[ad_1]

Prykhodov

A Fast Take On Jamf Holding

Jamf Holding Corp. (NASDAQ:JAMF) gives IT companies for corporations utilizing or interfacing with Apple (AAPL) merchandise.

I beforehand wrote about Jamf with a Maintain outlook based mostly on softer demand and continued excessive working losses.

Administration just lately lowered ahead income steerage on weak demand from expertise purchasers.

Given continued macroeconomic dangers, excessive working losses and lowered income steerage, my outlook on Jamf Holding Corp. is Bearish [Sell] within the close to time period.

Jamf Holding Overview And Market

Minnesota-based Jamf gives enterprises with a full vary of companies it calls Apple Enterprise Administration.

The corporate is led by Chief Govt Officer Mr. John Strosahl, who was beforehand President and COO of the agency and, previous to that, was a Vice President at eBay.

The agency’s companies allow organizations to extra simply combine all forms of Apple merchandise and software program into their present techniques with out ever having to the touch the gadgets.

Jamf sells its SaaS options by way of a subscription income mannequin and sells bigger accounts via an in-house direct gross sales drive and smaller accounts by way of its on-line portal.

Firm merchandise embody:

Lifecycle Utility Administration

Stock & Machine Administration

Id & Safety Administration

Risk Prevention & Remediation

Visibility & Compliance.

The agency additionally sells via channel companions, which embody Apple itself.

In accordance with a management-cited current IDC survey of U.S. business IT determination makers, it expects the penetration of Apple Mac computer systems to extend from 11% to 14% by the tip of 2022.

Moreover, extra enterprises are searching for to permit workers to make use of extra of the expertise of their selection as options to combine varied platforms develop into extra accessible and cost-effective.

Statcounter additionally reported that Apple OSs “comprised 22% of worldwide net site visitors (each enterprise and client) in December 2019, up from 4% in January 2009.”

The rise in the usage of cell gadgets is usually the explanation for Apple’s use development within the enterprise, though the Mac has been an essential contributor.

Administration says its deal with offering a vertically built-in suite of choices means it will possibly compete higher in opposition to small startups that don’t have the breadth of built-in choices, in addition to in opposition to the big suppliers who don’t provide specialised options.

