[ad_1]

Slowly however certainly we’re getting all the weak sisters flushed out of undervalued nice firms – whereas they chase into overpriced momentum automobiles which might be arrange for a fall.

Regardless of the backyard selection headline correction of 10% within the S&P 500, underneath the floor weak palms are getting flushed out of a number of the greatest companies on the earth at clearance costs.

As I all the time say, “Wall Avenue is the one retailer on the earth that once they mark down stock at clearance sale costs, everybody runs OUT of the constructing!”

Let’s have a look at two examples:

1. PayPal (NASDAQ:)

Right here’s a enterprise buying and selling down ~85% from its peak. These sellers should not silly, however they could be overreacting from worry. What are they afraid of?

1. Declining margins.

2. Elevated competitors.

What ought to they (buyers) be targeted on?

BUSINESS: PayPal Holdings, Inc. operates a expertise platform that allows digital and cellular funds by shoppers and mer-chants all through the world. It gives a variety of cost options underneath the manufacturers: PayPal, PayPal Credit score, Venmo, Xoom, Paydiant, and Braintree. Has greater than 435 million energetic customers. In 2022, roughly 22.3 billion transactions have been accomplished on its platform.

Paypal has gone from buying and selling at 12x gross sales simply 2 years in the past to 2x gross sales right now. It has fallen from an unrealistic ~87x earnings in 2021 to a discount basement ~10x earnings right now.

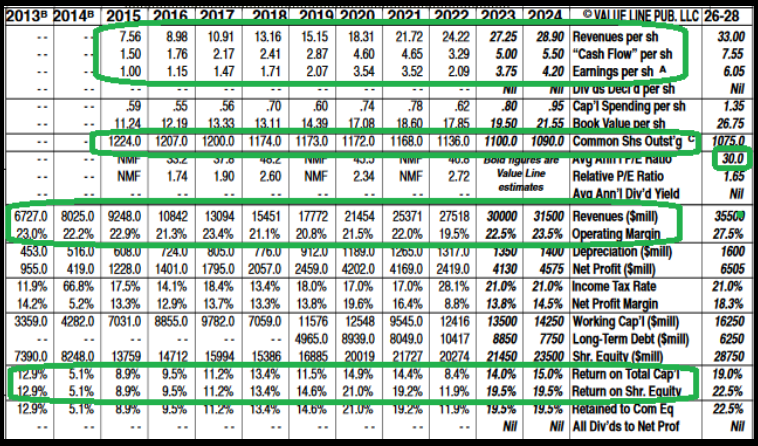

The “short-term impairment” realized in 2022 (when earnings and cashflow dipped) has since recovered again to pattern (see above in inexperienced). The 5yr long run EPS development fee is projected at 16.89% which means a PEG (value to earnings development) of simply 0.59x. For common context 3x+ is dear, 1x is reasonable. That is what we name shopping for with a “margin of security.”

The important thing when approaching these alternatives is:

Zero to minimal leverage. Should you suppose you possibly can decide the precise backside tick after an 85% drop, you might be in fantasy land. Nonetheless, for those who mannequin out worst case, greatest case and pattern assumptions over the subsequent 3-5 years and estimate a good worth within the neighborhood of $150-200+, does it actually matter for those who purchase it at $65 or $45?

Taking the decrease case goal of $150 over 36 months from current ranges you wind up with a 41% IRR. It will probably outperform the S&P 500 by 4x. However in trade for that profit, are you able to sit by way of a attainable short-term drop of 20-30% from compelled sellers who have been on leverage and are getting liquidated on the backside? It relies upon whether or not you realize what you personal. The unhappy truth is MOST market individuals are shopping for this (quick time period fluctuations – often called the “VOTING MACHINE”) PRICE:

When they need to be shopping for this (long-term fundamentals – often called the “WEIGHING MACHINE”) CASHFLOW:

Since PayPal’s 2015 spinout from EBAY it has generated $29B of free money circulate. They’ve used $19B to purchase again inventory.

Paypal will generate a document $5B of free cashflow in 2023 alone. To place that in perspective, they may take the complete firm personal in a decade or much less!

Further catalyst:

At all times guess on the jockey.

Efficient as of September twenty seventh, Alex Chriss assumed the roles of President and CEO, succeeding Dan Schulman, who will stay on the board till Could of 2024.

