[ad_1]

Lengthy-time readers know that I have a tendency to hold with the glass-is-at-least-half-full crowd in the case of the longer-term market outlook. The explanations are easy. At first, shares transfer greater over time. Sure, I acknowledge that this pattern, which has largely continued since buying and selling started, might finish in some unspecified time in the future. And if the U.S. democracy or our capitalistic financial system had been to alter, I would want to regulate my pondering. However for now, greater than 40 years of expertise in Ms. Market’s sport jogs my memory that it often pays to provide the bulls the good thing about the doubt – the overwhelming majority of the time.

Certain, bear markets occur. Crises happen, which trigger the financial system, and in flip, earnings to falter. And Wall Avenue has an extended historical past of overdoing nearly all the pieces, which results in the occasional painful reset.

Such intervals aren’t enjoyable by any means. Nevertheless, these intervals of discomfort additionally are typically comparatively short-lived – particularly for those who have a look at issues from a longer-term perspective.

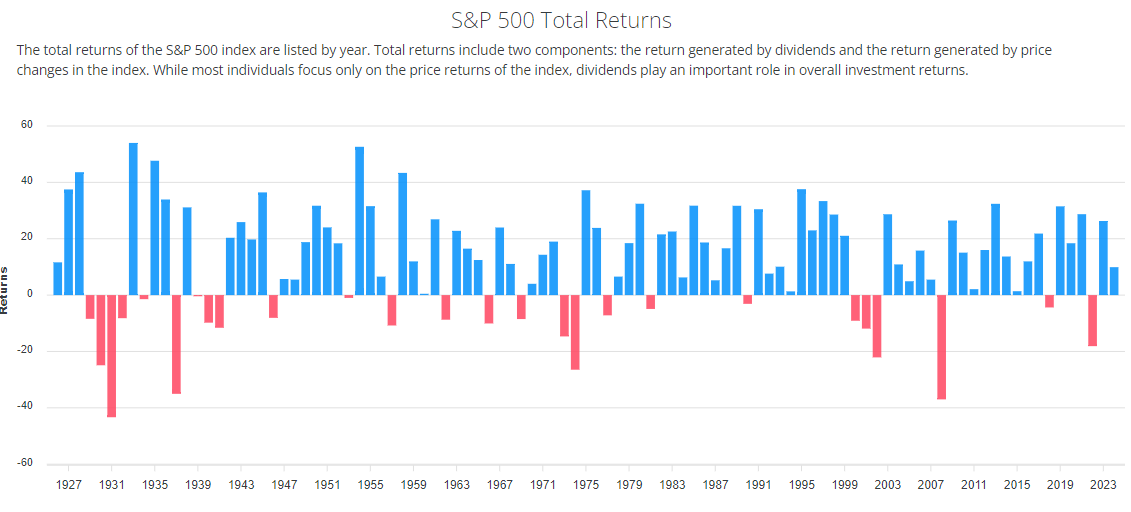

My level is made pretty clearly beneath. The chart reveals the calendar 12 months returns for the going again to the inception of the index. The blue bars characterize positive aspects. And as you’d count on, the crimson bars are calendar 12 months declines.

Supply: Slickcharts.com

When taking a look at this chart, my first takeaway is the overwhelming majority of the bars are blue. Because of this the S&P ends most years with a achieve. The following vital factor to notice is there are only a few consecutive crimson bar streaks. And the longest stretch of crimson years was within the Nice Despair. In fashionable occasions, the longest shedding streak was three years – seen after the tech bubble burst.

Aside from that, you might have a crimson 12 months right here and there. However once more, from a big-picture perspective, I believe it is very important remember that most years have a tendency to finish with positive aspects within the inventory market.

Now let’s flip to a different vital cause to remain seated on the bull prepare from a shorter-term perspective.

Historical past Favors the Bulls Proper Now

To make certain, there are many issues for the bears to worry about right here. Inflation staying sticky. The wars. Politics. Excessive valuations. Overzealous sentiment. The Fed, and so on.

One other factor the bears have been crowing about these days is how far the market has run since final fall’s correction ended. The spectacular rally that ensued has produced 4 straight month-to-month positive aspects and created overbought situations. And with sentiment getting not less than a little bit frothy right here, our furry mates recommend {that a} pullback is overdue.

To be honest, I do not disagree on the final level. Pullbacks, corrections, and/or what I prefer to name “sloppy intervals” can/do happen on a reasonably common foundation. And in right this moment’s markets, they’ll occur for all types of causes (or no cause in any respect at occasions).

However, with the caveat that shares can pull again 3-5% for nearly any cause, at any time, the historical past of rallies just like the one we’re having fun with now recommend we push apart the near-term worries and lean bullish.

The Knowledge is Convincing

This is the deal. The computer systems at Ned Davis Analysis inform us that within the historical past of S&P 500, the index has rallied from November by way of February 16 occasions. Three months later, the S&P has been greater than the place it closed on the finish of February 87.5% of the time, by a mean of 4.9% (which is double the two% common seen for all intervals). In fashionable occasions – since 1960 – shares have been decrease three months after a Nov-Feb rally solely as soon as, in 2004.

Six months later, the S&P has been greater 93.8% of the time, sporting a imply return of 6.4%. Ten months later – as in the remainder of a calendar 12 months – the market has been greater, anticipate it… each single time. Ditto for the twelve months following a Nov-Feb rally… greater each single time.

The common achieve for the remainder of a calendar 12 months following the Nov-Feb rally has been 15.5%, which is greater than double the 6.8% return for all March by way of December intervals. Identical thought for twelve months out, as the common achieve has been 18.1% in comparison with the 8.2% seen for all March – February intervals. Not dangerous. Not dangerous in any respect.

So… If you will discover a technique to look previous the subsequent few months, that are more likely to comprise not less than some kind of scary pullback, correction, or sloppy interval, one can relaxation straightforward within the information that shares have robust odds of being greater within the coming 3-, 6-, and 12-month time frames.

Works for me.

Thought for the Day:

Let him that will transfer the world first transfer himself. -Socrates

***

Disclosures

On the time of publication, Mr. Moenning held lengthy positions within the following securities talked about: None – Be aware that positions might change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

[ad_2]

Source link