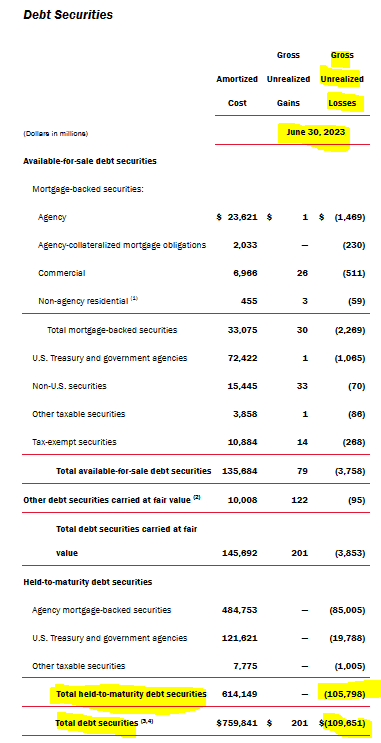

The held to maturity losses ballooned as soon as extra and hit an unprecedented $136.2 billion.

BAC Q3-2023 Supplemental

This quantity was at $109.6 billion final quarter.

BAC 10-Q

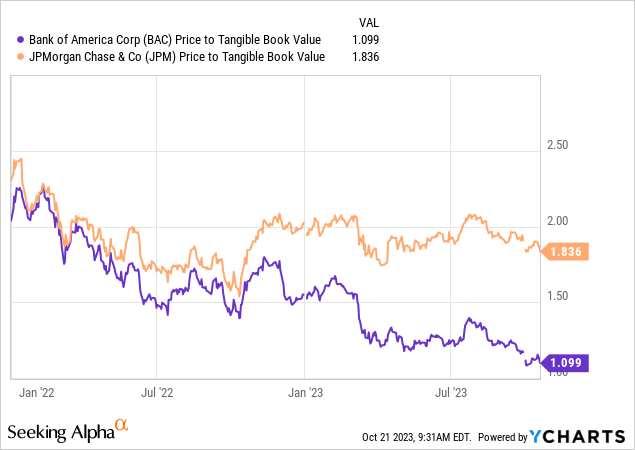

The market individuals are clearly frightened about this and the most important proof is the a number of distinction between JPMorgan (JPM) and BAC.

However from our perspective there are causes to be constructive right here.