Jamf Holding’s Current Monetary Traits

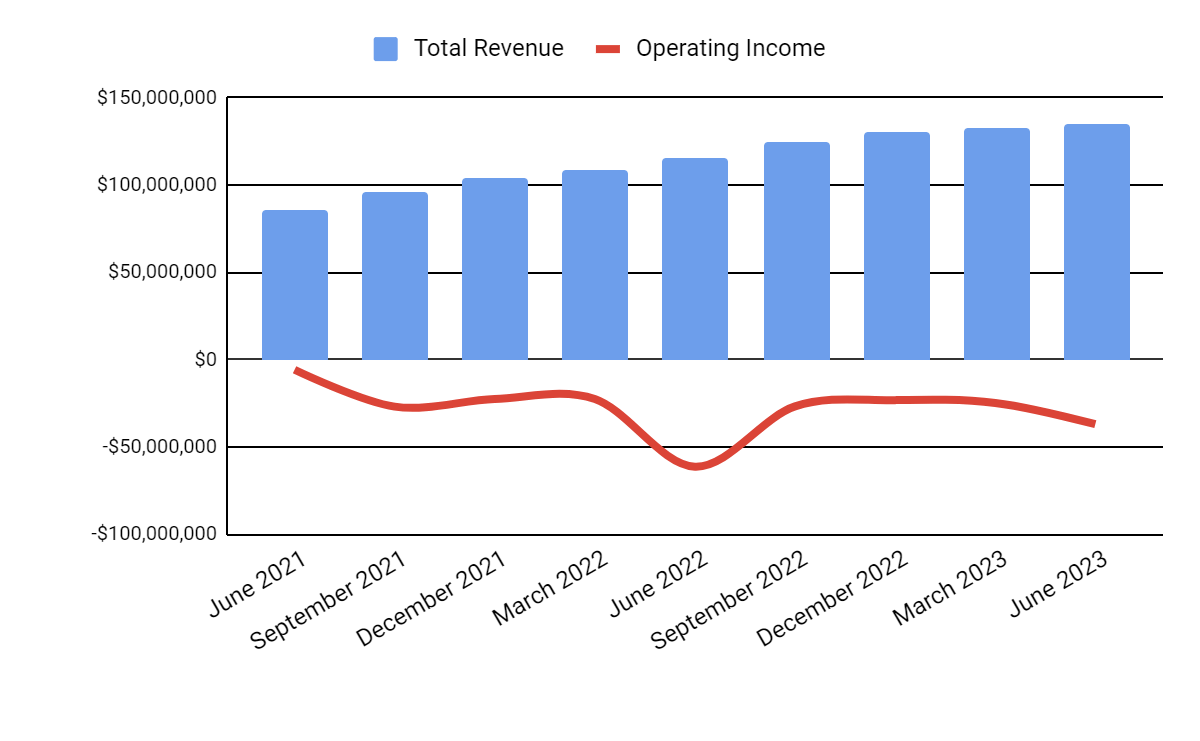

Complete income by quarter has continued to rise; Working earnings by quarter has remained closely detrimental:

Searching for Alpha

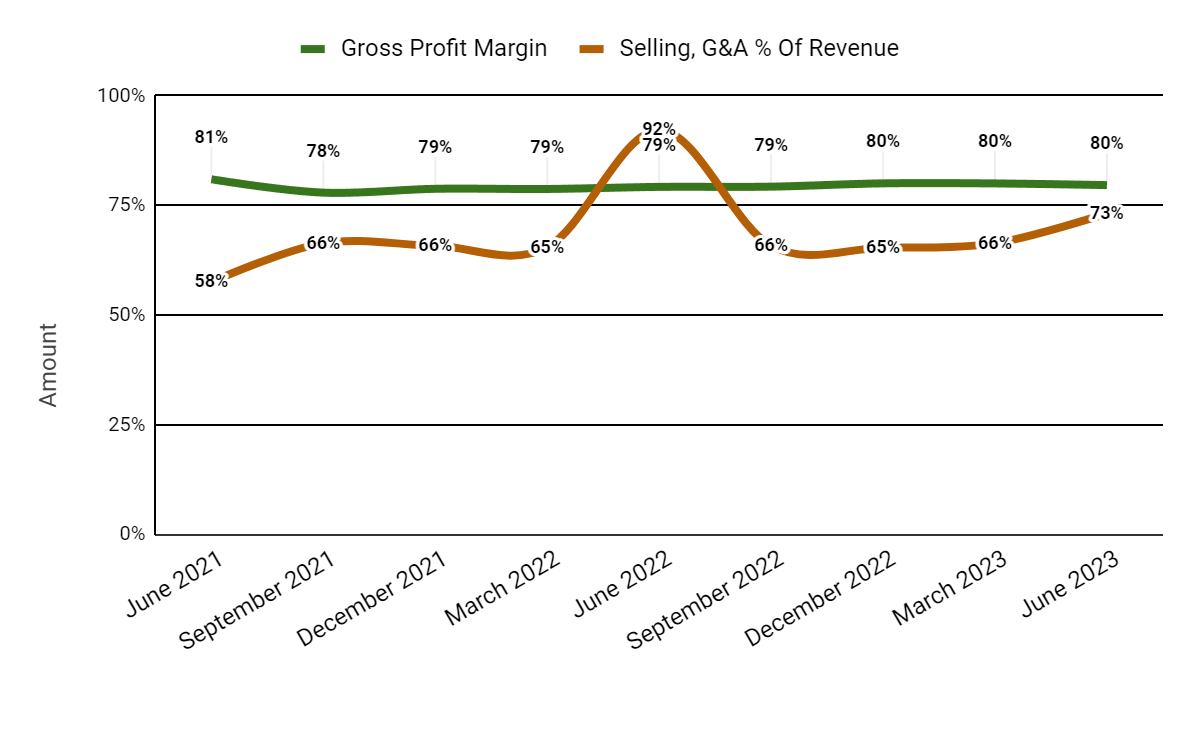

Gross revenue margin by quarter has trended barely greater in current quarters; Promoting and G&A bills as a proportion of whole income by quarter have moved greater just lately:

Searching for Alpha

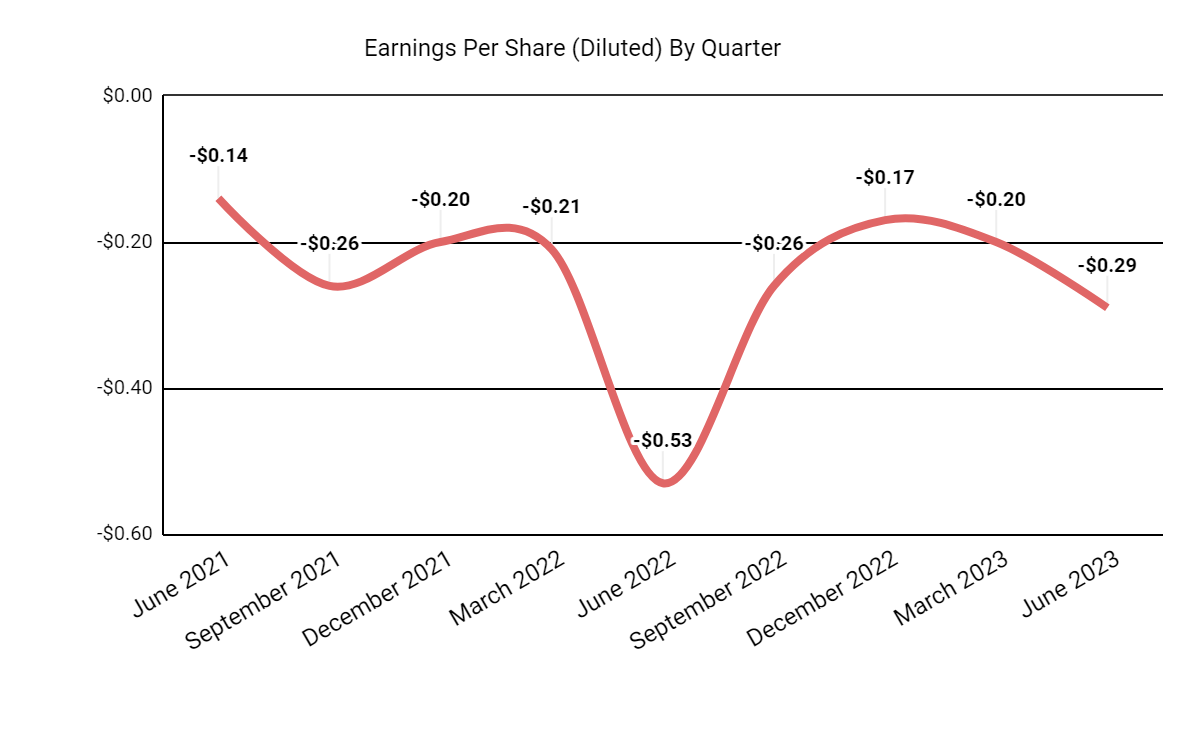

Earnings per share (Diluted) have remained considerably detrimental and have worsened just lately:

Searching for Alpha

(All information within the above charts is GAAP.)

