[ad_1]

imaginima

Funding Rundown

In case you are searching for a dividend-distributing firm that has maybe among the most strong margins within the vitality sector then a prime choose of mine is Enterprise Merchandise Companions L.P. (NYSE:EPD) proper now. The enterprise has been extremely strong and I feel the excessive dividend yield is sustainable due to the numerous development in FCF, a results of regular asset enlargement measures the corporate has taken over the past decade. With a market cap of almost $60 billion the corporate receives a considerable amount of consideration and I am unable to say that the market would not worth it accordingly. By this, I imply that it is unlikely that we’re to see a major earnings low cost seem for instance. With the p/e at 10.8 at the moment, I feel you might be getting a very good value now, and given the dependable FCF, you might be additionally getting a dependable dividend yield.

Firm Segments

EPD serves as a significant participant within the midstream vitality sector, offering important options to producers and customers in each the pure gasoline and pure gasoline liquids segments. Furthermore, the corporate extends its attain into different essential sectors akin to crude oil, petrochemicals, and refined merchandise. This numerous operational scope is structured into 4 distinct segments: NGL Pipelines & Companies, Crude Oil Pipelines & Companies, Pure Fuel Pipelines & Companies, and Petrochemical & Refined Merchandise Companies.

Earnings Report

The final quarter for the corporate showcased power because the DCF remained excessive at $1.7 billion. There have been fewer favorable commodity costs within the final quarter as in comparison with Q2 FY2022. However that hasn’t stopped EPD from nonetheless being a robust dividend distributor.

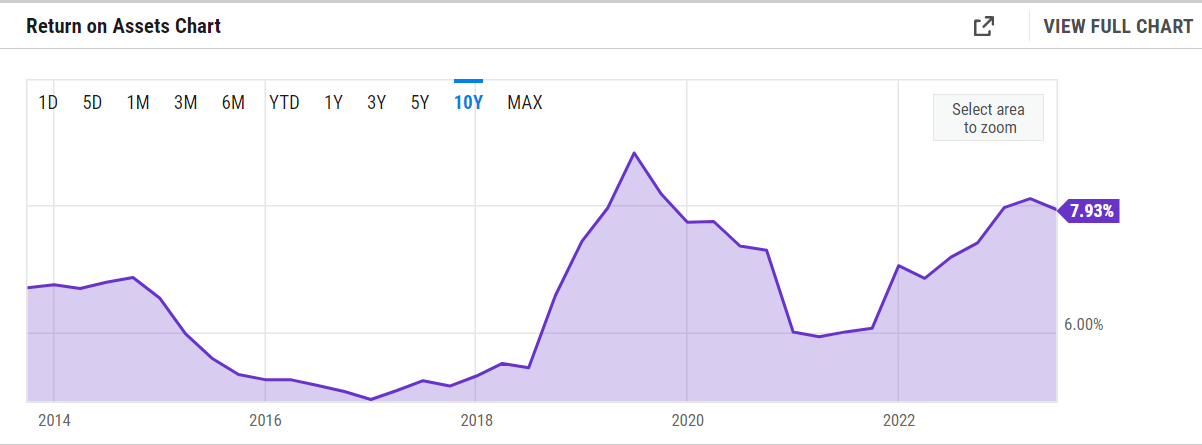

The corporate has managed to speed up the full asset development of the enterprise and over the past decade, it has averaged a 5.98% CAGR. If this may be maintained because of buying extra firms and yield pipeline enlargement then I feel EPD seems to be very enticing as an funding. However it will not be simply enlargement that may lead to larger valued property. The truth that they have already got the property and the need for pure gasoline and crude oil development every year is ample sufficient to lead to it rising too.