Why BAC Might Go Up In A Gentle Recession

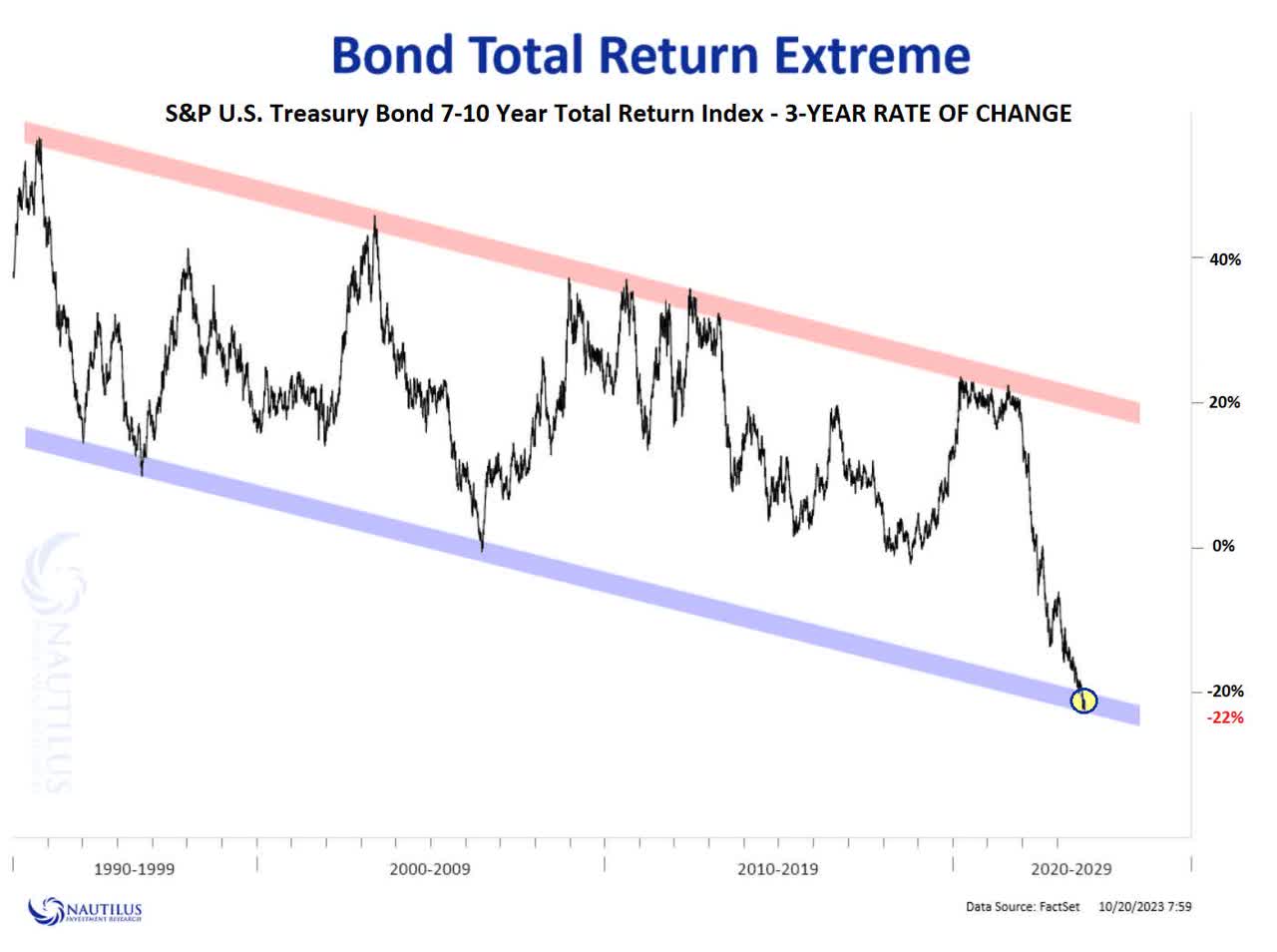

Recessions are inevitable. Financials clearly are fairly susceptible because of the excessive ranges of leverage they make use of. However we’re moving into right here with some of the excessive setups for bonds.

