[ad_1]

Wall Avenue’s three main indexes closed blended on Friday to notch their greatest week of 2024 after the Federal Reserve caught with projections for 3 rate of interest cuts by 12 months’s finish and amid continued optimism over synthetic intelligence.

For the week, the benchmark rallied 2.3% in its largest weekly share acquire since mid-December.

In the meantime, the tech-heavy and the blue-chip rose 2.9% and a couple of% respectively.

Supply: Investing.com

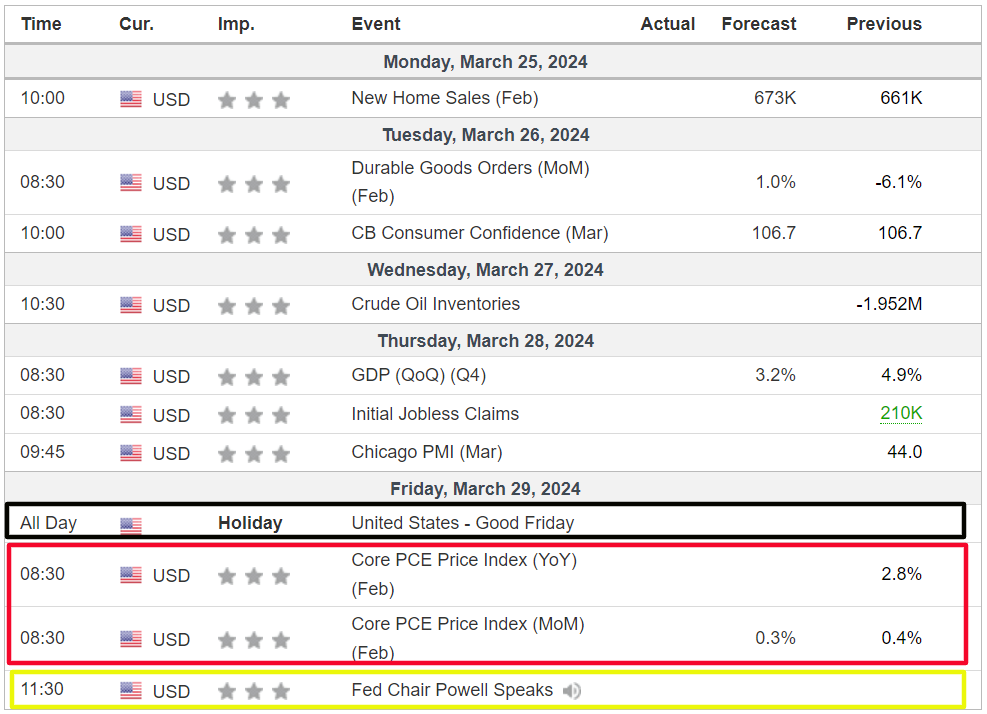

The vacation-shortened week forward – which is able to see U.S. inventory markets closed on Friday for the observance of the Good Friday vacation – is anticipated to be a busy one as traders proceed to evaluate how a lot juice is left within the AI-inspired rally on Wall Avenue and when the Fed will begin slicing rates of interest.

Most necessary on the financial calendar will probably be Friday’s core private consumption expenditures (PCE) worth index, which is the U.S. central financial institution’s most popular inflation measure. As well as, there’s additionally necessary fourth quarter GDP knowledge due on Thursday.

Supply: Investing.com

These releases will probably be accompanied by a heavy slate of Fed audio system, with the likes of district governors Raphael Bostic, Christopher Waller, and Mary Daly set to make public appearances following final week’s FOMC assembly.

In the meantime, Fed Chairman Jerome Powell will take part in a moderated dialogue earlier than the Federal Reserve Financial institution of San Francisco Macroeconomics and Financial Coverage Convention.

Merchants now see a couple of 75% probability of the primary fee lower hitting in June, in accordance with the Investing.com .

Elsewhere, on the earnings docket, there are only a handful of company outcomes due, together with Walgreens Boots Alliance (NASDAQ:), GameStop (NYSE:), and Carnival (NYSE:).

