[ad_1]

The European Central Financial institution (ECB) and the Financial institution of England (BoE) are each anticipated to keep up their present rates of interest with none vital modifications. ECB officers are typically leaning in the direction of preserving charges secure, and the probability of a charge reduce within the close to future is low. Within the central state of affairs, rates of interest are anticipated to stay unchanged by the primary half of subsequent 12 months.

Within the UK, there’s a greater probability of an rate of interest enhance attributable to persistent inflation. Nonetheless, the likelihood that charges have already reached their peak can also be turning into extra probably as financial development slows down.

The upcoming ECB assembly isn’t anticipated to deliver any main surprises, and the central financial institution is predicted to maintain its official charges regular. These hoping for a extra dovish stance could also be dissatisfied, because the ECB may keep a hawkish maintain that leaves room for potential future charge hikes. The central state of affairs means that charges might have peaked, however latest will increase in oil costs and developments within the Center East have created further uncertainty, which can lead the ECB to maintain its choices open. Even the extra dovish members of the ECB will not be pushing for fast charge cuts, and it’s possible that charges will stay secure by the primary half of subsequent 12 months.

ECB Chief Economist Lane, regardless of not being one of many extra hawkish members, has emphasised that the ECB remains to be a distance away from reaching its objectives and desires to watch wage agreements. He additionally talked about that the ECB can solely think about normalizing its coverage when it’s assured that inflation will decelerate to 2%. The bulk inside the ECB seems to need to wait till the March 2024 projections earlier than eradicating the tightening bias, which the extra hawkish members want to keep for now.

Governing Council member Holzmann expressed concern about inflation and steered that additional shocks would possibly necessitate further charge will increase. For the time being, these shocks are most certainly to come up from greater power costs, and ECB President Lagarde has talked about that the central financial institution is monitoring the oil value for potential inflationary impacts arising from the Israel-Hamas battle.

The ECB’s newest inflation forecast predicts that the Client Worth Index (CPI) will lower to 2% in 2025, assuming a decline in oil costs. Nonetheless, within the present state of affairs, there are upward dangers to this forecast, primarily attributable to greater power costs, that are additionally placing stress on financial development.

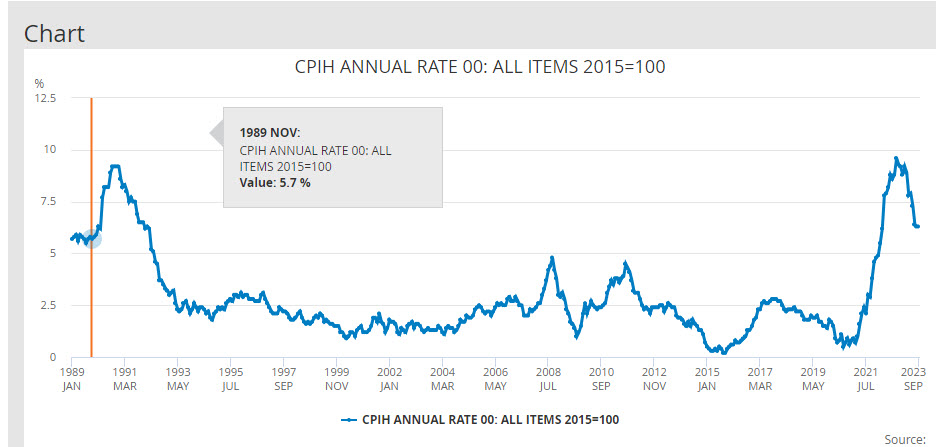

Within the UK, regardless of higher-than-expected inflation and powerful wage figures, these elements alone will not be more likely to immediate one other charge hike on the upcoming assembly. There’s a vital likelihood that rates of interest within the UK have already peaked. Officers are cautious about deciphering the alerts from wage knowledge, and confidence indicators recommend a cooling labor market. Although UK headline inflation remained excessive in September, it’s anticipated to drop considerably in October when the affect of final 12 months’s power value surge is not factored into the calculations.

The Financial institution of England expects inflation to common round 4.3% within the first quarter of 2024. Whereas the financial institution’s latest monitor document on inflation projections has not been good, it’s probably that inflation has already reached its peak and can regularly lower. Nonetheless, there are nonetheless upside dangers, significantly in service value inflation.

The Financial institution of England expects inflation to common round 4.3% within the first quarter of 2024. Whereas the financial institution’s latest monitor document on inflation projections has not been good, it’s probably that inflation has already reached its peak and can regularly lower. Nonetheless, there are nonetheless upside dangers, significantly in service value inflation.

The labor market, which noticed a major rise in wages over the previous 12 months, is exhibiting indicators of cooling, and hiring has slowed. Firms have gotten extra reluctant to rent attributable to rising value pressures, which may restrict wage development within the coming months.

In abstract, the ECB is predicted to maintain charges unchanged, and the main focus might be on President Lagarde’s assertion and press convention, with consideration to the latest rise in oil costs and reinvestment of belongings. Within the UK, regardless of excessive inflation and powerful wage knowledge, one other charge hike isn’t anticipated on the subsequent assembly, and there’s a rising perception that charges have already peaked.

Nonetheless, some upside dangers stay, significantly in service value inflation. The labor market is exhibiting indicators of cooling, which may have an effect on wage development. The vast majority of members in each central banks don’t seem to favor charge cuts, and the opportunity of additional charge hikes stays open, though there’s a recognition of the subdued financial outlook.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or ought to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link