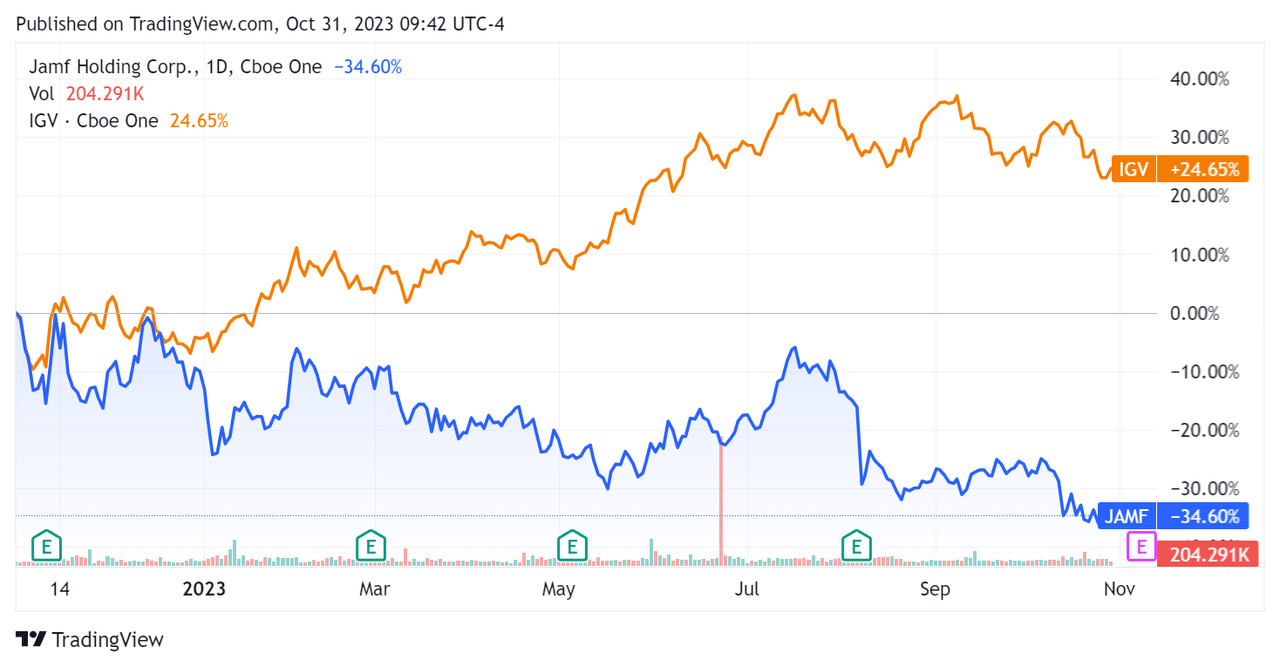

Prior to now 12 months, JAMF’s inventory value has fallen 34.6% vs. that of the iShares Expanded Tech-Software program Sector ETF’s (IGV) rise of 24.65%:

Searching for Alpha

For steadiness sheet outcomes, the agency ended the quarter with $211.5 million in money and equivalents and $365.8 million in whole debt, none of which was categorized as the present portion due inside 12 months.

Over the trailing twelve months, free money movement was $53.8 million, throughout which capital expenditures had been $6.6 million. The corporate paid $89.9 million in stock-based compensation within the final 4 quarters.

Valuation And Different Metrics For Jamf Holding

Under is a desk of related capitalization and valuation figures for the corporate:

Measure (Trailing Twelve Months)

Quantity

Enterprise Worth / Gross sales

4.0

Enterprise Worth / EBITDA

NM

Value / Gross sales

3.6

Income Progress Charge

23.4%

Internet Revenue Margin

-21.6%

EBITDA %

-11.4%

Market Capitalization

$1,910,000,000

Enterprise Worth

$2,090,000,000

Working Money Circulate

$60,430,000

Earnings Per Share (Totally Diluted)

-$0.92

Ahead EPS Estimate

$0.28

Free Money Circulate Per Share

$0.44

SA Quant Rating

Maintain – 2.94

Click on to enlarge

(Supply – Searching for Alpha.)

