[ad_1]

lucky-photographer

Jefferies analyst Steven DeSanctis argued that worries in regards to the small-cap house, as evidenced by the Russell 2000 (RTY) lately sliding to a brand new 2023 low, have been overblown, as many corporations on this class have robust steadiness sheets, which ought to enable them to cushion the influence of upper charges.

“We expect one of many greatest considerations traders have with small caps is the influence of rising charges on borrowing prices,” DeSanctis said in a report over the weekend. “We’re not as involved, as steadiness sheets have near-record ranges of money, the high-yield market is holding up very nicely with spreads nonetheless under their long-term averages, and firms appear to have entry to capital.”

In the mean time the Russell 2000 trades proper close to the 1,640 degree and Jefferies signifies that the index will advance to 1,800 by 12 months finish.

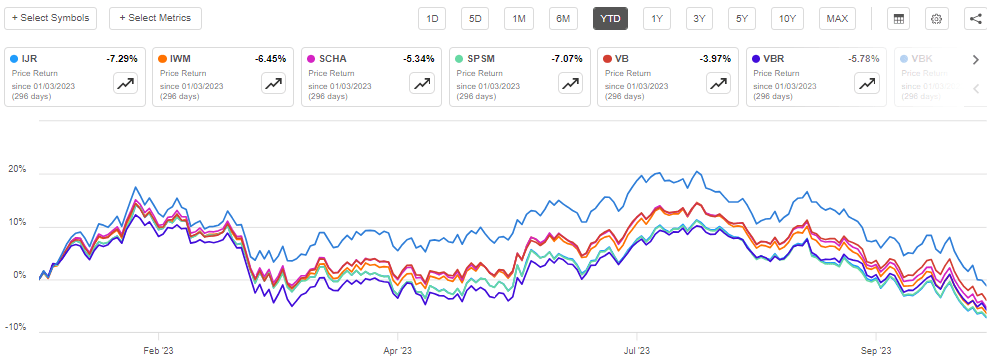

Small-Cap Trade Traded Funds:

iShares Core S&P Small-Cap ETF (NYSEARCA:IJR) iShares Russell 2000 ETF (NYSEARCA:IWM) Schwab U.S. Small-Cap ETF (NYSEARCA:SCHA) SPDR Portfolio S&P 600 Small Cap ETF (SPSM) Vanguard Small Cap ETF (VB) Vanguard Small Cap Worth ETF (VBR) Vanguard Small Cap Progress ETF (VBK)

[ad_2]

Source link