Nautlius Analysis As Shared On X

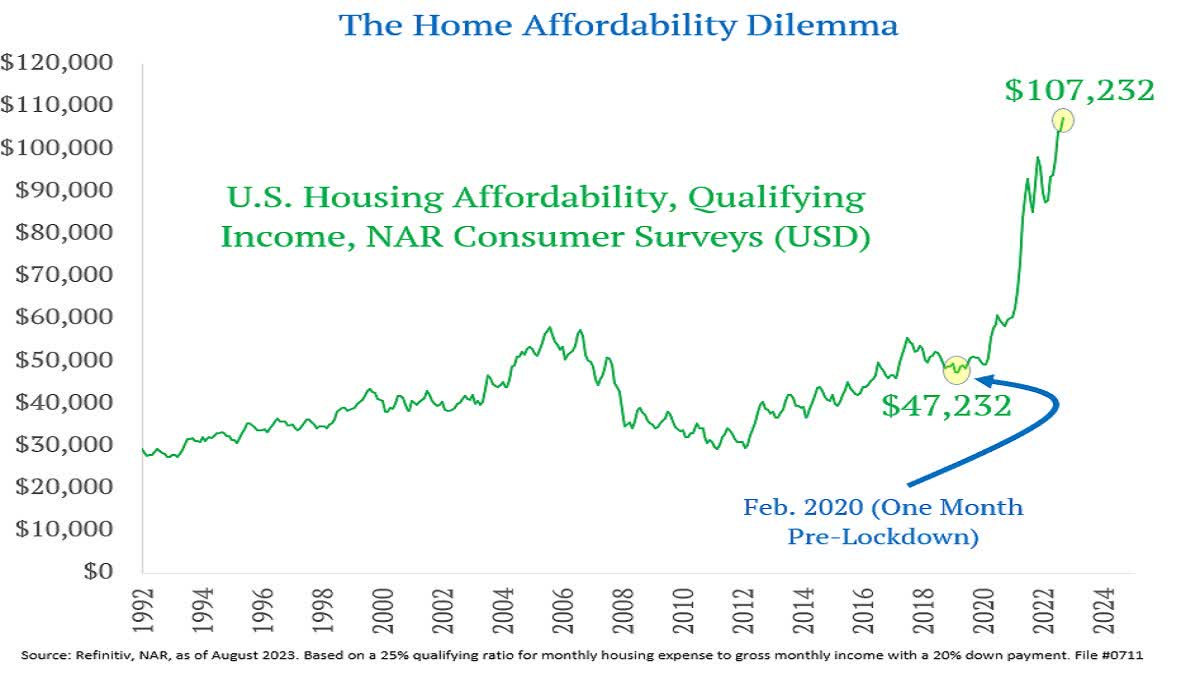

Whereas the group embraced ZIRP and the deflation nonsense in 2020, it now believes in infinitely larger charges with zero consequence. From our perspective, the US market can’t operate if new residence gross sales are comatose. At present rates of interest, they don’t seem to be simply comatose, they’re half previous useless.

Jeff Weniger

Our level is that the bond bear story, even when it pans out long run, will take time to take action. There aren’t any one-way markets and a recession possible offers the bond bear market a breather. BAC will profit immensely as its poorly bought held to maturity securities cease taking losses and roll-off over time. One different issue right here is that BAC’s losses are nearly solely on company mortgage bonds. In a recession, they may profit from a trifecta of decrease charges, shallower spreads to treasuries (from stoppage quantitative tightening) and barely larger prepayments. General, we just like the inventory right here and are upgrading it to Purchase with the expectation of seven%-9% annual returns over the long run. We now go over the popular shares and inform you how one can make the low finish of that vary with nearly zero danger from BAC.

Financial institution of America Company 7.25% CNV PFD L (BAC.PR.L)

For traders trying only for revenue, BAC.PR.L is a wonderful safety that has stripped yield of 6.93% as we write this. Due to a singular setup, these most popular shares are virtually non-callable. These are convertible at your possibility (possibility of the holder) into 20 shares of widespread inventory. The quantity for this conversion was the $50 inventory value when this was issued.

BAC additionally has a proper to pressure a conversion however there’s a catch for the financial institution. For it to pressure a conversion the value has to exceed $65 (130% of BAC widespread share value at issuance) for 20 buying and selling days throughout any interval of 30 consecutive buying and selling days. After all if that occurred, you make out like a bandit because the $1,050 would convert to $1,300 and provide you with an enormous upside. So 6.92% yield plus huge upside (23%) to name. Keep in mind these two.

Financial institution of America Company 5.875% NCM PFD HH (BAC.PR.Ok)

To point out you ways ridiculously low cost BAC.PR.L is, we provide you with two comparisons from BAC most popular suite. BAC.PR.Ok presently has a stripped yield of 6.63%. So instantly, you’re getting a greater yield with BAC.PR.L. Since BAC.PR.Ok trades at $22.26, upside to name is simply 12.3%. So on each measures BAC.PR.Ok falls quick. Sure, BAC.PR.Ok has extra possible name chance in a deflationary bust versus BAC.PR.L, however the total setup for BAC.PR.L is a lot better for these in search of a robust “locked-in” revenue supply.

Financial institution of America Company 4.125% DP PFD PP (BAC.PR.P)

There are some BAC fastened charges like BAC.PR.P which can be buying and selling properly beneath par and have enormous theoretical upside to name. BAC.PR.P for instance has 58% upside to par. However because of the extraordinarily low coupon charge, par is an not possible dream. Even right here you’re getting simply 6.56% stripped yield, versus 6.92% for BAC.PR.L.

Please word that this isn’t monetary recommendation. It could appear to be it, sound prefer it, however surprisingly, it’s not. Buyers are anticipated to do their very own due diligence and seek the advice of with knowledgeable who is aware of their goals and constraints.

[ad_2]

Source link