[ad_1]

Fast Take

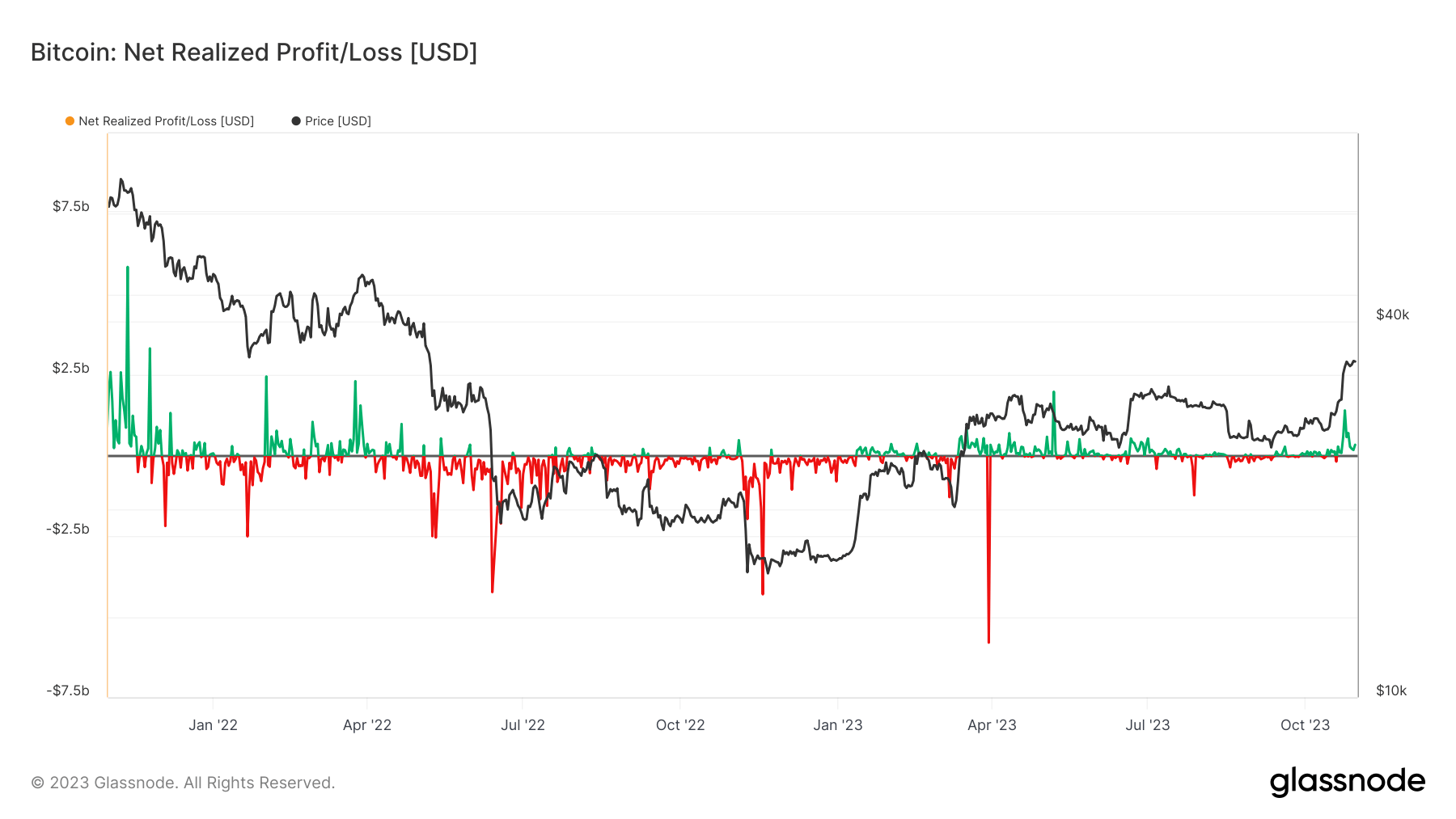

CryptoSlate’s latest knowledge evaluation reveals intriguing patterns in Bitcoin profit-taking behaviors amid unstable market circumstances. The evaluation confirmed that the Bitcoin worth stage of $35,000 has acted as a short-term resistance, with a surge in profit-taking round this level.

Particularly, on Oct. 24, over $1.5 billion of realized revenue was reported, marking the second-highest profit-taking occasion this 12 months. The one different larger occasion occurred on Could 7, coinciding with Bitcoin’s important drop from $30,000 to $25,000.

