[ad_1]

tumsasedgars

On our final protection of International Internet Lease, Inc. (NYSE:GNL), we spoke concerning the causes we exited the widespread shares in a well timed style. We additionally coated the popular shares, that are listed beneath.

International Internet Lease, 7.25% Sequence A Cumulative Redeemable Most well-liked Inventory (NYSE:GNL.PR.A) International Internet Lease 6.875% Sequence B Cumulative Redeemable Perp Most well-liked Inventory (NYSE:GNL.PR.B) International Internet Lease, Inc. 7.50% Sequence D Cumulative Pink Perp Most well-liked Inventory (NYSE:GNL.PR.D) International Internet Lease, Inc. 7.375% Sequence E Cumulative Most well-liked Inventory (NYSE:GNL.PR.E)

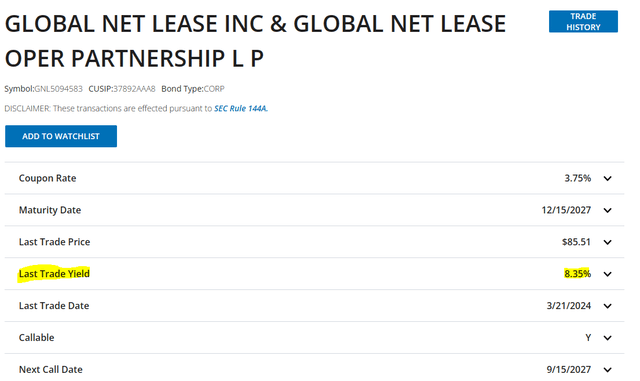

We in the end instructed investor keep on with bonds as they have been doubtless one of the best wager.

That stated, in the event you actually should take an funding in GNL, the bonds are nonetheless one of the best relative wager. They’re yielding about 8% to maturity proper now on the 2027 notes and we predict GNL ought to make it by that hump (the corporate, not the present dividend) with no points. That’s what we might deal with.

Supply: 15.66% On Frequent Or 8.50% On Preferreds?

Within the two and half months, the corporate has dropped like a stone and reset the dividend fee and AFFO expectations.

Searching for Alpha

We inform you why issues are getting riskier for buyers.

This fall-2023

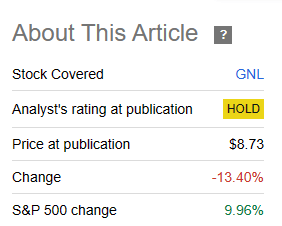

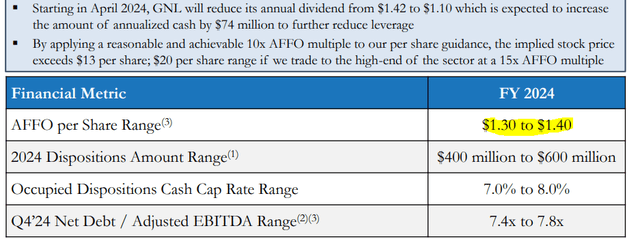

GNL not too long ago accomplished its merger with RTL and the quarter was extremely noisy. That stated the corporate reiterated its pre-merger technique.

GNL Presentation

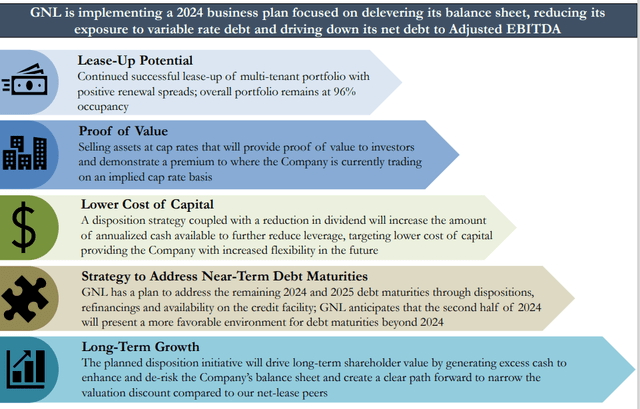

One notable factor right here is that GNL, after years of buying serially with out regret is now trying to dispose belongings. On the entire, we predict these trades over the complete cycle can be massively worth damaging. Most of those properties have been acquired throughout ZIRP (zero rate of interest coverage), by both GNL or RTL and promoting now will include far decrease costs. GNL confirmed that the money cap fee on these can be within the 7-8% vary.

So why the change in tune after the last decade lengthy shopping for binge?

You in all probability noticed why whenever you learn the assertion.