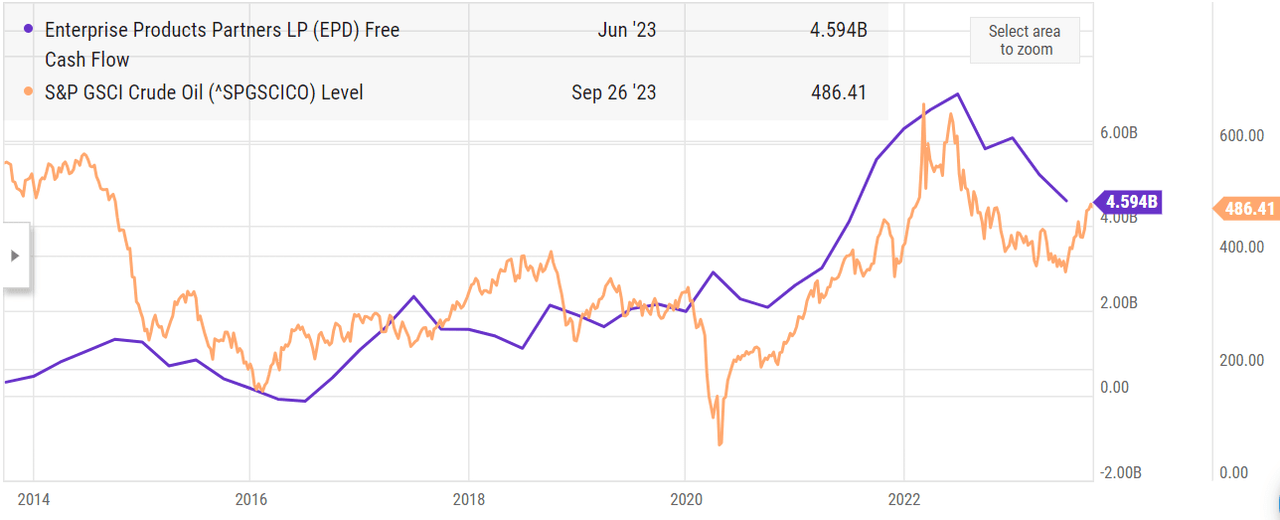

YCharts

As for a way EPD has been in a position to leverage this into stronger earnings I feel that they’ve accomplished a terrific job as commodity costs of each oil and gasoline have appreciated within the final couple of years. Each appear to be trending upwards as effectively and manufacturing cuts are leading to larger costs.

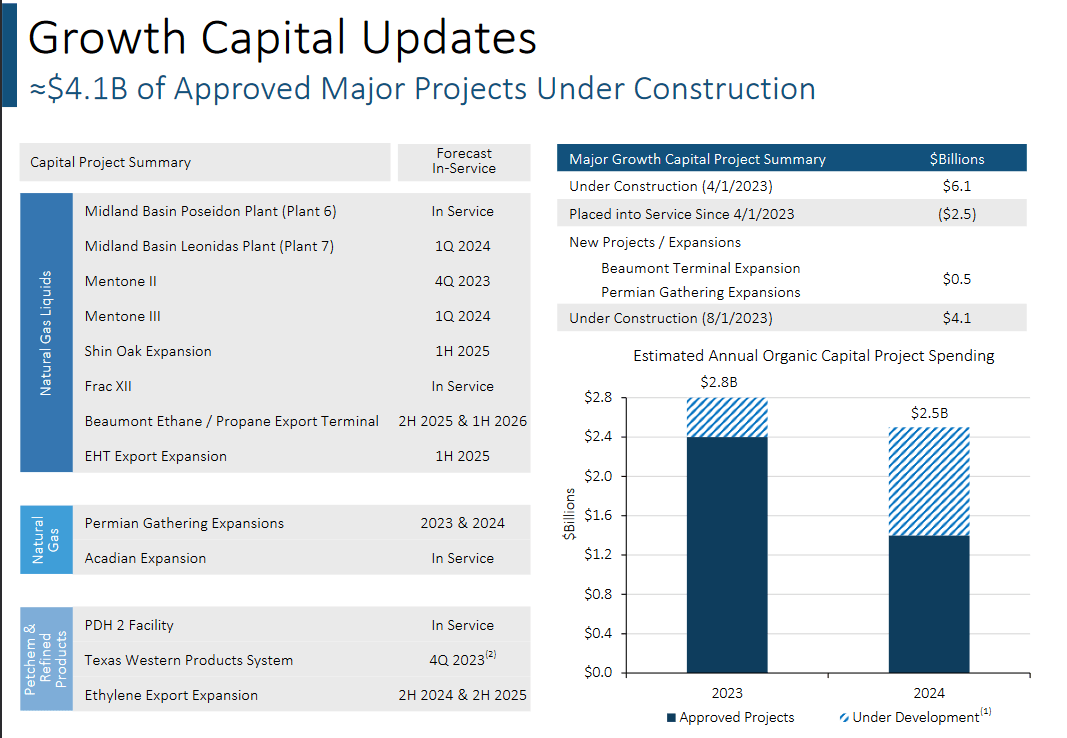

Investor Presentation

Although there’s a common sentiment that renewables are going to make up a bigger portion of vitality technology, EPD remains to be investing fairly closely in new initiatives associated to grease and gasoline pipelines. Accredited and under-development initiatives have a complete worth of $4.1 billion thus far. Trying forward a number of initiatives are anticipated to be in service as of 2024 and 2025, which helps the prospects of rising distributable money flows as EPD expands the asset base.