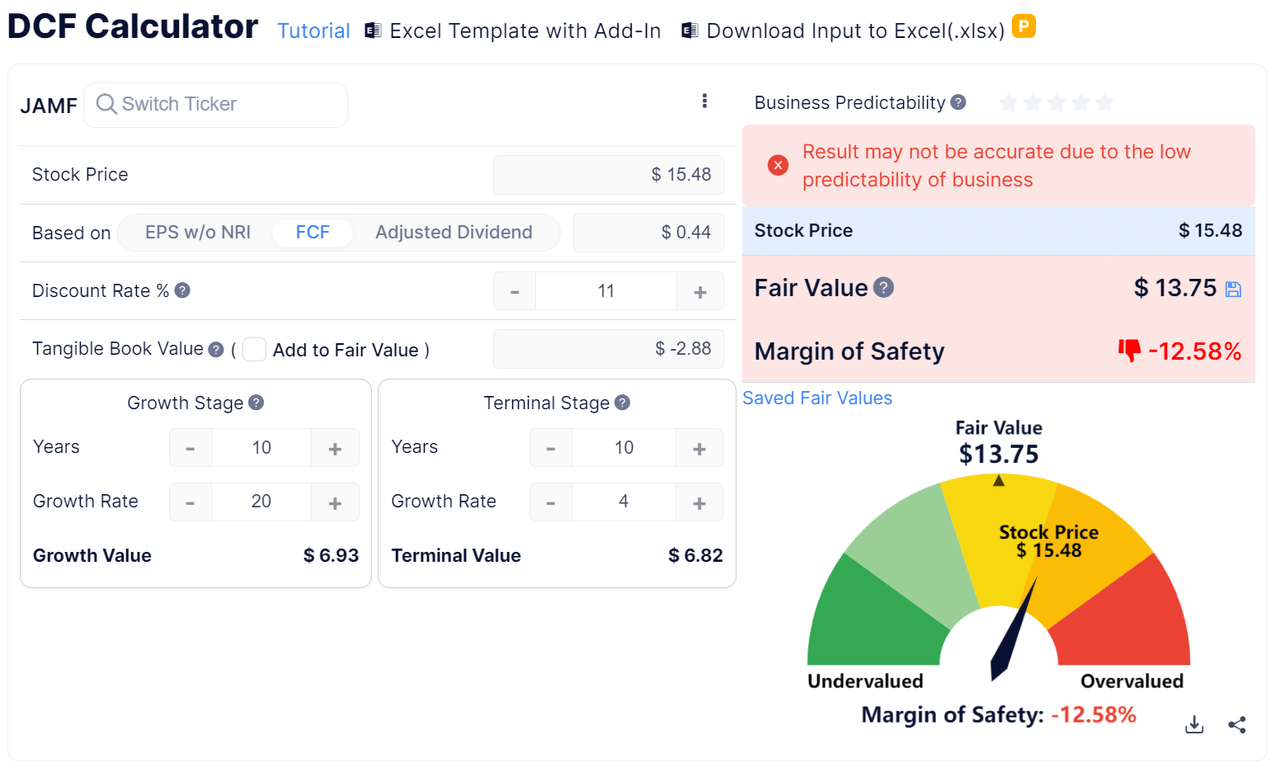

Under is an estimated DCF (Discounted Money Circulate) evaluation of the agency’s projected development and earnings:

GuruFocus

Based mostly on the DCF, the agency’s shares can be valued at roughly $13.75 versus the present value of $15.48, indicating they’re probably at the moment overvalued.

JAMF’s most up-to-date unadjusted Rule of 40 calculation was detrimental (4.0%) as of Q2 2023’s outcomes, so the agency’s efficiency has worsened sequentially, per the desk under:

Rule of 40 Efficiency (Unadjusted)

Q1 2023

Q2 2023

Income Progress %

27.6%

23.4%

Working Margin

-16.4%

-27.3%

Complete

11.2%

-4.0%

Click on to enlarge

(Supply – Searching for Alpha.)