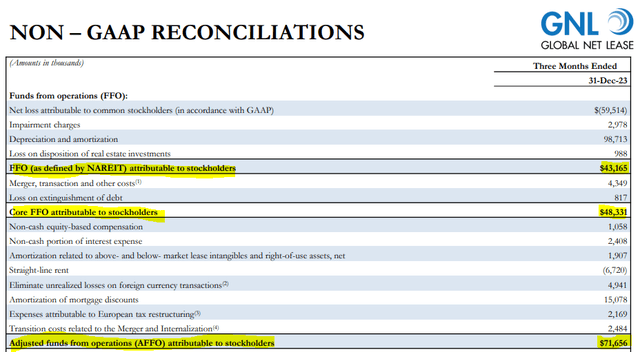

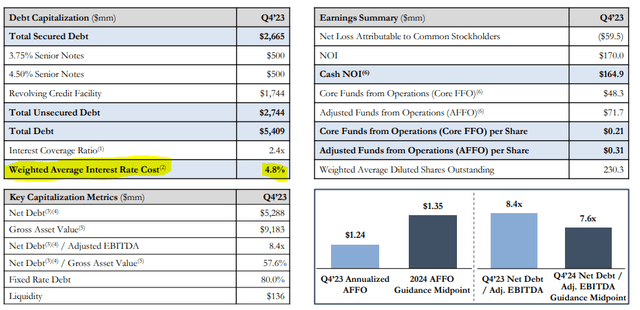

Our internet debt to adjusted EBITDA ratio was 8.4 instances. We ended the quarter with internet debt of $5.3 billion at a weighted common rate of interest of 4.8% and have liquidity of roughly $135.7 million and $206 million of capability on the credit score facility. The weighted common maturity on the finish of the fourth quarter 2023 was 3.2 years with minimal debt maturity due in 2024. Our debt contains $1 billion in senior notes, $1.7 billion on the multicurrency revolving credit score facility and $2.7 billion of excellent gross mortgage debt. Our debt was 80% fastened fee, which incorporates floating fee in-place rate of interest swaps and our curiosity protection ratio was 2.4 instances.

Supply: GNL This fall-2023 Convention Name Transcript

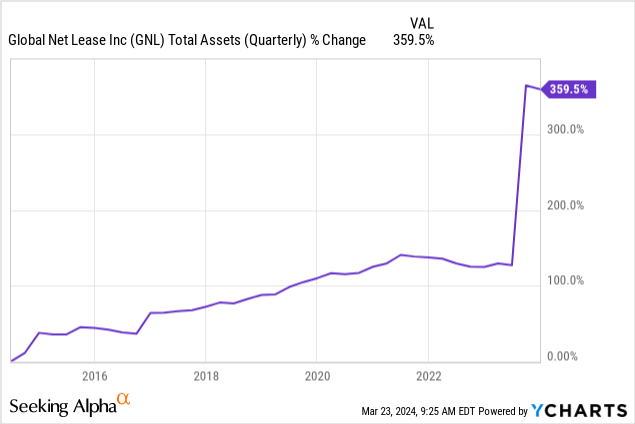

That 3.2 years is the issue and it is going to be a much bigger drawback for its belongings within the single tenant workplace class.

GNL Presentation

GNL after all disagrees that this can be a difficulty.

One of many metrics that differentiates GNL’s single-tenant workplace portfolio is that it is comprised of 70% mission-critical amenities, which we outline as headquarters, lab or R&D amenities and have 68% investment-grade or implied investment-grade tenants, which we consider supplies our portfolio with lease stability and low stage of default threat. Given GNL’s profitable monitor file of lease renewals, the single-tenant workplace phase additionally consists of restricted near-term lease maturities, minimizing the danger of emptiness.

Supply: GNL This fall-2023 Convention Name Transcript

However when your debt to EBITDA is in that vary, you do not want quite a lot of vacancies to maneuver the stress.

2024 Outlook

The AFFO is now anticipated to be round $1.35.

GNL Presentation

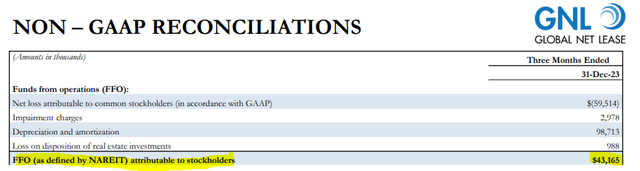

The humorous facet right here is that the majority analysts nonetheless present FFO anticipated at round $1.10 per share. This could typically not make sense as analysts won’t ignore administration steerage to such an extent. However the confusion for buyers (not analysts) stems from the truth that GNL is speaking about AFFO whereas analysts are centered on FFO. In most REITs, AFFO tends to be decrease than FFO. Whereas there isn’t a customary definition of AFFO on the US facet (Canadian REITs are extra in keeping with this), typically AFFO entails lowering the FFO down by upkeep capex and straight line lease. Within the case of GNL, as seen in This fall-2023, AFFO was considerably larger than FFO.