No matter which path the market goes, beneath I spotlight one inventory prone to be in demand and one other which may see recent draw back. Keep in mind although, my timeframe is only for the week forward, Monday, March 25 – Friday, March 29.

Inventory to Purchase: Carnival

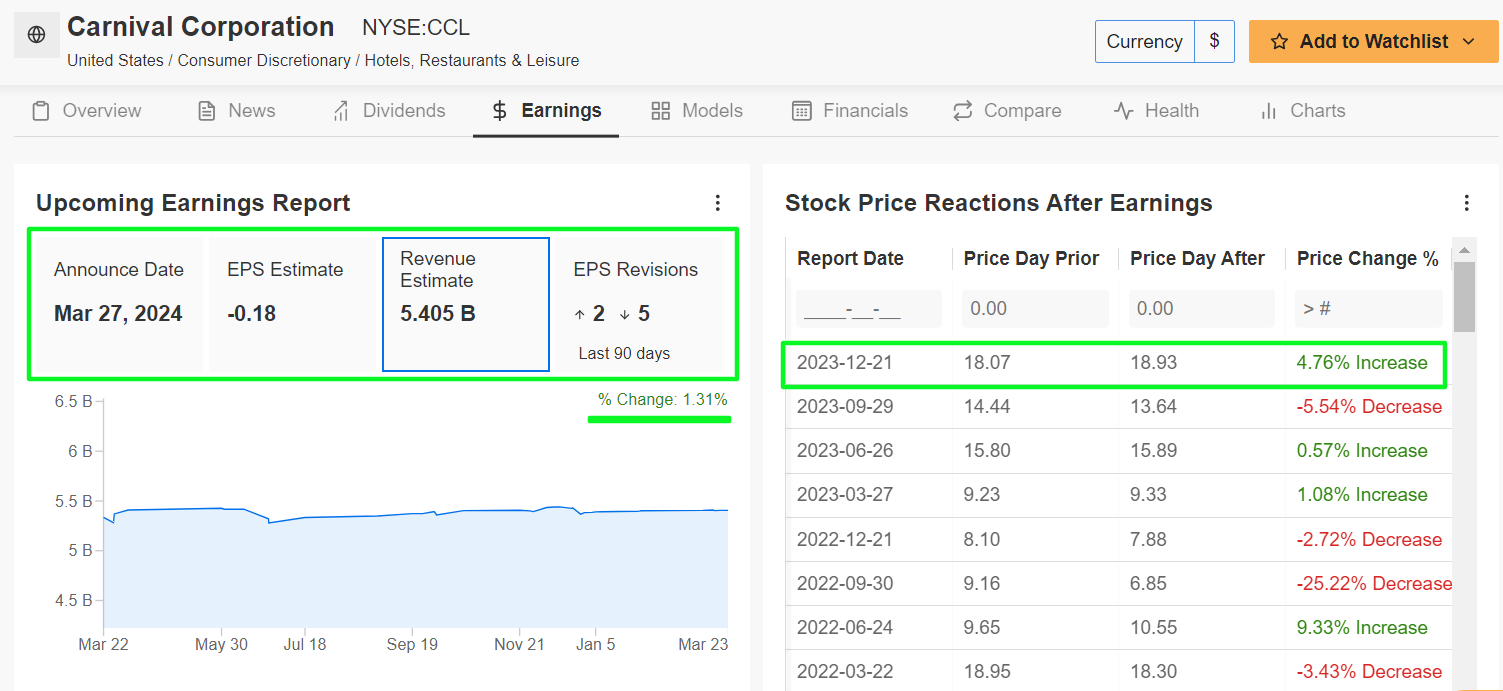

I count on Carnival (NYSE:) to outperform this week, because the cruise line operator’s newest earnings report will shock to the upside for my part because of favorable client journey demand developments.

The Doral, Florida-based cruise firm is scheduled to ship its first quarter replace earlier than the U.S. market opens on Wednesday at 9:15AM ET.