Sentiment Evaluation

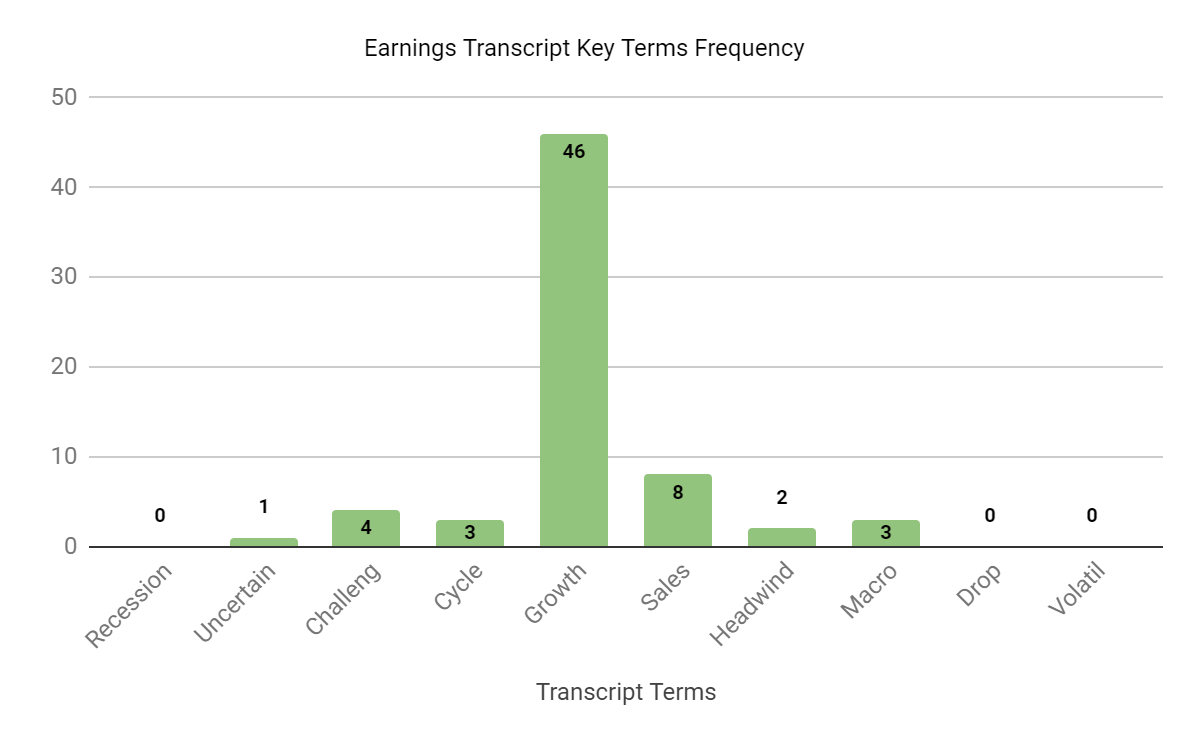

The chart under exhibits the frequency of assorted key phrases talked about in administration’s most up-to-date earnings convention name:

Searching for Alpha

The chart signifies the corporate is dealing with macro headwinds and a difficult surroundings as purchasers in verticals resembling expertise cut back their hiring or lay off workers.

Analysts requested administration about up to date steerage and forecasts, prospects and ARR development and macro tendencies.

Administration mentioned that Q3 is uncovered to seasonal schooling weak point and normal tech weak point, being pushed by much less strategic, uneven income streams.

Management expects the corporate’s internet retention charges to reasonable and see gross and misplaced retention ranges secure and inside pre-pandemic ranges.

Whereas administration expects to attend out the weak point generally tech, it’s seeing power in business, monetary companies and retail sectors.

Commentary On Jamf Holding

In its final earnings name (Supply – Searching for Alpha), masking Q2 2023’s outcomes, administration’s ready remarks highlighted its 18% ARR (Annual Recurring Income) development year-over-year, with “robust new bookings and buyer retention.”

Notably, 40% of latest bookings got here from its Safety Options phase, now 21% of the corporate’s whole ARR.

The agency is seeing optimistic tendencies in different industries with traditionally decrease penetrations of Macs, resembling Skilled Companies.

Complete income for Q2 2023 rose by 16.9% year-over-year, and gross revenue margin elevated by 0.4%.

The online income retention charge declined to 109% resulting from muted buyer hiring. The agency is uncovered to the final expertise sector, which has been shedding employees after hiring too many through the pandemic.

Promoting and G&A bills as a proportion of income fell by 19.0% YoY, a optimistic sign indicating rising effectivity in producing incremental income.

Working losses dropped by 39.7% year-over-year however stay very excessive at $36.9 million.

The corporate’s monetary place is comparatively robust, with ample liquidity and a few debt however robust free money movement.

JAMF’s Rule of 40 efficiency has worsened into detrimental territory sequentially, as working losses have elevated over the earlier quarter.

Wanting forward, administration diminished its full-year 2023 income steerage to an estimated development charge of 16.5% over 2022.

If achieved, this might symbolize a major decline in income development charge versus 2022’s income development charge of 30.7% over 2021.

Potential upside catalysts to the inventory might embody the current introduction of latest Mac computer systems by Apple and power in non-tech sectors.

Nonetheless, my discounted money movement calculation suggests the inventory could also be overvalued at its present stage of round $15.50.

Given continued macroeconomic dangers, excessive working losses and lowered income steerage, my outlook on Jamf Holding Corp. inventory is Bearish [Sell] within the close to time period.

[ad_2]

Source link