GNL Presentation

GNL expects an identical delta for all the 12 months 2024. We’ll go away it as much as the readers to resolve what truly is the true measure of proprietor’s equal earnings however these “one-time” changes have been an everyday function for GNL.

Our Outlook

GNL believes that 15X AFFO is feasible.

As we have taken a conservative strategy, our technique for deleveraging is designed to be earnings impartial with the expectation that our internet debt to adjusted EBITDA will lower by roughly 1 full flip. By making use of an affordable and achievable 10 instances AFFO a number of to our per share steerage, the implied inventory value exceeds $13 per share, $20 per share vary if we commerce to the excessive finish of the sector at a 15 instances AFFO a number of.

Supply: GNL This fall-2023 Convention Name Transcript

Realistically, when you’ve W. P. Carey Inc. (WPC), Agree Realty Company (ADC) and Realty Revenue (O), buying and selling at a mean of 13X FFO, we might pay about 7X FFO for GNL after we gained the lottery and 5X earlier than. Word that we stated FFO and never the fluffed up AFFO quantity. So at $7.50 (contemplating now we have not gained the lottery), GNL seems to be costly. The brand new dividend of $1.10 is near a 100% payout ratio on the now anticipated FFO. This FFO is supposedly bumped up by all the varied synergies anticipated. However the one factor buyers have to deal with right here is that the weighted common rate of interest remains to be from the ZIRP period.

GNL Presentation

Any affordable repricing of this over the subsequent 3 years can imply quite a lot of points for the corporate. Traders would possibly suppose we’re being overly cautious, however simply have a look at the info. We have now had the largest easing of credit score situations because the finish of the worldwide monetary disaster. Regardless of that, GNL”s close to time period bonds yield 8.35% to maturity.

FINRA

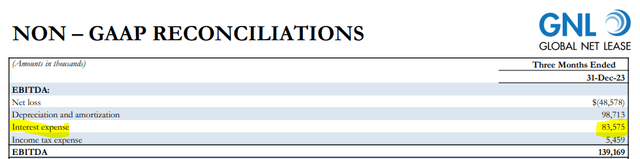

GNL is after all paying the coupon fee on that however simply think about in the event you reprice this complete deck to even 7.2% from 4.8%. That may be a 50% enhance, however pretty affordable assumption until we return to ZIRP. It’s not exhausting to seek out or to do. There’s the This fall-2023 curiosity expense.

GNL Presentation

50% of that’s about $42 million. So in the event you extract $42 million out of present FFO, you will not be left with lots.

GNL Presentation

Verdict

After all that reset is a very long time away however all the things now we have seen reveals that GNL’s base fee of FFO will decline over time. So by the point we get to that 2027 maturity issues might look even worse. GNL must get the leverage down and Fitch’s line within the sand would require quite a lot of FFO lowering asset gross sales.

Components that might, individually or collectively, result in destructive score motion/downgrade:

–Lack of fabric enhancements in EBITDA and discount of debt such that Fitch expects the mixed entity’s leverage above 8.0x on a sustained foundation;

–Lack of significant enhancements in governance such that Fitch expects capital entry to stay constrained for the mixed entity on the ‘BB+’ score stage.

Supply: Fitch

In all of this, now we have the popular shares buying and selling truly larger than once we final wrote about this. They at the moment yield round 8.3% collectively. We consider they signify a really excessive threat relative to that yield. As we had proven not too long ago, you may get 7%-8% yields with nearly zero credit score threat over a 5-7 12 months horizon. With GNL, your credit score threat is way larger than even implied by their credit standing in our opinion. So the 8.3% yield is simply too low. If we have been getting 10%-12% that will be a unique matter. Traders can lose lots in most popular shares. These utilizing the one line thesis “Regulated, Ergo Secure” for CorEnergy Infrastructure Belief, Inc. (OTCPK:CORRQ) and its most popular shares CorEnergy Infrastructure Belief, Inc. DEP SHS REPSTG (OTCPK:CORLQ), discovered that out with a 96% loss. However right here, we’re downgrading all of the preferreds to a Promote.

Please word that this isn’t monetary recommendation. It could look like it, sound prefer it, however surprisingly, it isn’t. Traders are anticipated to do their very own due diligence and seek the advice of with knowledgeable who is aware of their targets and constraints.

[ad_2]

Source link