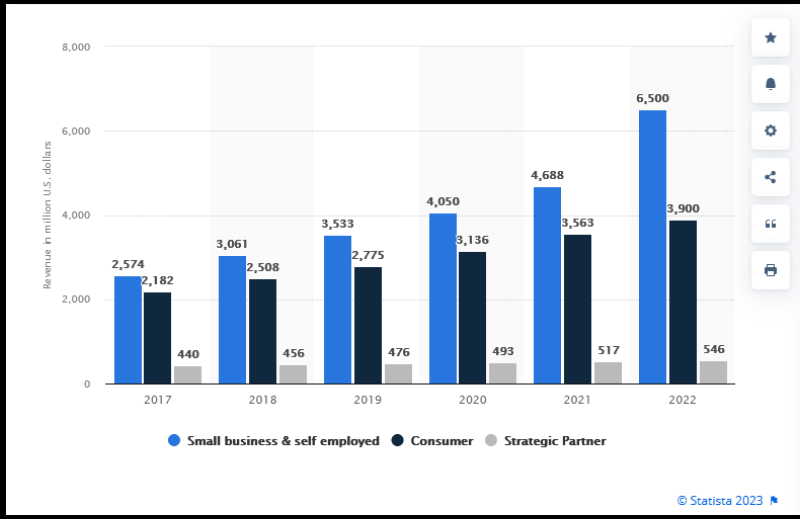

Chriss got here from Intuit (NASDAQ:) the place he ran the Small Enterprise and Self Employment group [from 2017 forward – which represented the majority of revenues for the company (see blue lines below)]:

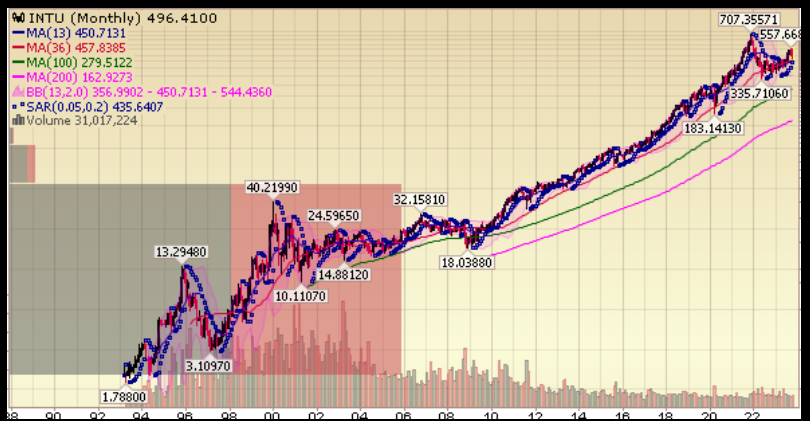

Right here have been his key roles on the firm from 2008-2023 when the corporate peaked at a 38x – bagger ($18 to $707):

If anybody understands small enterprise, development, acquisitions and easy methods to handle/carry out to Wall Avenue expectations it’s Alex Chriss.

However please, be my visitor and promote it within the gap on the subsequent $5 pullback!

However whenever you do, simply ask your self, “who’s shopping for from me at these ranges?”

2. VF Corp (NYSE:).

Final night time, VF Corp’s new CEO did what most model new CEOs do once they come right into a turnaround state of affairs – e-book a “kitchen sink” quarter. Take all losses without delay, launch all of the unhealthy information, minimize the dividend and decrease expectations in order that all the pieces shifting ahead is GOOD NEWS!

That’s precisely what Bracken Darrell did final night time.

Whereas VF Corp truly BEAT on the top-line and got here inside capturing distance on the underside line, they took all of their medication without delay by chopping the dividend 70% and pulling steerage. WFC (Wells Fargo (NYSE:)) did this in 2020 earlier than it doubled, VNO (Vornado) did it earlier this yr earlier than taking off from the low teenagers, and most lately DIS (Disney) did it as a brand new activist (Nelson Peltz) entered the fray. It’s all the time darkest earlier than daybreak…

In his interview with Jim Cramer final night time Darrell laid out a transparent 4 level plan to return the corporate to greatness. This can be a spectacular interview:

They are going to obtain a part of the deleveraging by promoting off their “packs” enterprise that consists of include Eastpak, JanSport and Kipling.

To place this “catastrophe” in context, revenues are down 2% (fundamentals). The inventory then again is down 85% (value)!

The final turnaround Bracken Darrell was answerable for was Logitech (NASDAQ:). Beneath his tenure, the inventory went from $5 to $130 (peak 26x bagger).

Bracken began at Logitech in 2013. Right here’s what occurred subsequent:

Of observe, Logitech’s inventory was down ~82% from its 2007 peak when he took over in 2013.

However please, be my visitor and promote it within the gap on the subsequent $2 pullback!

However whenever you do, simply ask your self, “who’s shopping for from me at these ranges?”

We’ll be again subsequent week at our regular time and place with a lot to cowl on common market outlook, Cooper Normal earnings/strike decision and extra…

Till then…

This content material was initially revealed on Hedgefundtips.com.

[ad_2]

Source link

![The Full List of Stocks That Pay Dividends in November [Free Download]](https://moneywiseinc.com/wp-content/uploads/2022/10/November-Dividend-Stocks-e1667003372640.png)