YCharts

At the same time as the corporate has been rising its FCF over time the relation between it and the worth has been declining. EPD nonetheless posts a premium in p/fcf compared to the sector of about 52.13% on a FWD foundation. I don’t assume that ought to construed because the purchase case right here although. EPD remains to be a really interesting firm to be in given the dependable dividend it has maintained by way of the years, that’s what buyers and the market are valuing. On a p/e foundation, it seems to be just a little extra life like because it trades kind of in keeping with the broader sector median proper now. EPD nonetheless equals a purchase in my e-book primarily due to the dividend yield of over 7% and the actual fact there are nonetheless a number of ongoing initiatives within the pipeline that additional solidify the place of the corporate within the markets.

Trying At The Dividend

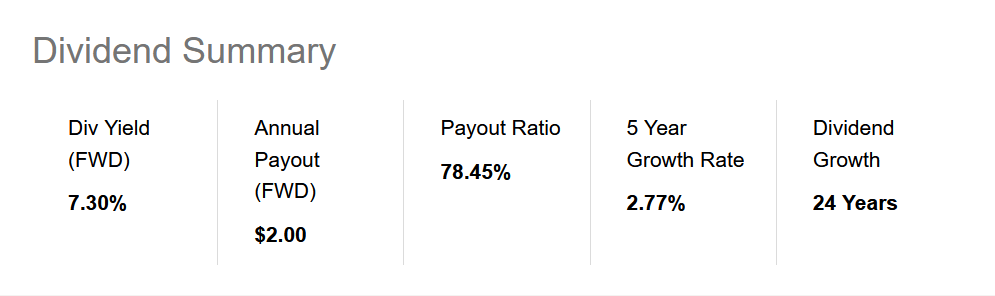

In search of Alpha

I feel that for EPD the dividend stays extremely steady as we are going to see under, the FCF of the enterprise has been extremely steady all through the commodity cycle of oil for instance. With the final quarter having $1.7 billion in distributable money flows, it greater than covers the TTM dividends paid of $4.1 billion on an annualized foundation.

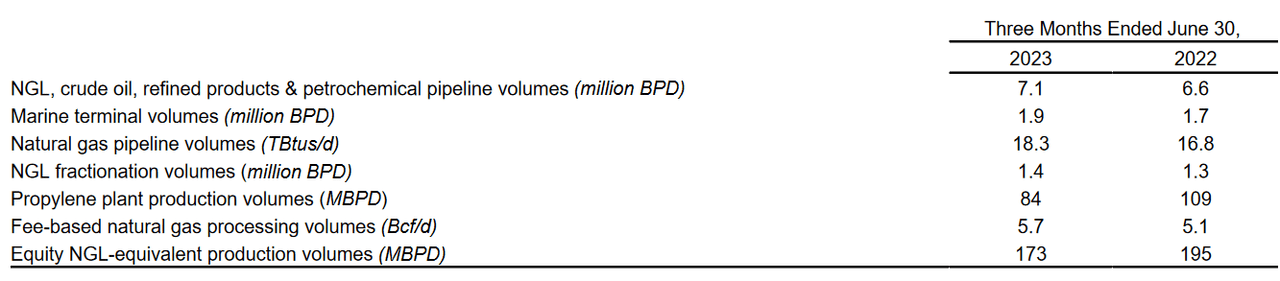

Volumes (Earnings Report)

Quantity elves stay steady for the corporate and I feel this underscores the aptitude the corporate inhabits to probably put up even stronger earnings within the coming quarters. If commodity costs maintain ticking upwards going into the colder months of the yr I feel EPD is ripe to put up larger distributable money flows then the earlier $1.7 billion. Over the past 24 years, the dividend has been raised and this may add extra assist to that follow and let EPD maybe proceed doing it for one more 24 years, so long as they keep this fortress of property they’ve collected.

Danger

EPD’s unitholders are uncovered to a major danger issue that arises from the corporate’s development trajectory carefully aligning with broader macroeconomic traits inside the US. EPD’s enlargement efforts are intricately intertwined with the general financial local weather, which might affect the volumes of vitality assets it handles. Nevertheless, it is price noting that EPD has taken strategic measures to mitigate this danger successfully.

YCharts

EPD engages in a number of smaller sub-segments, akin to propylene and octane enhancement. These specialised areas will be difficult for buyers to foretell by way of gross sales margins and volumes. The restricted availability of information in these niches might introduce extra uncertainties for buyers who’re attempting to guage the corporate’s efficiency inside these particular markets. It appears unlikely although that these would closely construe the earnings outcomes and capabilities of the enterprise so the danger it presents is moderately slim.

Remaining Phrases

Traders who search a strong dividend addition to a portfolio ought to be contemplating EPD proper now. With an enormous presence within the vitality sector as a pipeline proprietor and operator for pure gasoline and oil, it has managed to develop right into a dividend aristocrat over time. 24 years of consecutive raises speaks volumes in regards to the worth shareholders have within the firm. With a lot extra initiatives and enlargement plans within the pipeline, I stay bullish on EPD and shall be ranking it a purchase as such.

[ad_2]

Source link