Market contributors count on a large swing in CCL shares, as per the choices market, with a attainable implied transfer of about 10% in both path. Notably, the inventory gained virtually 5% after its final earnings report in December.

Supply: InvestingPro

Wall Avenue sees Carnival shedding $0.18 per share, narrowing dramatically from a loss per share of $0.55 within the year-ago interval, as profitability developments proceed to get better from the Covid-19 pandemic.

In the meantime, Carnival’s income is forecast to extend 22.7% year-over-year to $5.44 billion, as vacationers flock to its cruises amid the continued enchancment in tourism developments.

Regardless of seeing 5 out of the seven analysts surveyed by InvestingPro downwardly revise their gross sales forecast forward of the report, estimates are nonetheless increased than they have been beforehand.

As such, I consider Carnival’s CEO Josh Weinstein will present an upbeat outlook for the months forward to mirror robust ahead reserving ranges and ticket demand as the important thing summer season vacation journey season approaches.

Supply: Investing.com

CCL ended at $17.09 on Friday, its highest shut since January 19. At present ranges, Carnival has a market cap of $21.3 billion, incomes it the standing because the second most beneficial cruise operator on the earth, behind Royal Caribbean Cruises (NYSE:).

Cruise line shares have surged up to now 12 months as they profit from pent-up demand for worldwide journey delayed by pandemic lockdowns.

Royal Caribbean’s shares have gained 124% within the final 12 months, which Carnival and Norwegian Cruise Line (NYSE:) are up 90% and 66% in the identical interval.

As ProTips factors out, Carnival’s share profile is pretty optimistic, with a number of bullish tailwinds working in its favor, together with an enhancing profitability outlook, and rising internet revenue prospects.

