[ad_1]

Japan’s Nikkei Inventory Common skilled a notable 1.3% surge, final buying and selling at a strong 30,990. This surge within the Japanese index seems to be influenced by the optimistic efficiency of US inventory index futures, which frequently function a harbinger of improved threat urge for food in world markets.

As merchants maintain a detailed watch on the financial panorama, US financial knowledge, notably private revenue and spending figures scheduled for launch later at present, are anticipated to be a focus.

Among the many stars of the day on the benchmark JPN225 index, we noticed Fujitsu hovering impressively by 12.0%. Equally, Nomura Analysis Institute secured a 5.5% achieve, and SG Holdings additionally participated within the uptrend, closing 4.5% increased.

Nevertheless, not all shares had been carried by the rising tide. Takeda Pharmaceutical confronted headwinds, recording a 6.4% decline after reporting a web loss for the second quarter and revising its net-profit steerage for the fiscal 12 months.

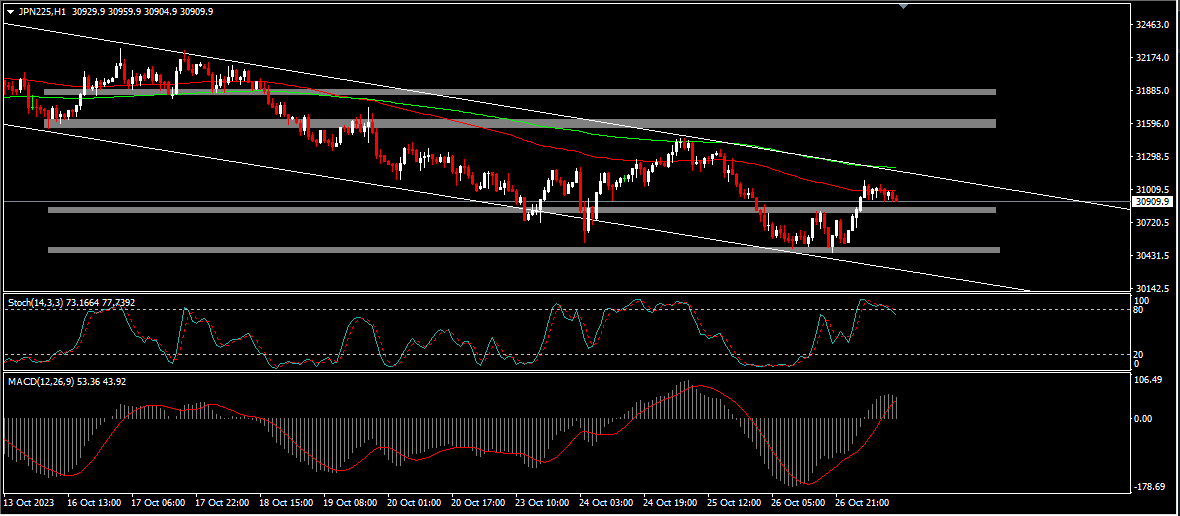

The speedy future for the JPN225 index hangs within the steadiness, contingent on its subsequent transfer inside its current buying and selling vary or channel. A breach above the higher boundary at 31,200 might signify a persistence of the present upward momentum and pave the way in which for additional advances in the direction of key resistance ranges, notably at 31,500.00 and 32,000.00. On the flip aspect, a breach under the help boundary at 30,780 might mark a reversal, ushering in additional downward momentum that might deliver the index all the way down to the subsequent help ranges at 30,500.00, and in the end, to the channel’s decrease restrict at 30,200.

In assessing the technical indicators, we discover a combined image for the JPN225 index. The Stochastic indicator teeters on the sting of the oversold zone, hinting at a possible shift in the direction of a downward trajectory. In distinction, the MACD (Shifting Common Convergence Divergence) sits above zero and the sign line, suggesting a prevailing bullish sentiment. This division underscores the significance of fastidiously monitoring the index’s actions because it navigates this pivotal juncture.

Click on right here to entry our Financial Calendar

Francois du Plessis

Market Analyst

Disclaimer: This materials is supplied as a common advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or needs to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link