The information additional confirmed {that a} majority of this profit-taking was led by short-term holders, particularly those that bought Bitcoin throughout the final 155 days when the value rose from $25,000 to $34,000.

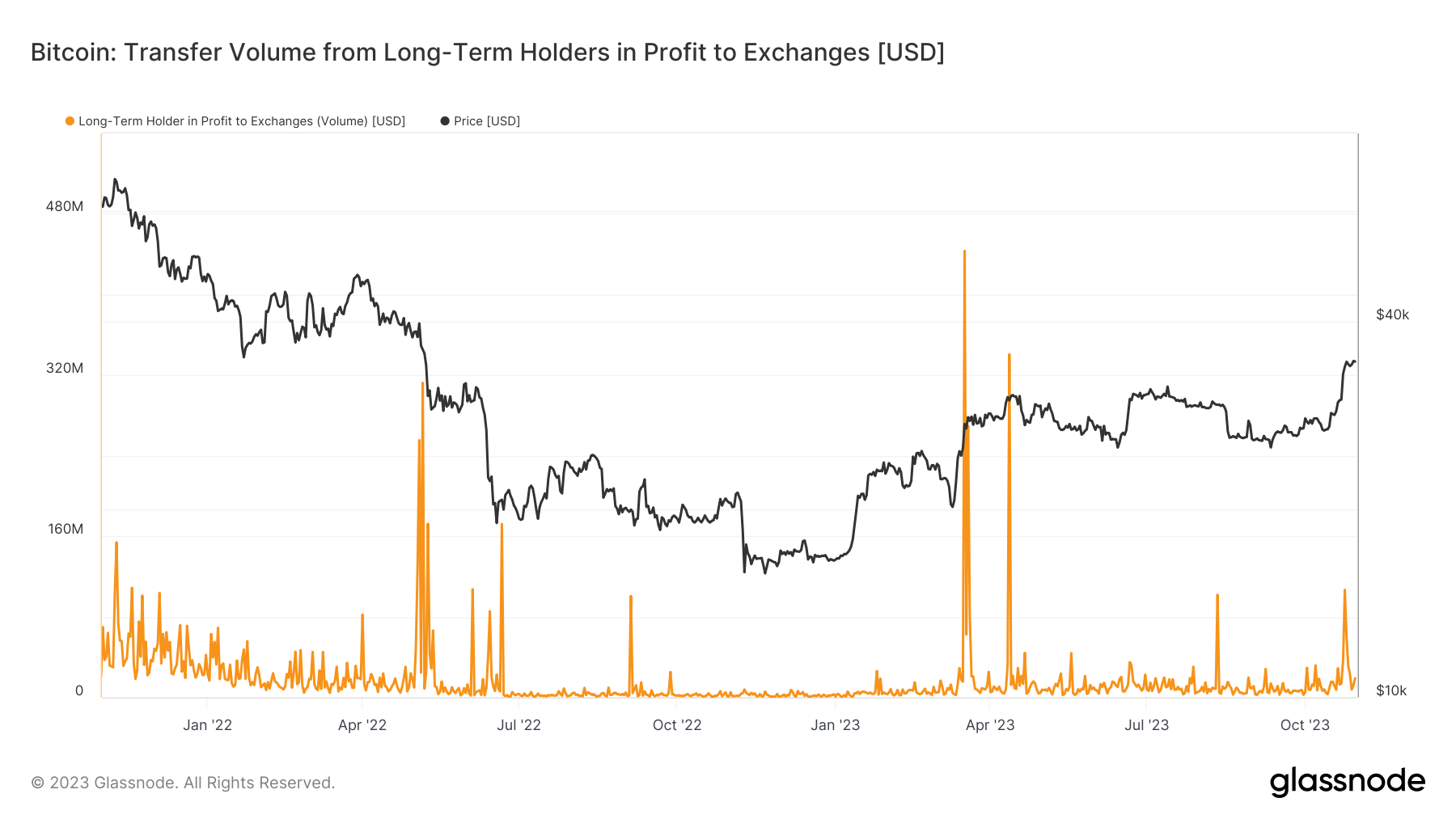

Curiously, profit-taking amongst long-term holders seemed to be minimal, accounting for a mere $100 million. This means a stage of steadiness available in the market amid shorter-term turbulence.

The submit Bitcoin worth surge to $35,000 triggers over $1.5B in profit-taking appeared first on CryptoSlate.

[ad_2]

Source link