Inventory to Promote: Walgreens Boots Alliance

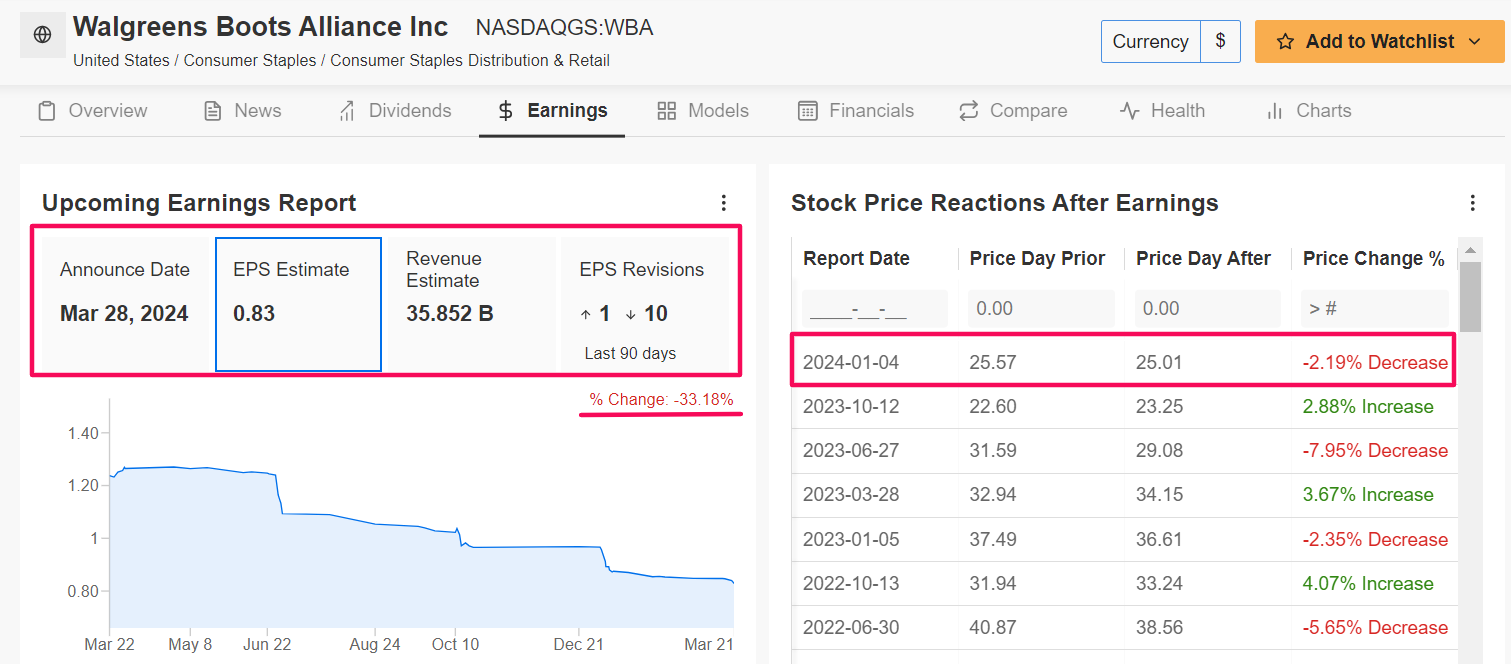

I consider Walgreens Boots Alliance (NASDAQ:) will undergo a disappointing week forward, with a possible breakdown to recent lows on the horizon, because the struggling pharmacy retailer chain’s earnings and steerage will possible underwhelm traders.

Walgreens’ replace for its fiscal second quarter is scheduled to return out earlier than the U.S. market opens on Thursday at 7:00AM ET, and outcomes are anticipated to take a success from a decline in buyer site visitors at its shops because it continues to lose market share to rivals.

Underscoring a number of near-term challenges going through Walgreens amid the present setting, 9 out of the ten analysts surveyed by InvestingPro lower their revenue estimates up to now 90 days to mirror a drop of roughly 33% from their preliminary expectations.

As per the choices market, merchants are pricing in a swing of about 9% in both path for WBA inventory following the discharge. Notably, shares fell 2.2% after the corporate’s fiscal Q1 report in January.

Supply: InvestingPro

The Deerfield, Illinois-based firm is seen incomes $0.83 per share, tumbling 28.5% from EPS of $1.16 within the year-ago interval, amid increased value pressures and declining working margins.

In the meantime, income is forecast to inch up 2.6% year-over-year to $35.8 billion, because it offers with low client spending, a drop in Covid-19 product gross sales and a gradual ramp-up of its new healthcare unit.

Taking that under consideration, I consider there’s a rising draw back threat that Walgreens may decrease its full-year outlook because it continues to spend closely on a metamorphosis from a retail drugstore chain operator and pharmacy providers supplier right into a full-service well being care firm.

Supply: Investing.com

WBA inventory closed Friday’s session at $20.58, not removed from a latest low of $19.68, which was the weakest degree since October 1998. At its present valuation, the pharmacy chain retailer has a market cap of $17.7 billion.

Walgreens was kicked out of the Dow Jones Industrial Common final month, shedding its spot within the blue-chip index to Amazon (NASDAQ:). It must be famous that the corporate was the Dow’s worst performer of 2023, plunging 30%. Shares are down one other 21% to date in 2024.

Not surprisingly, Walgreens has a poor InvestingPro ‘Monetary Well being’ rating of 1.7 out of 5.0 attributable to fears over its vital debt burden, and downbeat revenue and gross sales development prospects.

Moreover, Walgreens’ stability sheet is a reason behind nice concern, as the corporate – which almost halved its dividend payout in January – burns capital at a worryingly excessive fee. Walgreens had beforehand elevated its dividend for 47 consecutive years.

Be sure you take a look at InvestingPro to remain in sync with the market pattern and what it means to your buying and selling.

Readers of this text get pleasure from an additional 10% low cost on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe right here and by no means miss a bull market once more!

InvestingPro Supply

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the through the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Expertise Choose Sector SPDR ETF (NYSE:).

I frequently rebalance my portfolio of particular person shares and ETFs primarily based on ongoing threat evaluation of each the macroeconomic setting and corporations’ financials.

The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

[ad_2]

Source link